Funnel Analysis for Freedom Mortgage Prequalification Process

Key Strengths of the Funnel:

- Simple and Focused Entry Point: The funnel begins with a clear and straightforward call-to-action: “Start the prequalification process online.” This eliminates any ambiguity about what the user should do next, making it easy for potential customers to engage with the process.

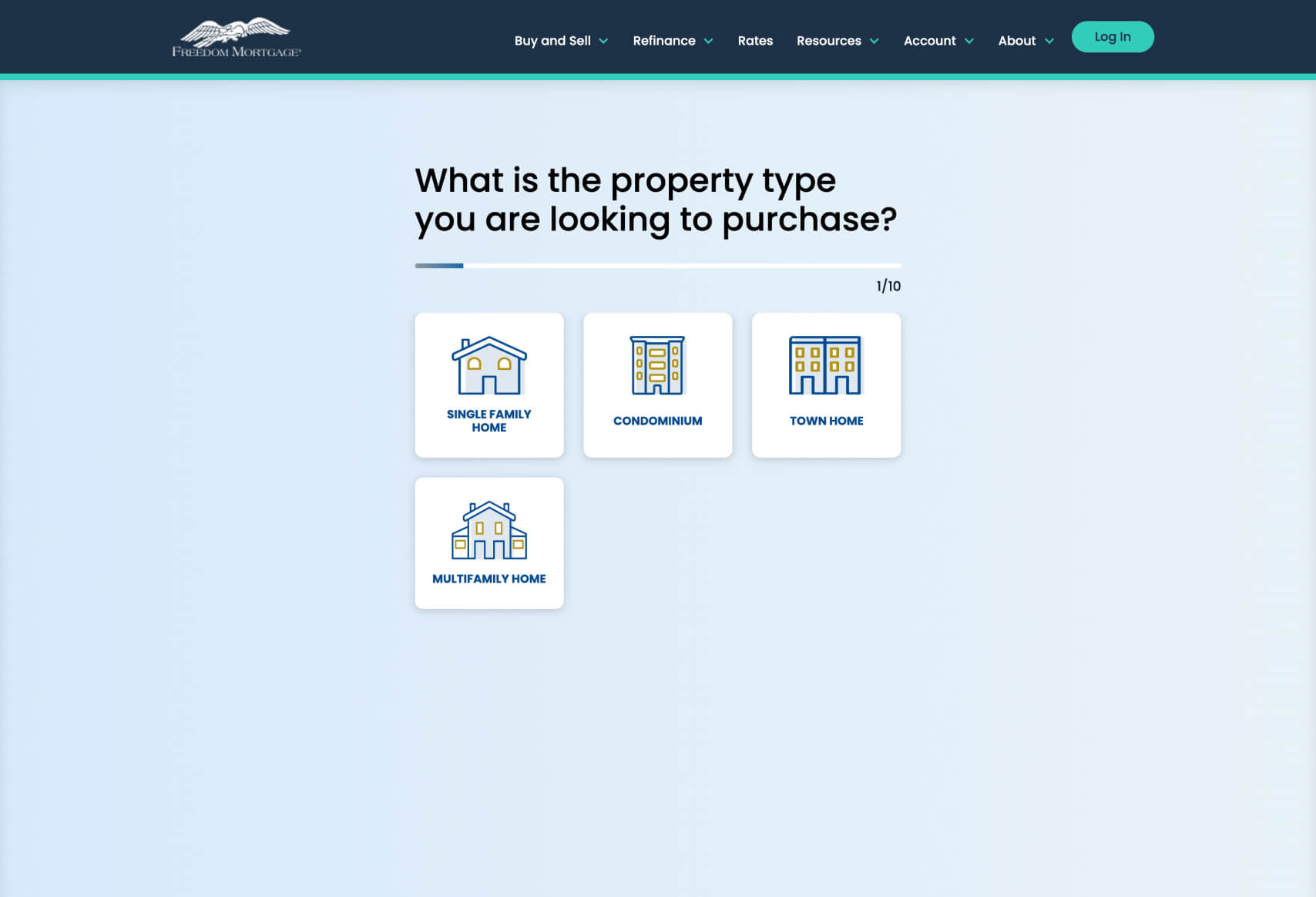

