Summary of Reasons Why This Funnel Works:

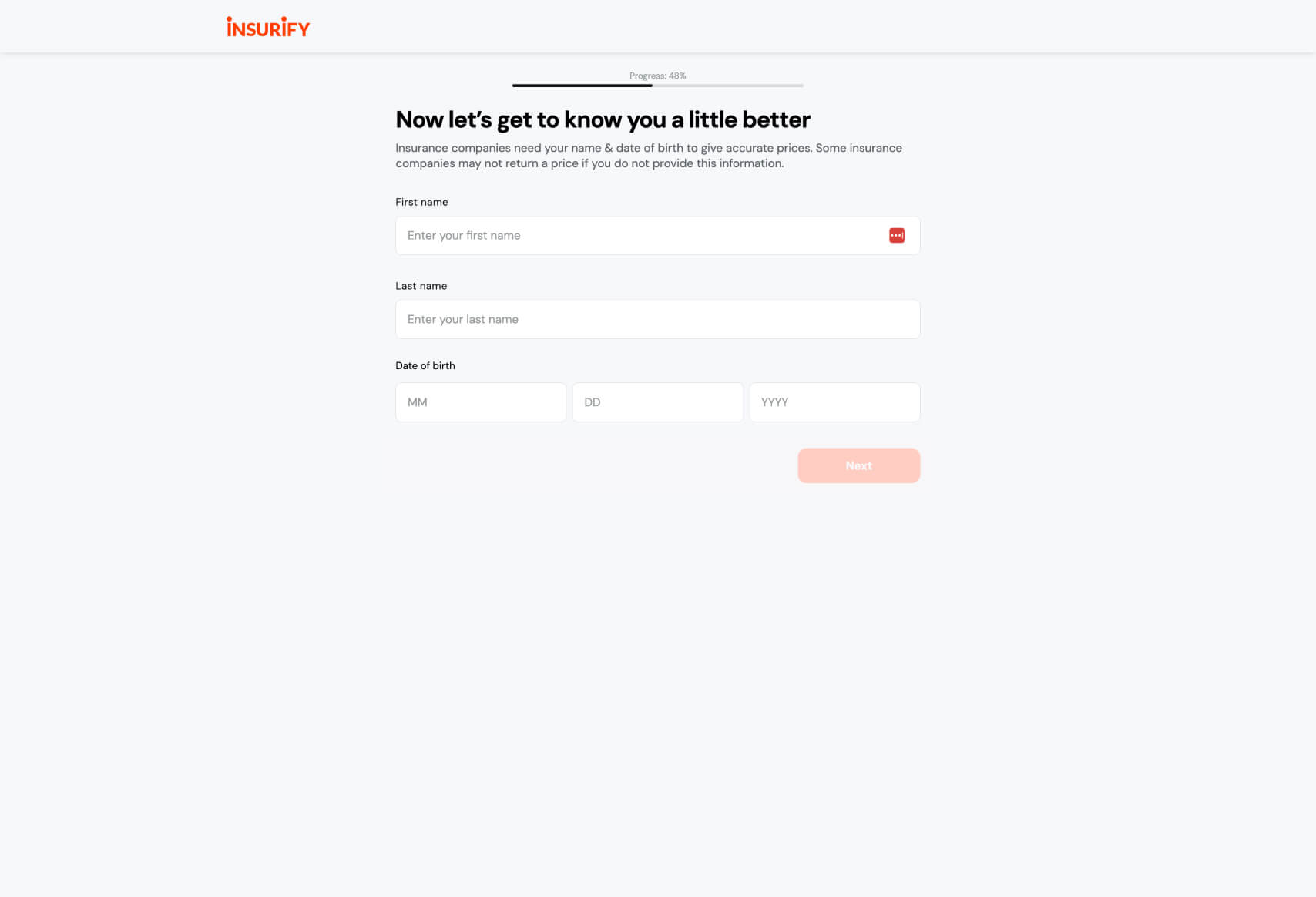

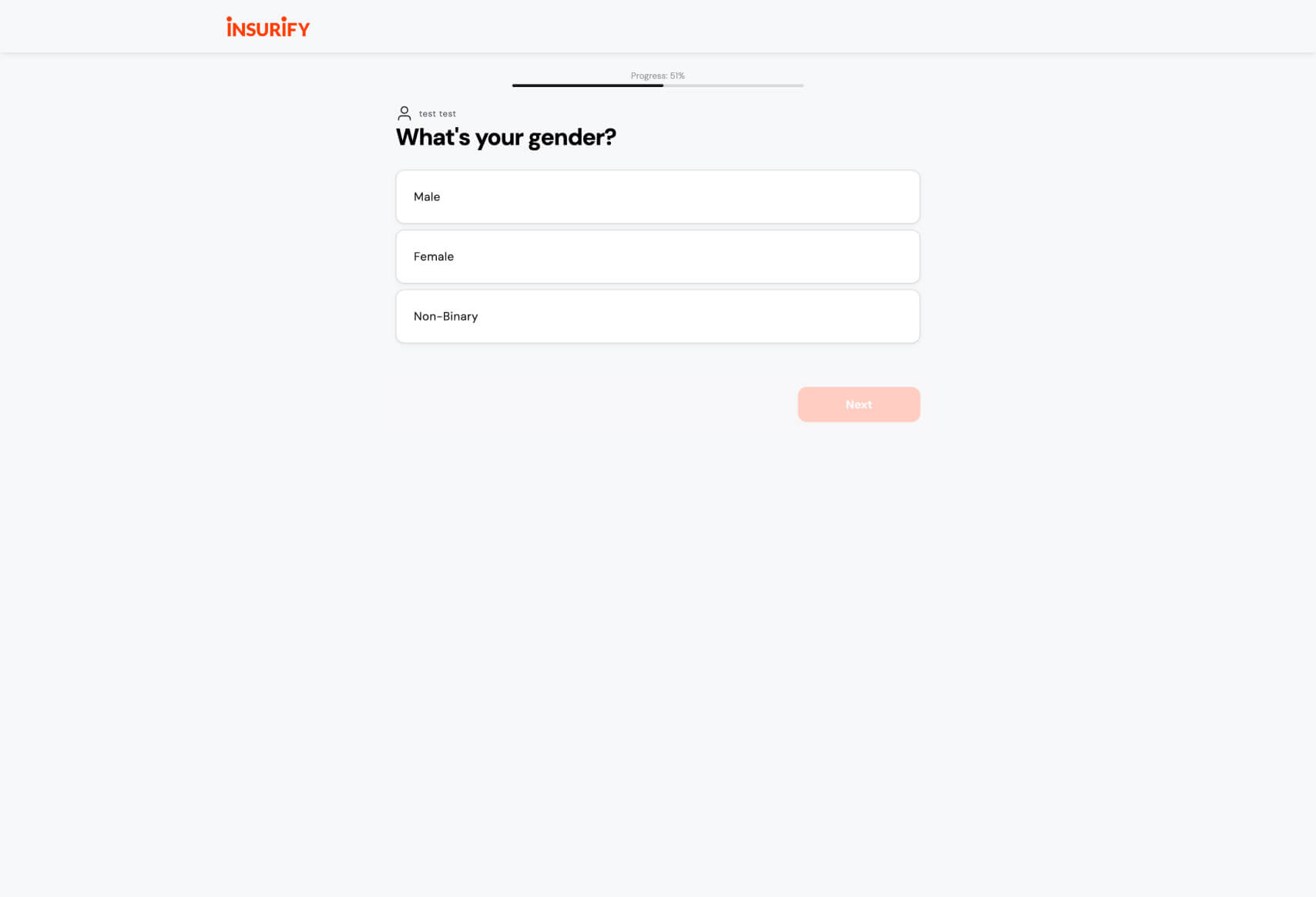

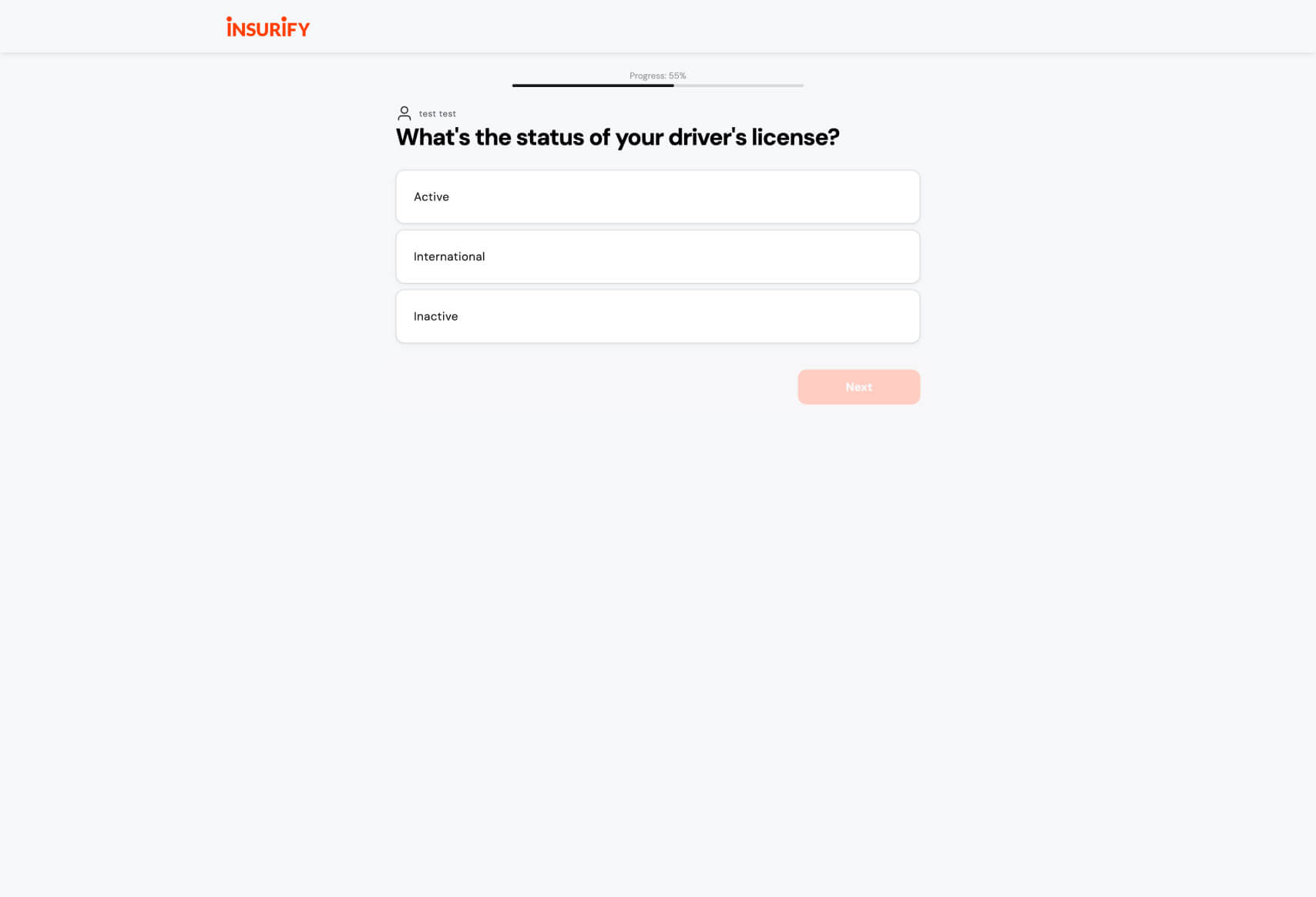

