Financial institutions are facing a critical challenge: customer acquisition costs are skyrocketing while conversion rates plateau.

Insurance providers and lenders are particularly feeling the squeeze as Google Ads costs climb and traditional marketing approaches deliver diminishing returns.

The solution? Personalized funnels that dramatically reduce reliance on expensive call centers while delivering higher conversion rates.

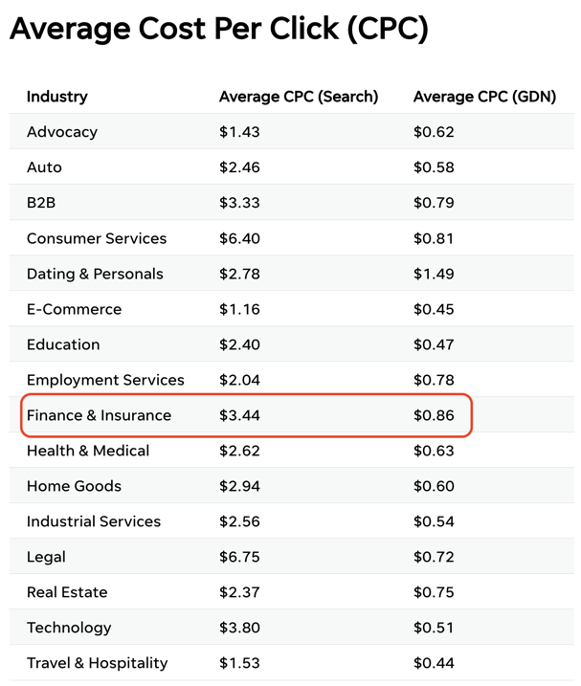

The cost problem in financial services marketing

Digital advertising costs for financial services keywords continue to rise year-over-year. Insurance and lending terms consistently rank among the most expensive Google Ads categories, with some competitive keywords commanding prices that erode profit margins on acquired customers.

This cost inflation creates a fundamental business problem where each lead now costs significantly more, directly reducing profitability on new customer acquisition.

Compounding this issue, most financial institutions still rely on inefficient conversion paths where transactions start online but must be completed via phone calls.

This traditional approach creates a linear relationship between growth and costs – more customers require more call center staff, imposing a practical ceiling on scalability.

The Conversion Gap: Online vs. Call Center

Most financial service providers face a stark reality: Call centers often convert at 20–30%, while many online funnels average just 1–2%, a gap we’ve seen repeatedly across the industry. This gap represents both a challenge and an opportunity.

When customers start online but finish via phone, companies incur substantial overhead costs for each conversion. However, organizations that can bridge this conversion gap through personalized funnels can dramatically reduce customer acquisition costs.

Four ways personalized funnels reduce costs

1. Complete transactions online without call center intervention

Business impact → Dramatic reduction in human resource costs while maintaining scalable growth without proportional increases in staffing.

By enabling customers to complete complex financial transactions entirely online, companies can eliminate or significantly reduce call center dependence.