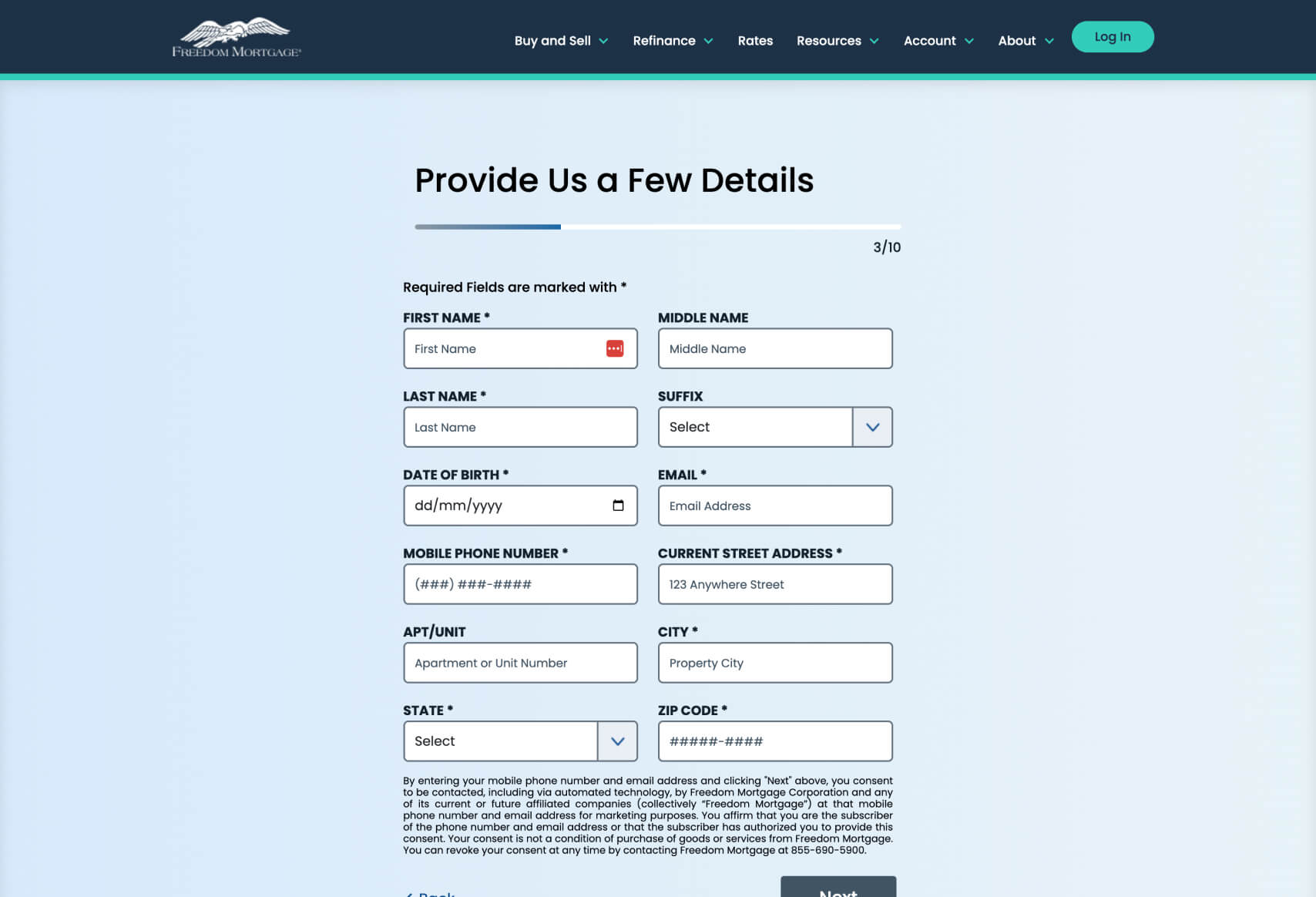

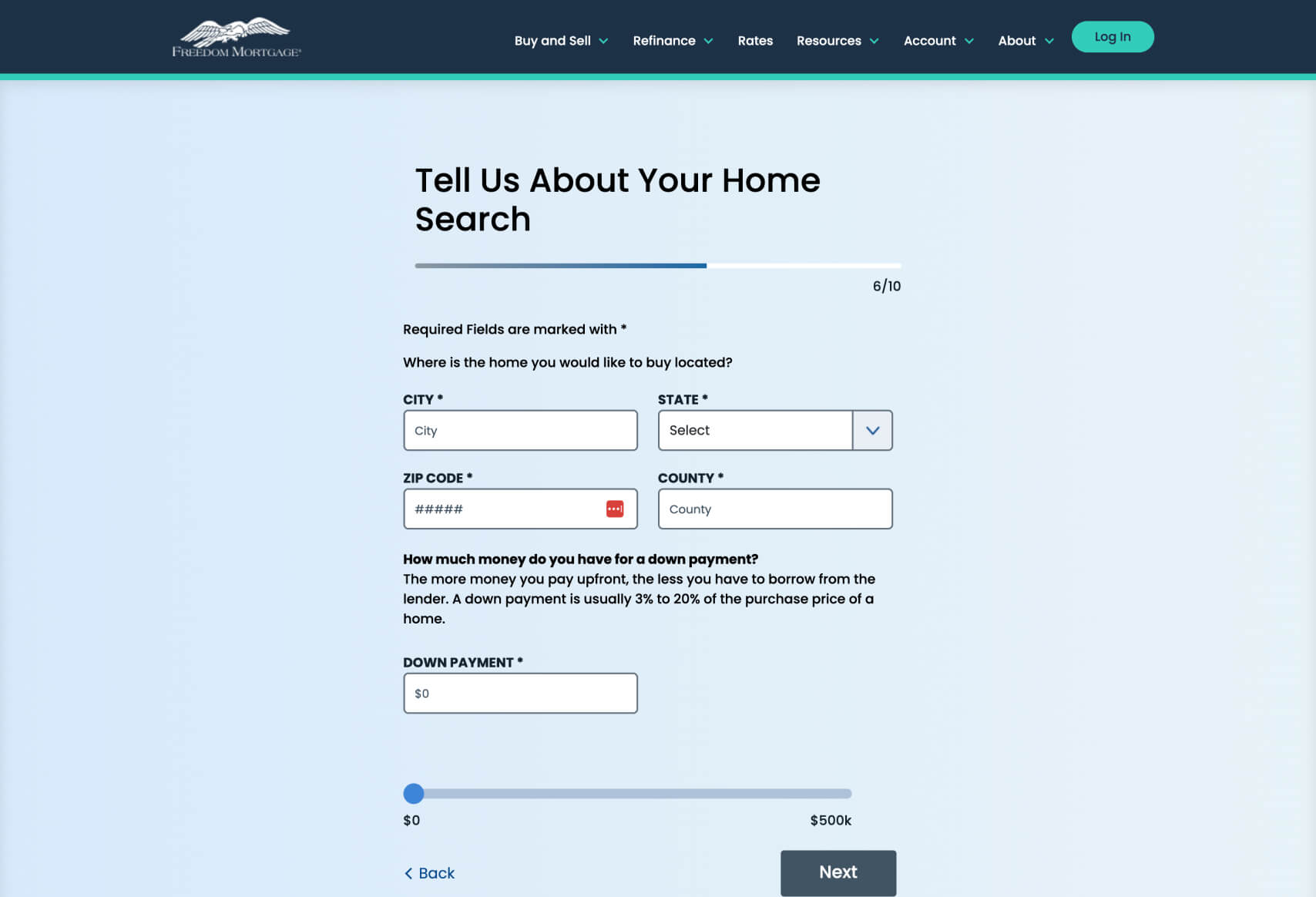

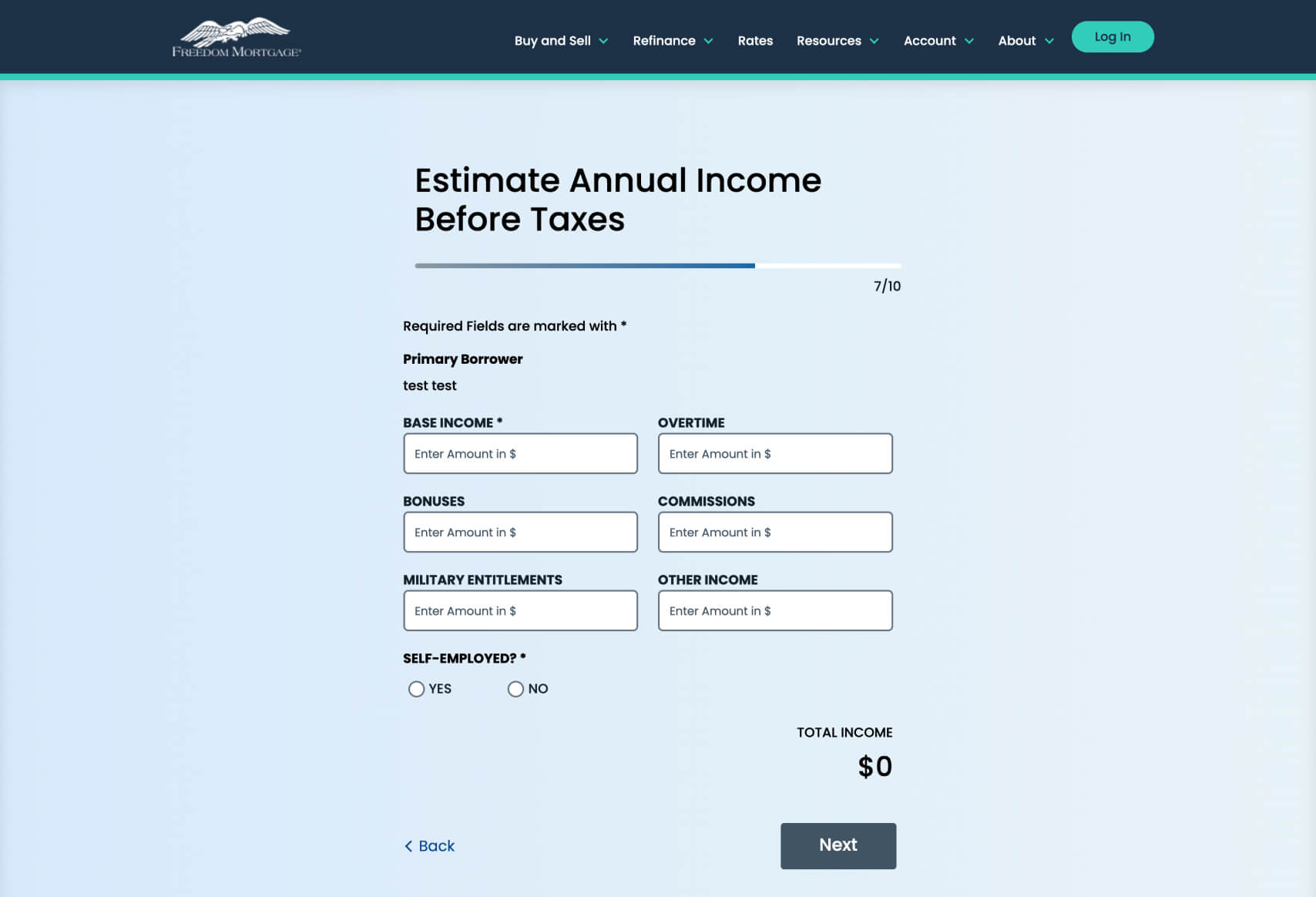

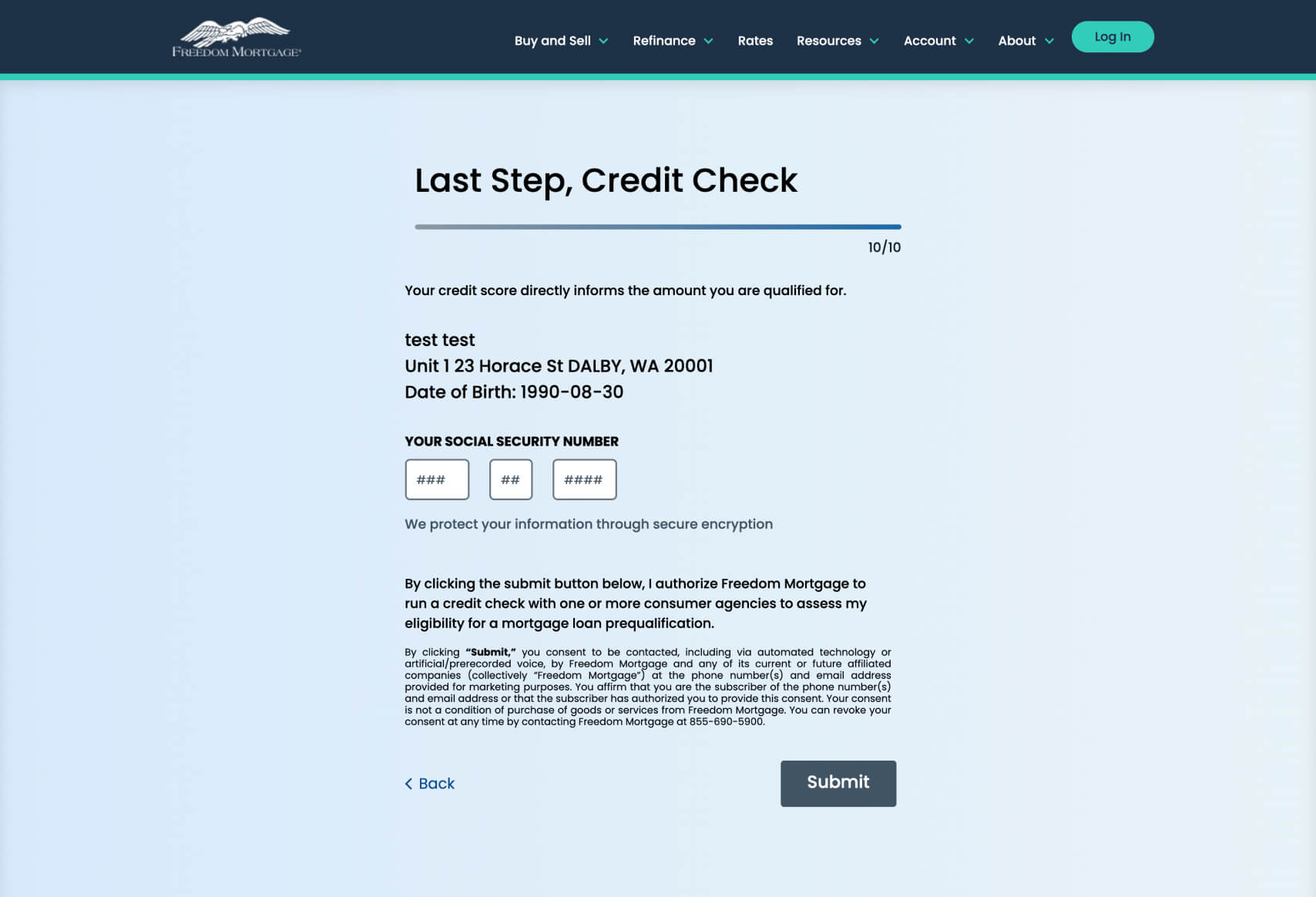

- Progressive Disclosure of Information: The funnel asks for information in a step-by-step manner, progressively revealing additional questions only as needed. This avoids overwhelming users with too many questions at once, which can reduce friction and drop-off rates.