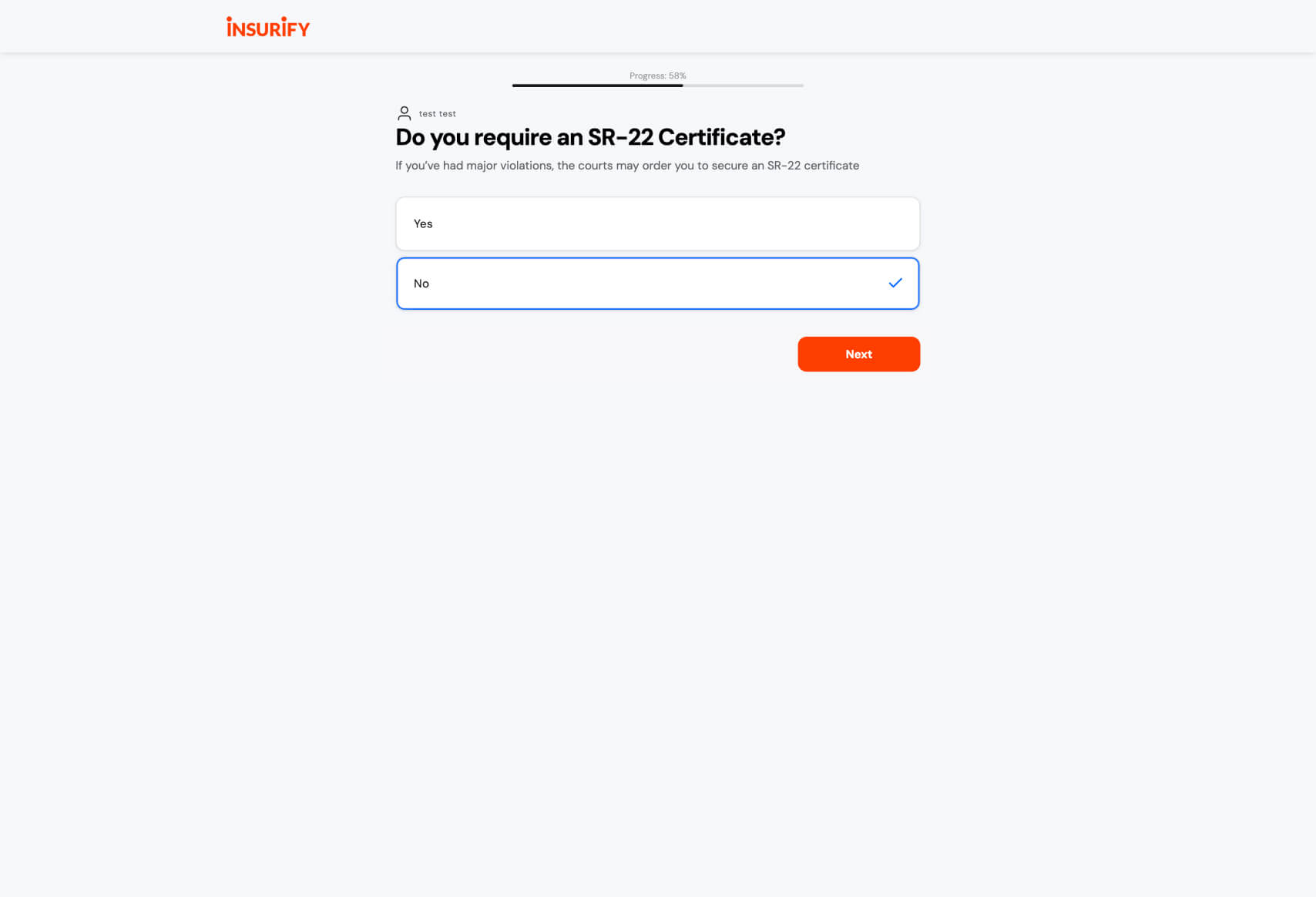

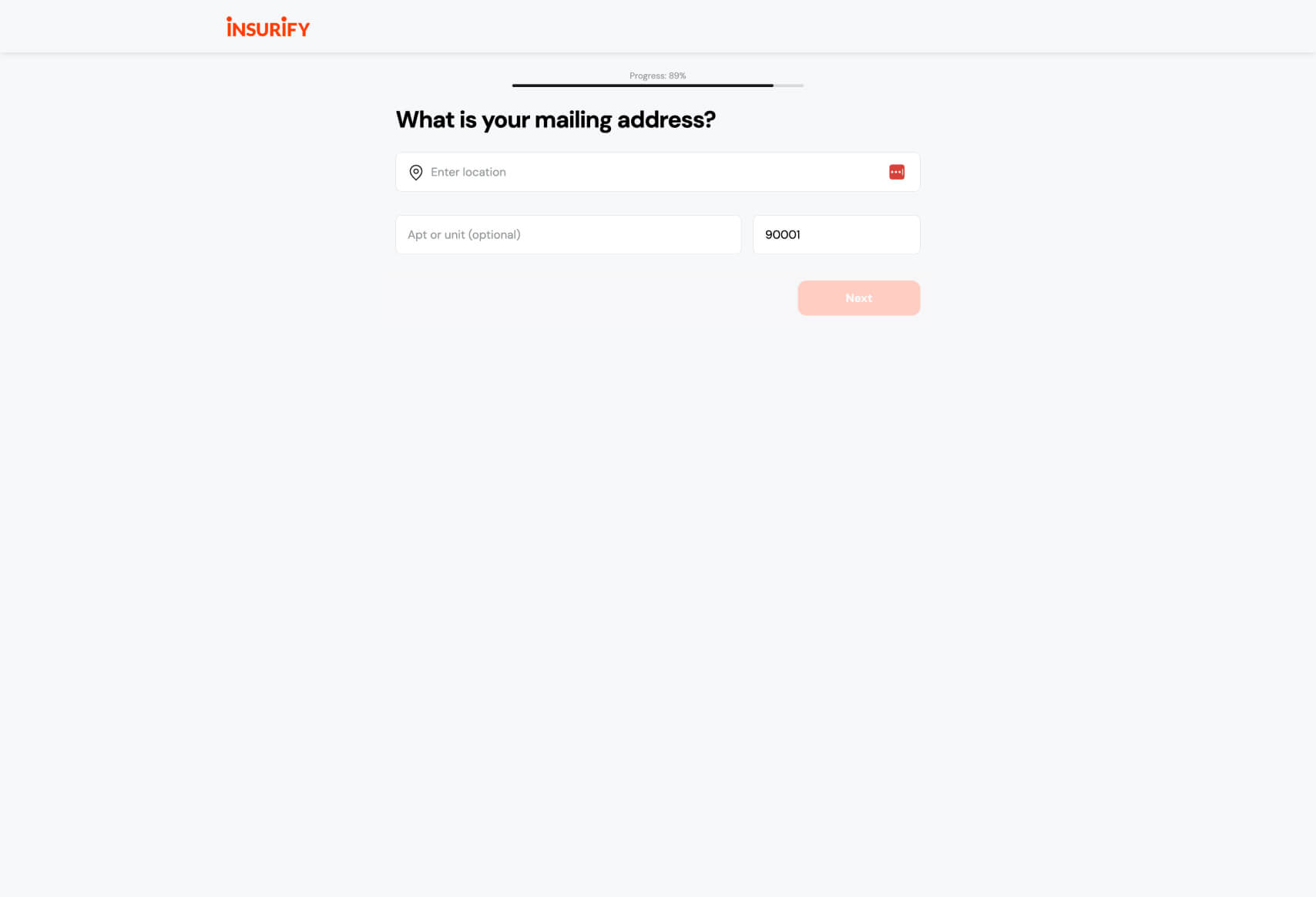

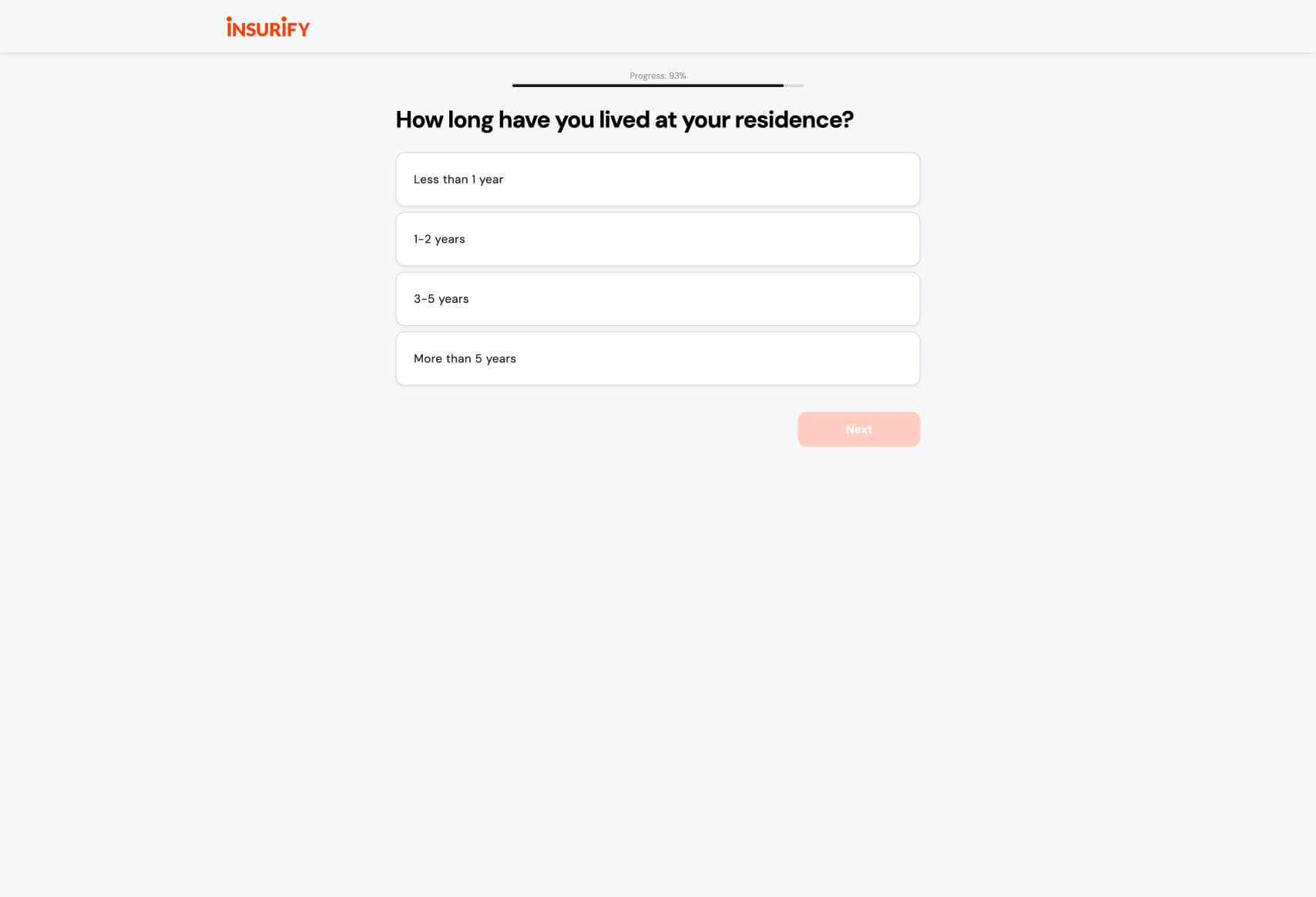

- Progress Indicator: The progress bar at the top of each screen clearly indicates how far along the user is in the process, reducing uncertainty and keeping users motivated to complete the funnel.