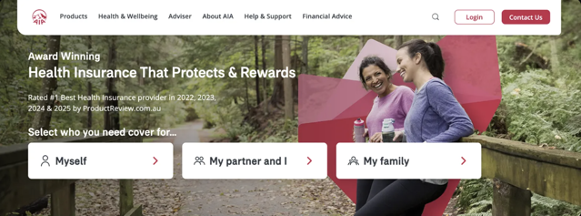

Real-world example → AIA Health Insurance Application Process

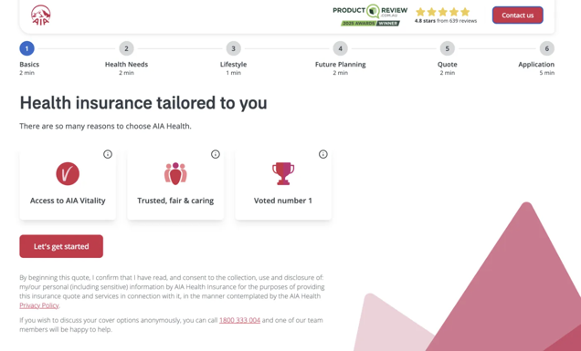

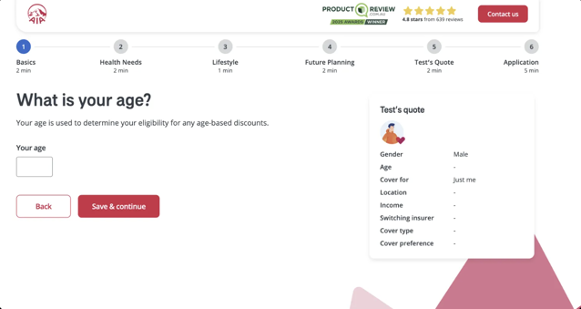

The AIA health insurance application funnel demonstrates how personalization begins from the very first interaction.

By asking “Select who you need cover for” with clear, simple options, the experience immediately tailors itself to the customer’s specific situation without overwhelming them with complex insurance terminology.

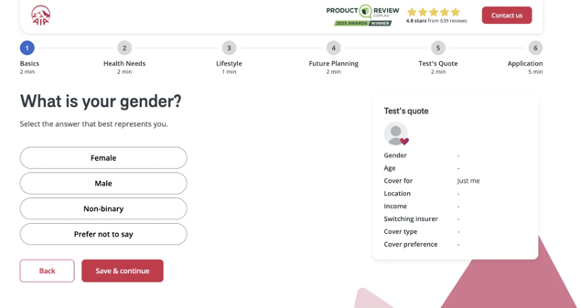

The process continues with clear navigation showing exactly where the user is in their journey. Each step includes estimated completion time, while the interface builds a visual profile of the customer.

As users provide more information, the system offers contextual explanations for each question. Here, the age input clearly explains its purpose (“to determine your eligibility for any age-based discounts”), while the avatar and sidebar profile continue to update, creating a sense of personalized progress through the application.

This approach eliminates the need for agent intervention while still providing the guidance customers need.

2. Intelligent customer triaging

Business impact → Higher conversion rates from the same call center resources

Not all prospects require the same attention. Personalized funnels can identify high-intent customers who are ready to buy, allowing companies to focus limited call center resources where they’ll have the greatest impact.