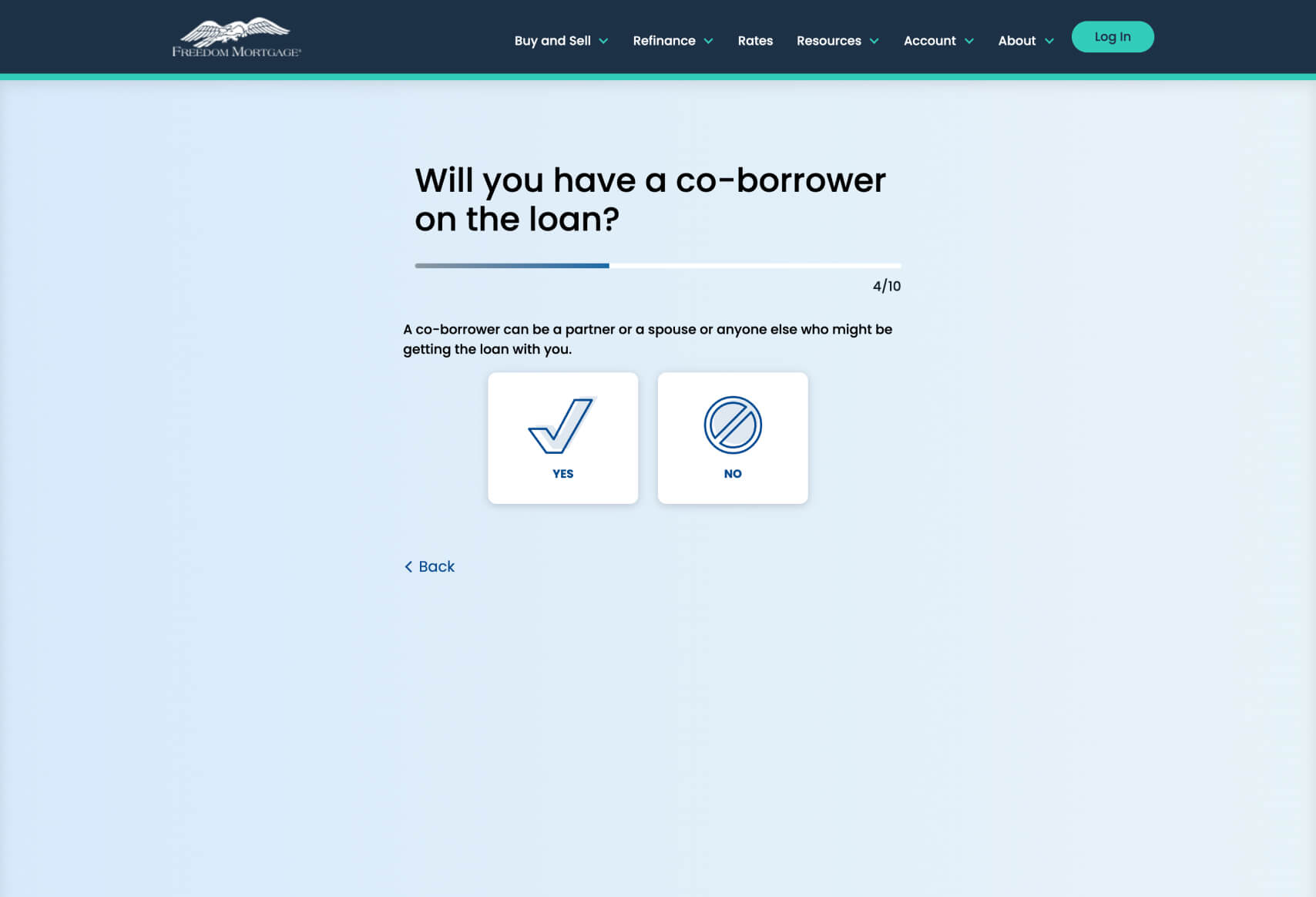

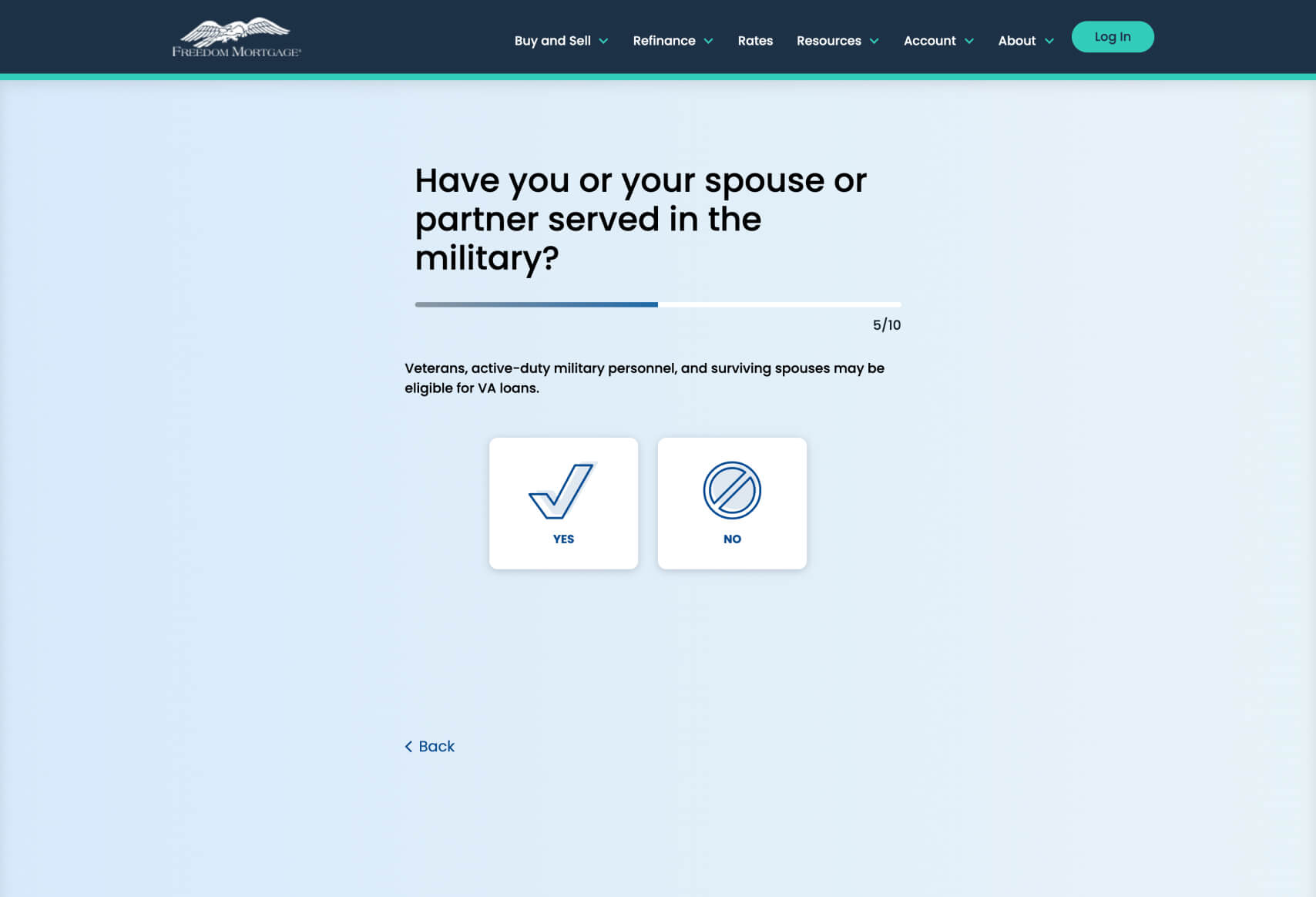

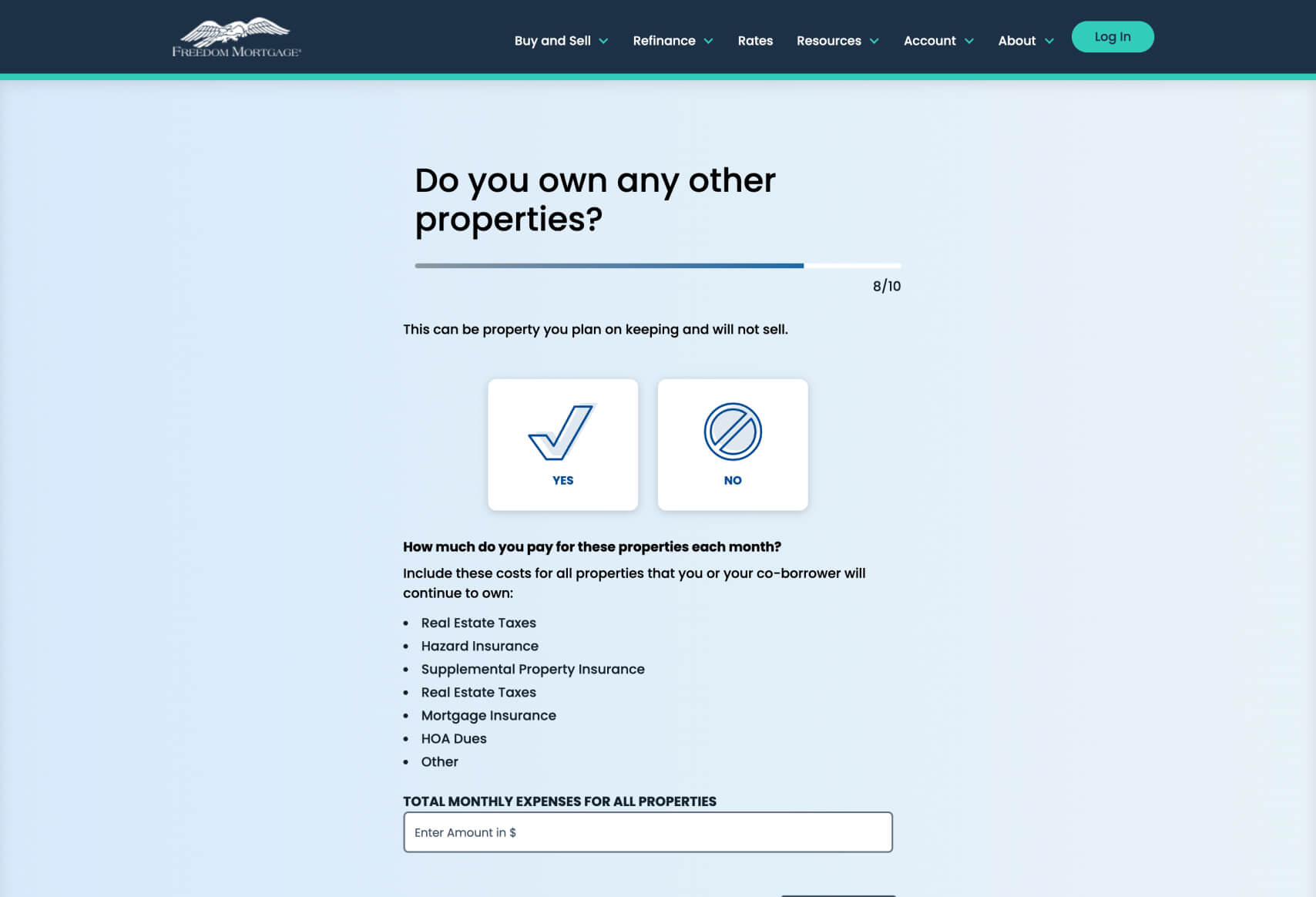

- Visual Progress Indicator: A progress bar is prominently displayed, showing users exactly how far along they are in the process (e.g., “3/10”). This transparency helps manage user expectations and encourages them to complete the process by providing a sense of achievement with each step.