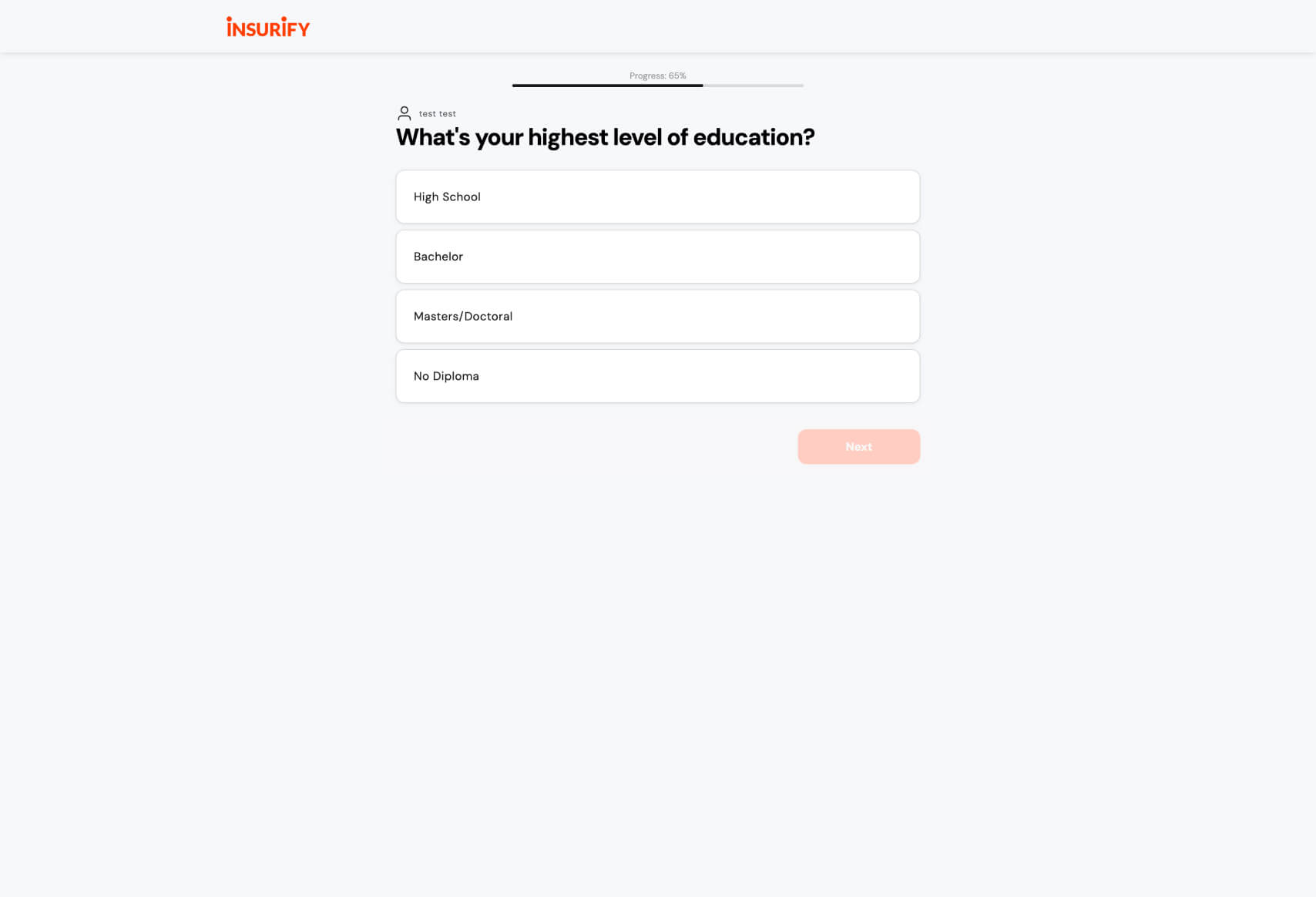

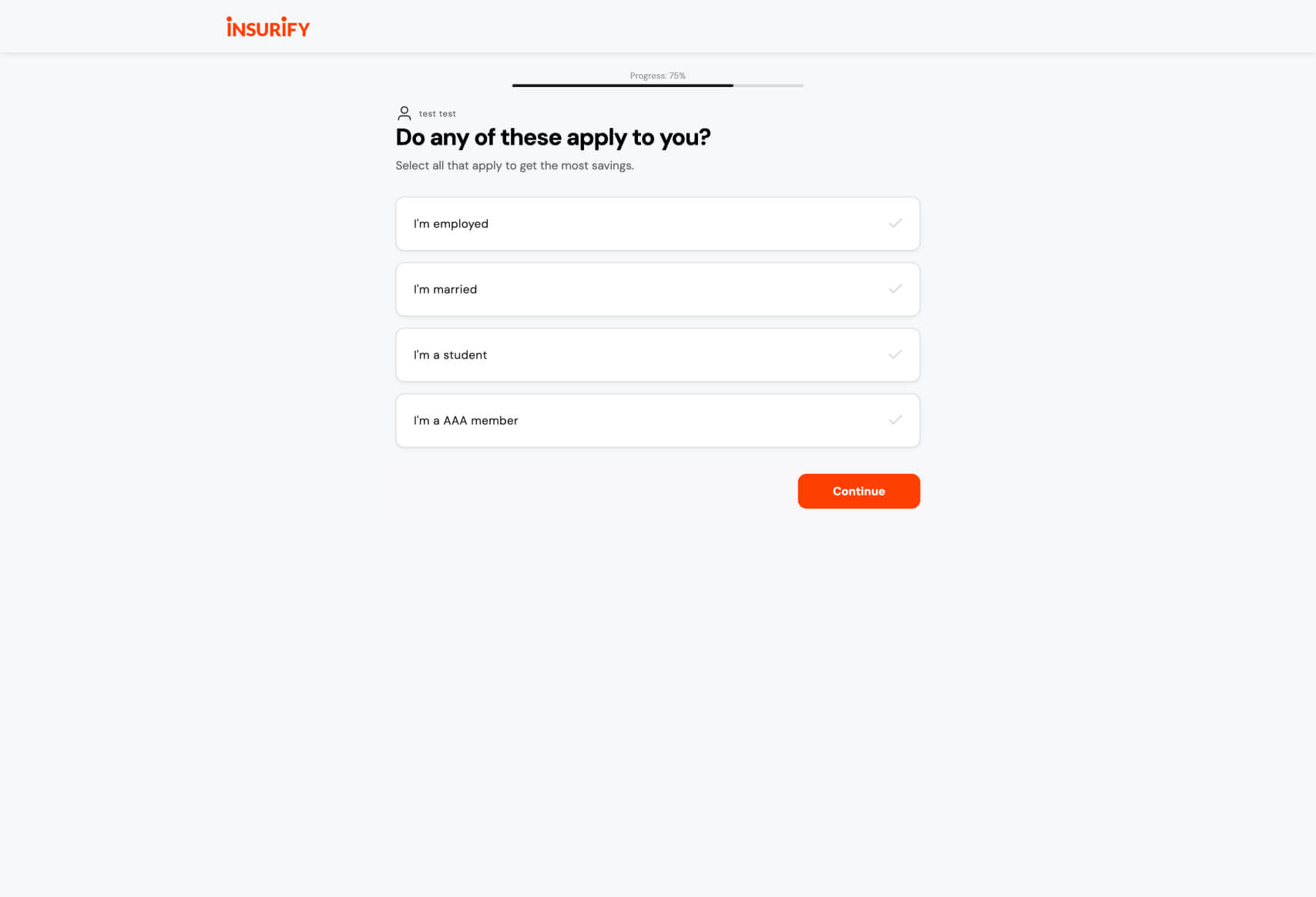

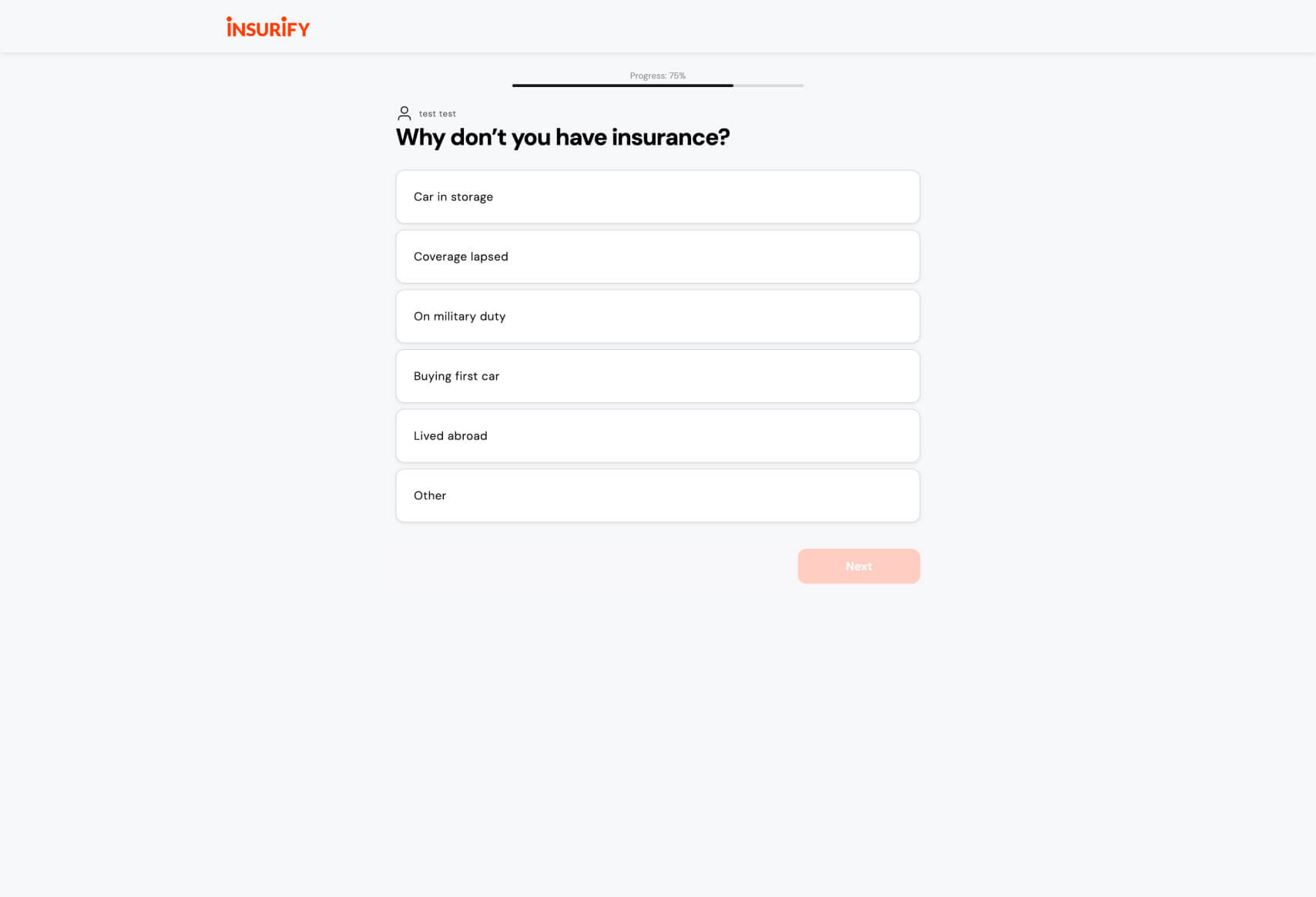

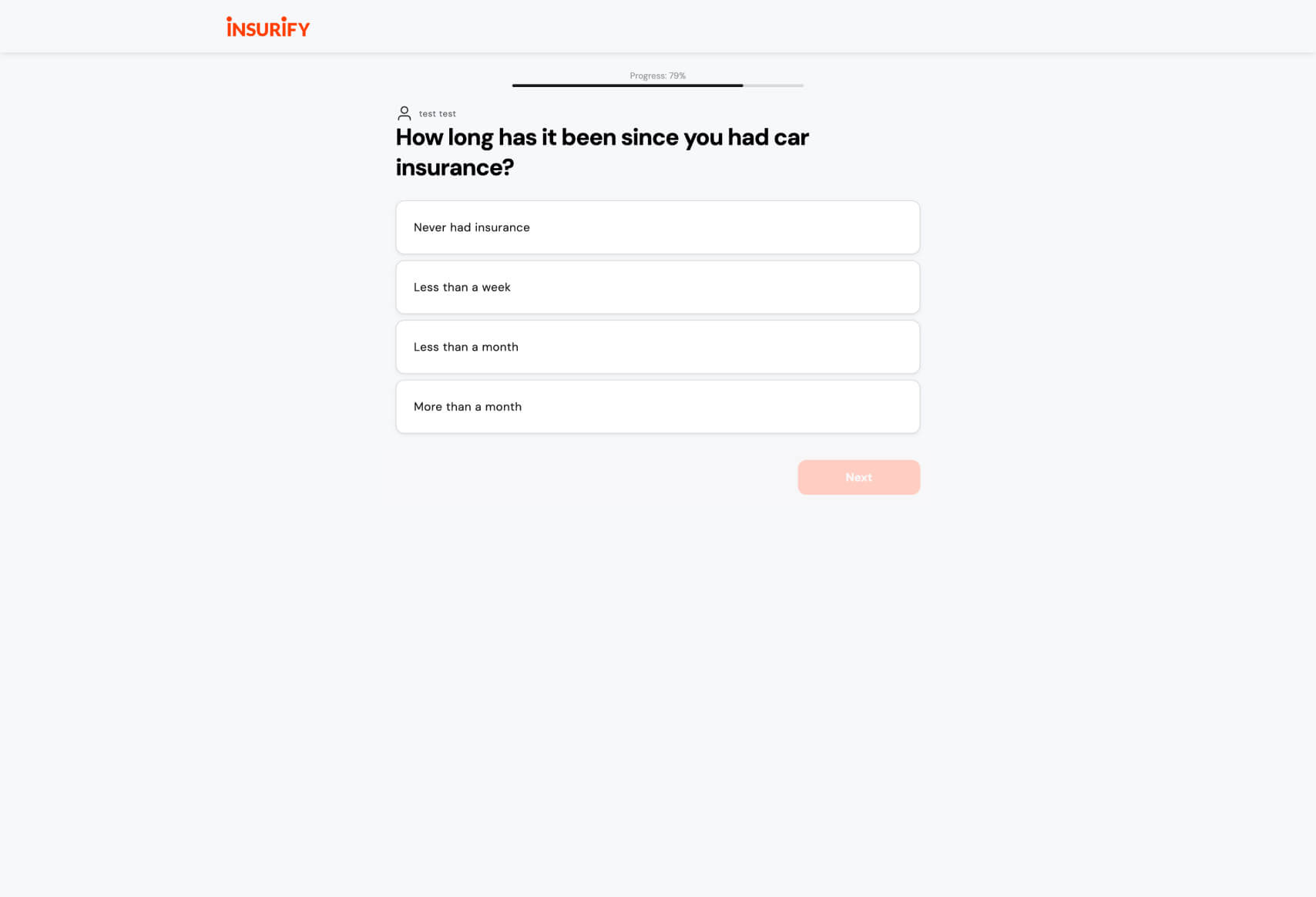

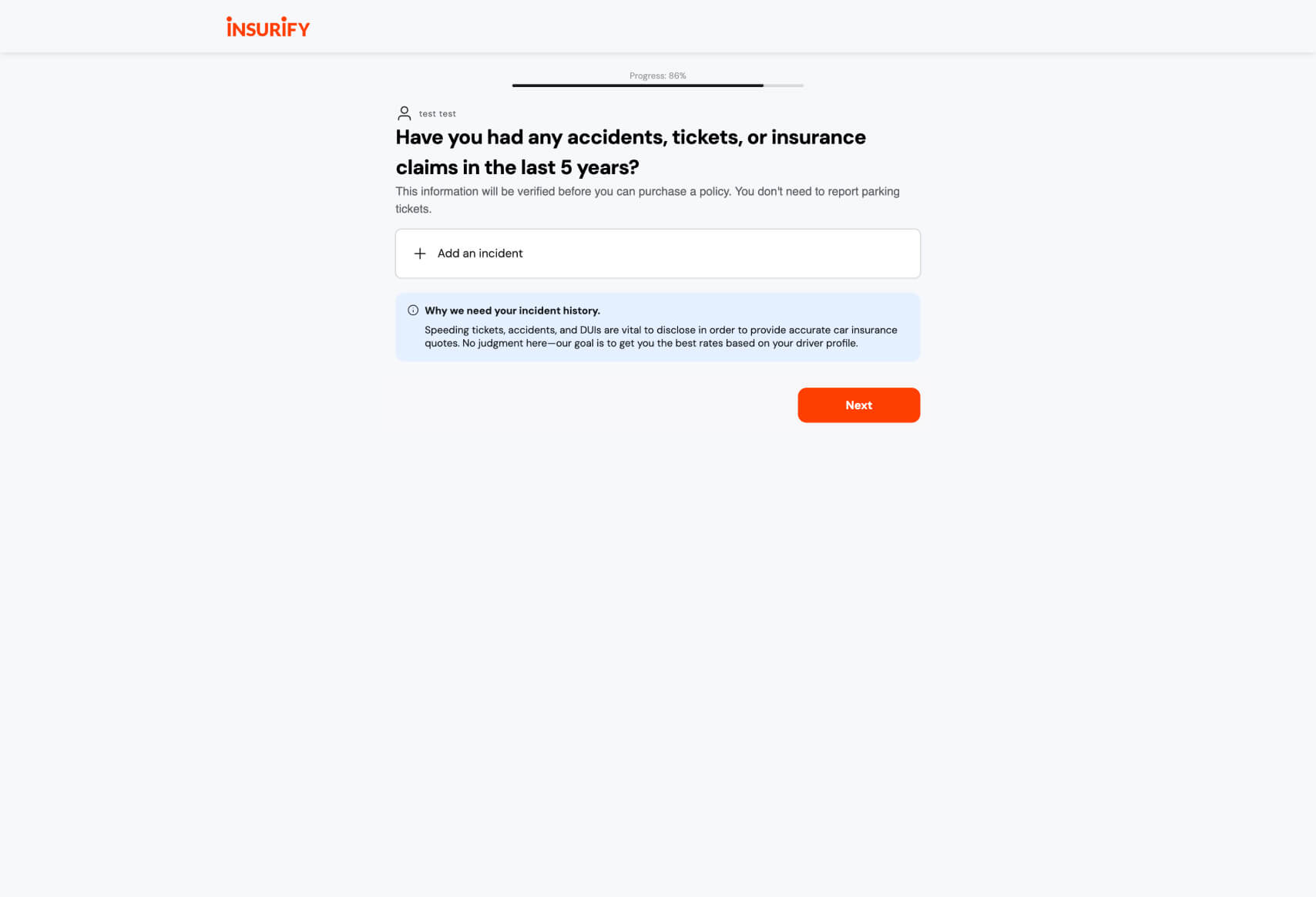

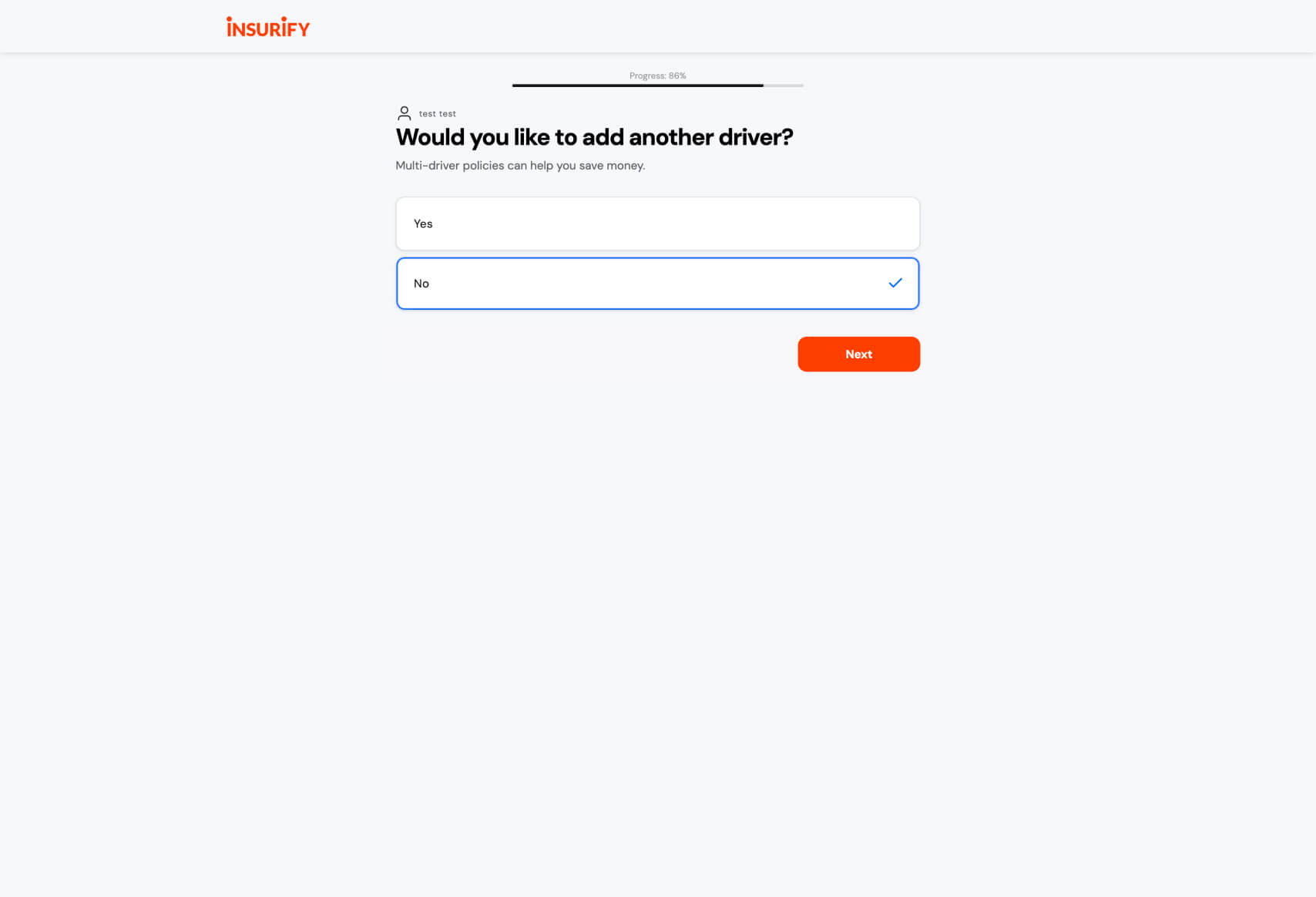