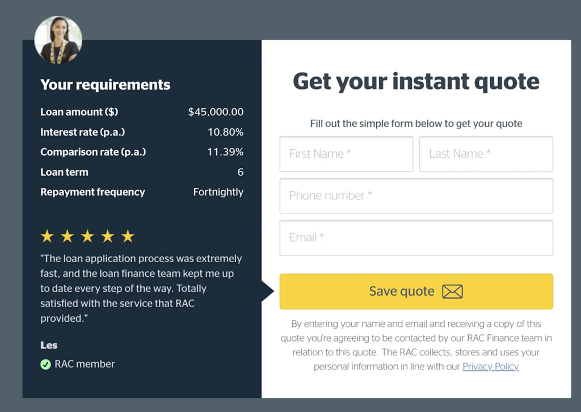

Real world example → RAC Car Loan Application Process

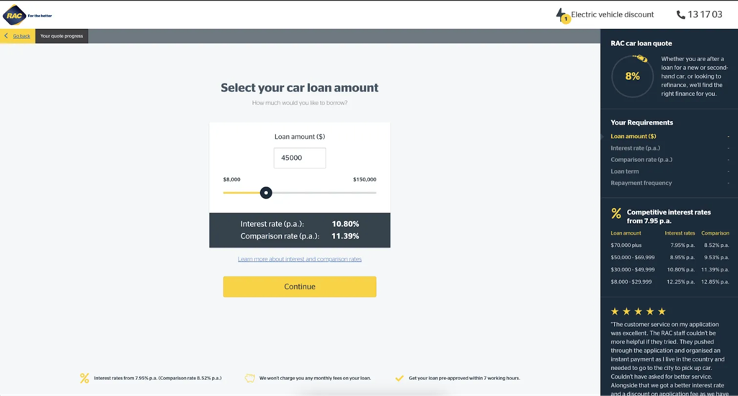

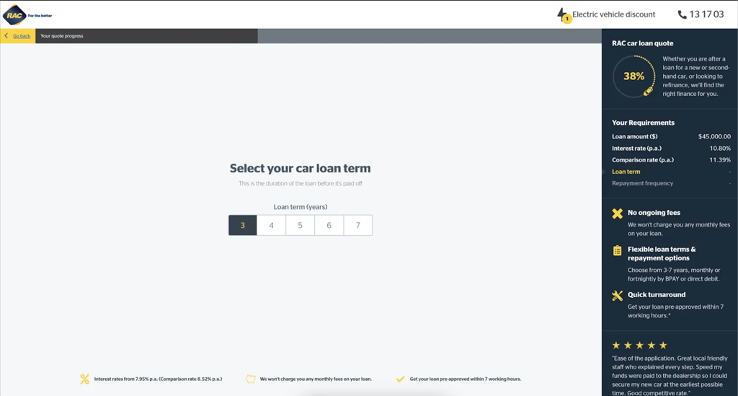

The RAC car loan application process demonstrates how lending institutions can effectively triage prospects based on their inputs.

The RAC car loan application begins with a clear loan amount selection that combines visual elements with practical options. Users can easily adjust their requested amount via slider or direct input, while the right panel shows their progress (8%) and begins building their personalized profile – all without requiring call center support.

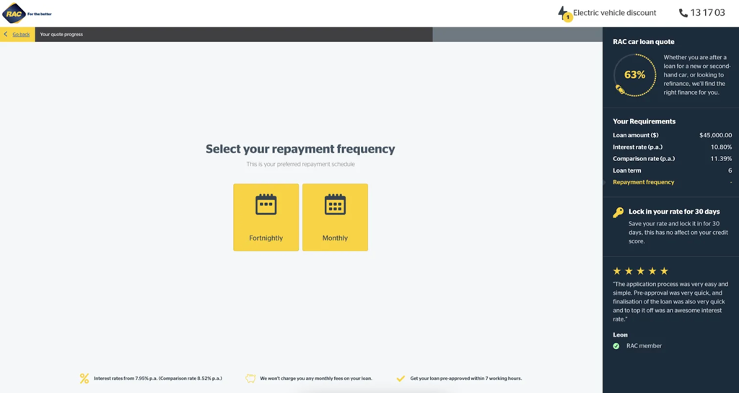

As users progress through the loan application, notice how the completion percentage jumps significantly (from 38% to 63%), creating a sense of momentum. Each step includes simple explanations like “This is the duration of the loan before it’s paid off” that eliminate the need for agent clarification while building the complete loan profile in real-time.

The final step summarizes all customer selections in a clean, organized format alongside a simple form to save their quote. By incorporating social proof (customer testimonial) and clearly displaying all loan parameters, this design creates confidence that typically would require agent reassurance, allowing the entire process to complete online without call center costs.

3. Bringing In-Person Experiences Online

Business Impact: Higher online conversion rates without additional marketing spend