- Clear and Intuitive Design: The use of large, clearly labeled buttons and easy-to-understand icons (such as check marks and crossed circles) makes it simple for users to make selections quickly. This visual clarity reduces cognitive load and enhances user experience.

- Personalized Questions: The funnel includes questions that are tailored to the user’s specific situation, such as “Will you have a co-borrower on the loan?” and “Do you own any other properties?” These targeted questions help gather the necessary information to offer personalized loan options, increasing the relevance and effectiveness of the funnel.

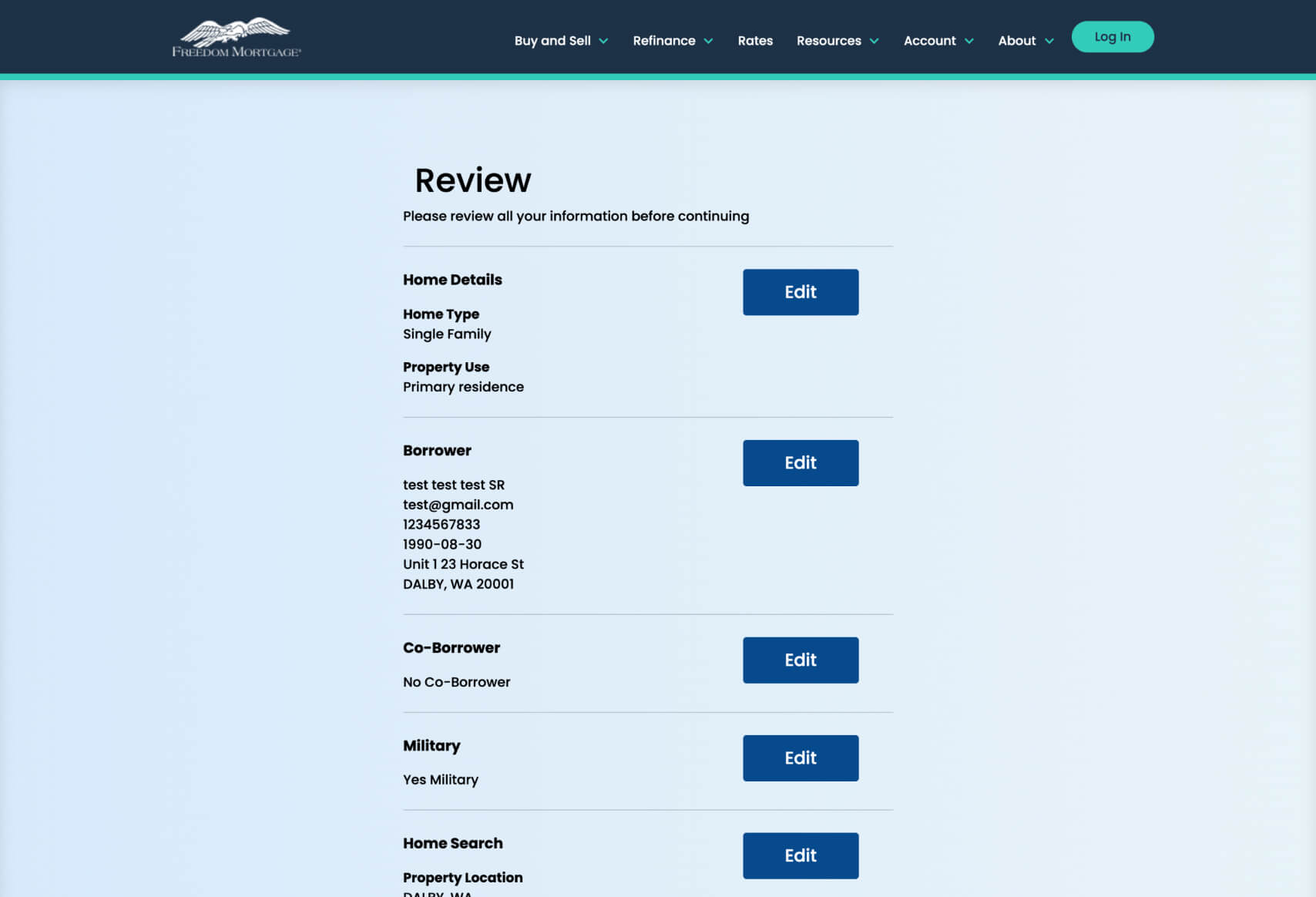

- Reassurance Through Copy: Throughout the funnel, there is consistent messaging that reassures users about the process. For example, phrases like “talk to an experienced Loan Advisor” or “please review all your information before continuing” convey a sense of support and thoroughness, building trust with the user.

Business Rationale and Benefits:

Freedom Mortgage’s funnel is designed to efficiently guide users through the prequalification process for a mortgage loan, which is often seen as complex and intimidating. By breaking down the process into manageable steps and clearly displaying the user’s progress, the funnel helps to reduce the perceived complexity of applying for a mortgage. This approach is likely to increase completion rates, as users feel less overwhelmed and more in control.

The use of personalized questions ensures that the information gathered is relevant to the user’s specific situation, allowing Freedom Mortgage to tailor their offerings and advice. This personalized approach not only improves the accuracy of the prequalification but also enhances the customer experience, making users feel understood and valued.