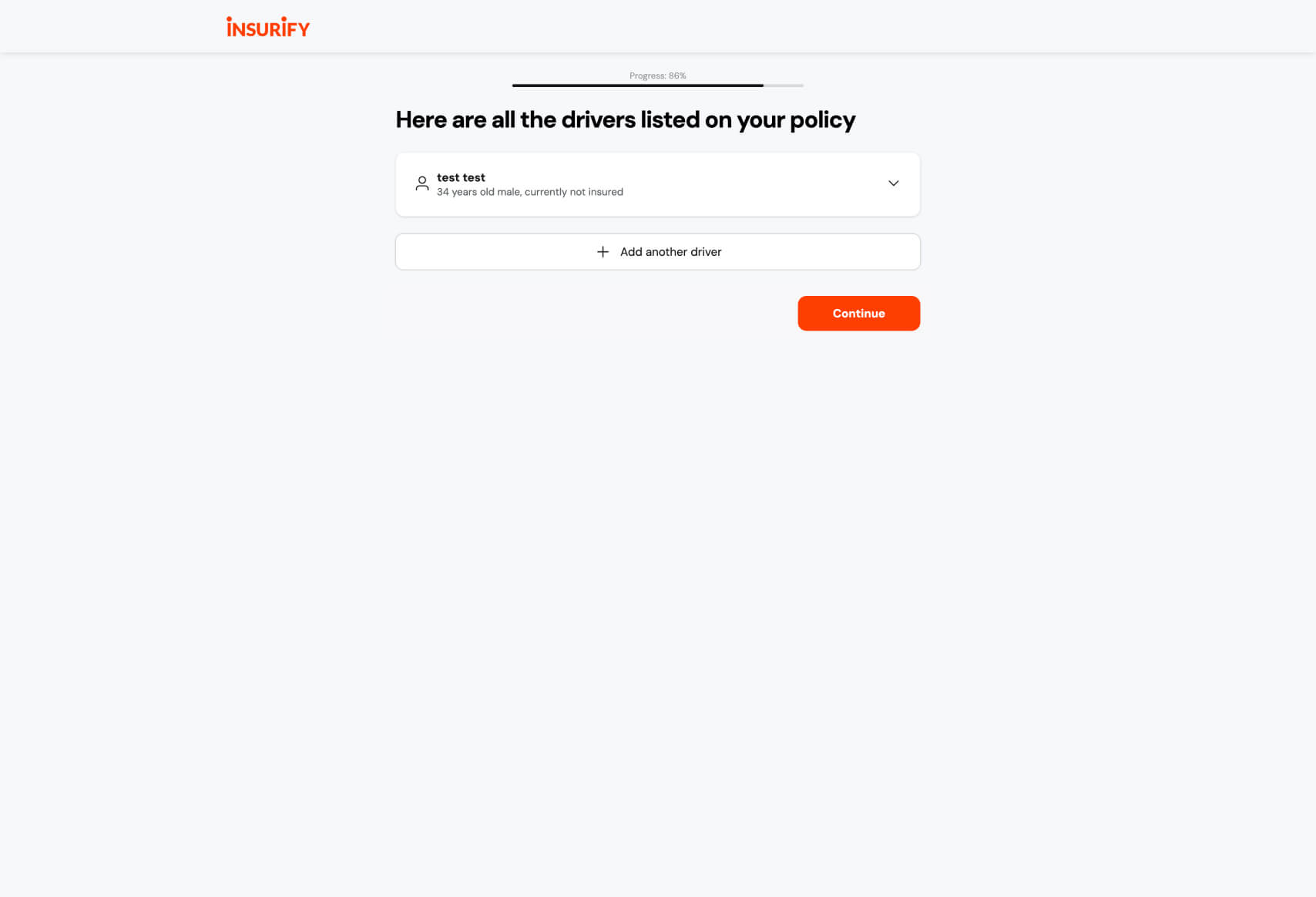

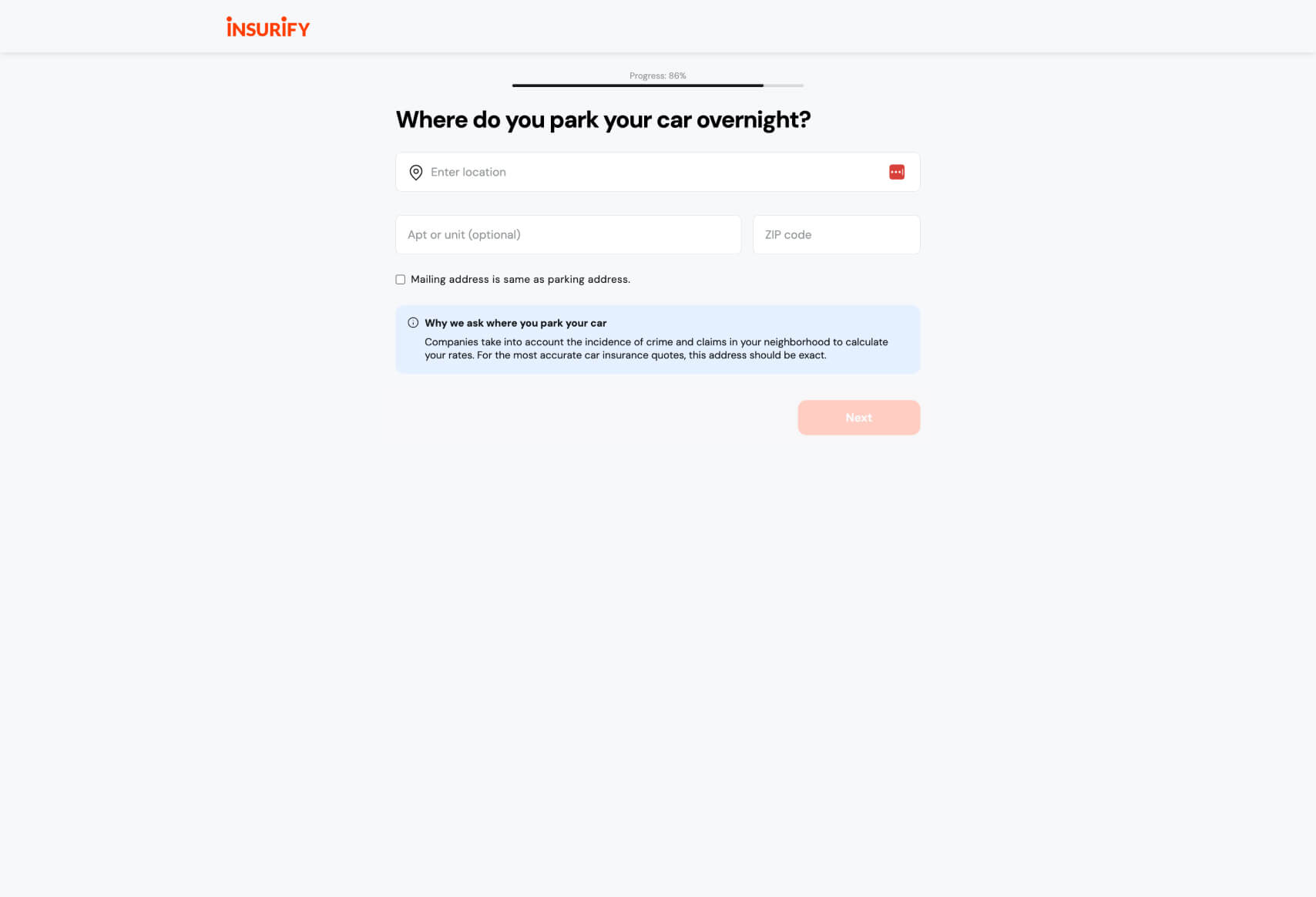

- Simple and Focused Design: Each page has a single, clear question with large, easily selectable options. This minimizes cognitive load and makes the process straightforward, reducing the likelihood of user drop-off.