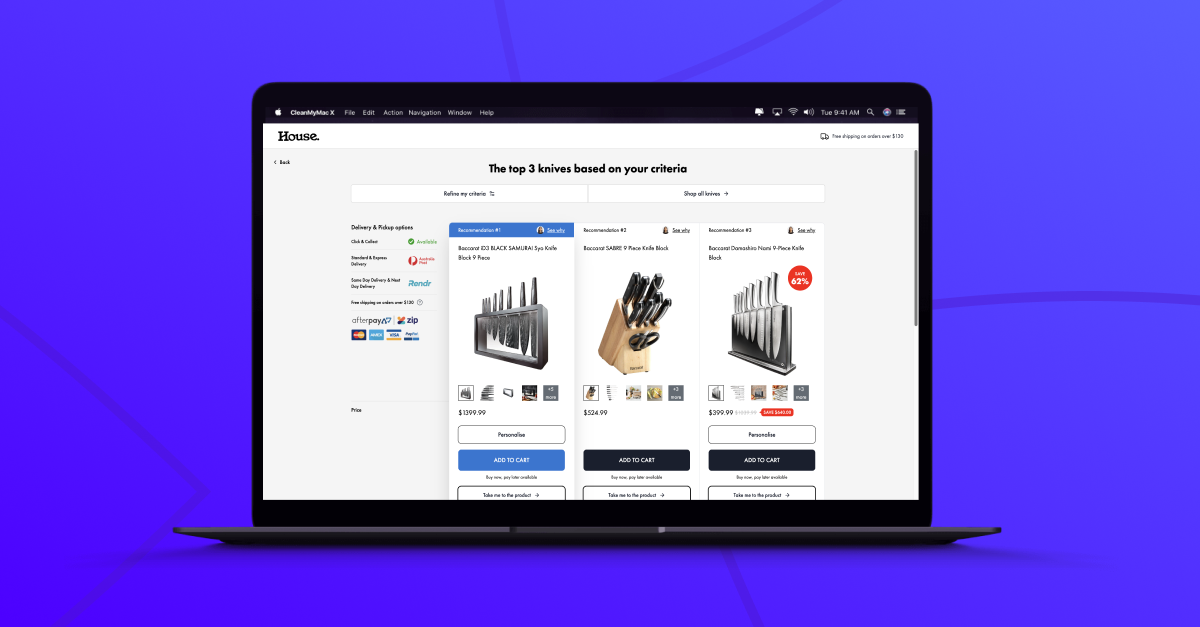

One reason call centers convert better than websites is the guided sales experience they provide. Personalized funnels can replicate this guidance online by incorporating explanation, comparison, and recommendation elements typically provided by sales staff. This significantly increases online conversion rates.

Dynamic Progression Through Financial Applications

The AIA example above shows how complex insurance applications can be broken down into clearly defined stages with estimated completion times. In this case, an entire process requiring just 14 minutes total. This resembles how an in-person agent would structure a conversation: “First, we’ll cover the basics (2 minutes), then discuss your health needs (2 minutes),” and so on.

This approach transforms what could be an overwhelming form into a guided journey with clear milestones, mimicking the psychological comfort of having a human guide through the process.

CASE STUDY: Members Own Health Insurance

“By personalizing the user experience and not making any other changes to our advertising program, we actually saw our customer acquisition cost improve out of sight.” — Brad Crossman, Members Own

4. Engaging Interfaces with Dynamic Visual Elements

Business Impact: Increased completion rates for complex financial applications

Drawing from game design principles, personalized funnels can transform tedious financial applications into engaging experiences that respond dynamically to user input.

As shown in the AIA health insurance funnel, the interface creates a visual representation of the user with an avatar that changes based on their selections. The progress completion percentage (shown in both AIA and RAC examples) provides immediate feedback that creates a sense of advancement and accomplishment – similar to level progression in games.

Personalized Visual Feedback

Both the AIA health insurance and RAC car loan funnels demonstrate how interfaces dynamically adapt to user responses. The AIA example (top) shows how the user’s avatar and profile information update in real-time as they provide information. Notice how the avatar changes to reflect the selected gender, creating a visual representation of the user within the application.

The RAC example (bottom) shows progress increasing from 8% to 38% as the user moves through the application, with the right panel maintaining a running summary of all selections. This creates a sense of accomplishment and investment that encourages completion.

No development or design required

No development or design required  Executed by just adding one line of Convincely code to your website

Executed by just adding one line of Convincely code to your website  Plan and strategize with your team. Execute and deploy with Convincely

Plan and strategize with your team. Execute and deploy with Convincely