By starting the funnel with minimal initial commitment—just a short form—the design minimizes barriers to entry. This can increase the number of users who start the process, thereby expanding the top of the sales funnel. The design’s clarity and user-friendliness likely contribute to higher conversion rates as users move through the funnel, feeling guided and supported at each step.

Impactful Questions and Why They Work:

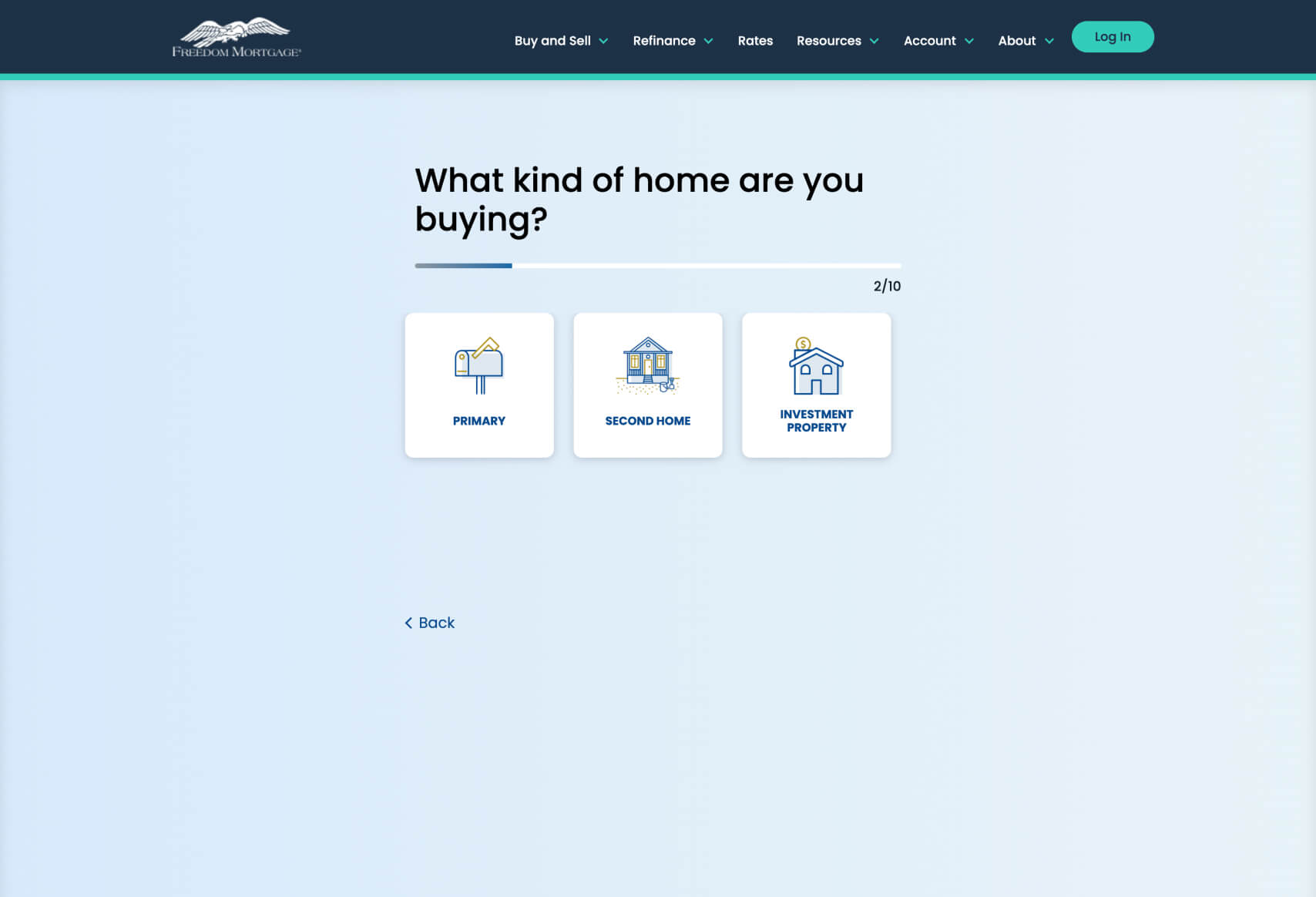

- “What kind of home are you buying?”

- User-Centric Personalization: This question allows the funnel to tailor subsequent steps and information based on the user’s specific type of home purchase, making the process feel more relevant and personalized.

- “Do you own any other properties?”

- Financial Context Gathering: By asking this, the funnel captures important financial context that will affect the loan qualification, ensuring the process is thorough and tailored to the user’s financial situation.

- “Will you have a co-borrower on the loan?”

- Engagement and Specificity: This question directly addresses a common scenario, making the process inclusive and specific to the user’s needs, which can increase user engagement and the perceived relevance of the application.

Overall, Freedom Mortgage’s funnel effectively simplifies a typically complex process, making it more accessible and user-friendly. The design focuses on clarity, progressive disclosure of information, and personalized questions, all of which contribute to a seamless user experience that likely improves conversion rates and enhances customer engagement. For businesses looking to optimize their conversion processes, exploring similar approaches on Convincely’s listings can offer valuable insights.

No development or design required

No development or design required  Executed by just adding one line of Convincely code to your website

Executed by just adding one line of Convincely code to your website  Plan and strategize with your team. Execute and deploy with Convincely

Plan and strategize with your team. Execute and deploy with Convincely