- Concise Language: The questions are short and to the point, with additional information provided in a small font when necessary (e.g., “Insurance companies may consider your credit as a rating factor in some states”). This approach helps maintain focus while still providing context.

- Consistent Visual Style: The consistent use of colors, fonts, and button styles across all screens helps create a cohesive user experience that feels professional and trustworthy.

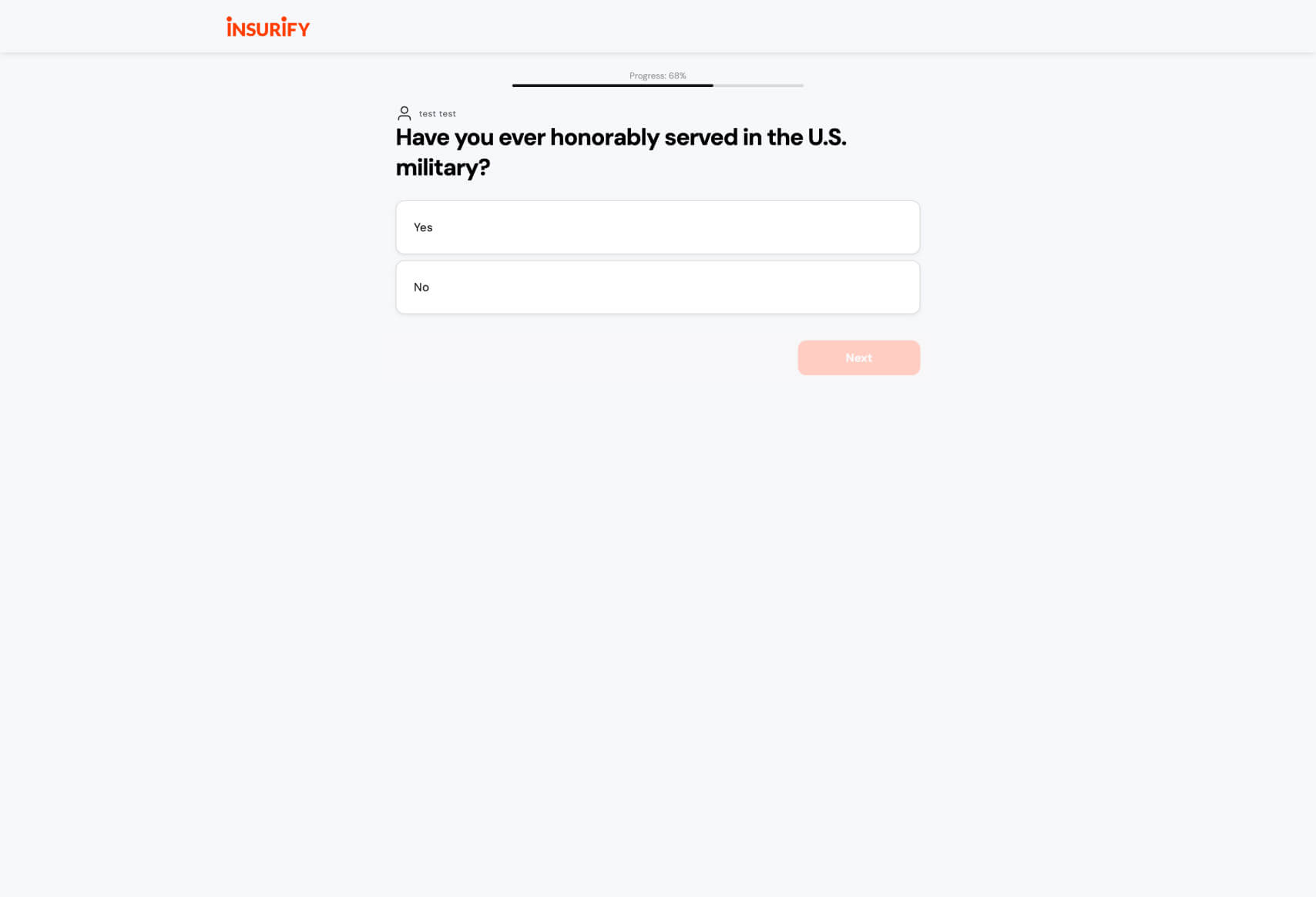

- Personalized Flow: The funnel adjusts to the user’s responses, ensuring that each question is relevant based on previous answers. This customization helps to keep the user engaged by making the process feel tailored to their situation.

Why This Design/Funnel Was Chosen:

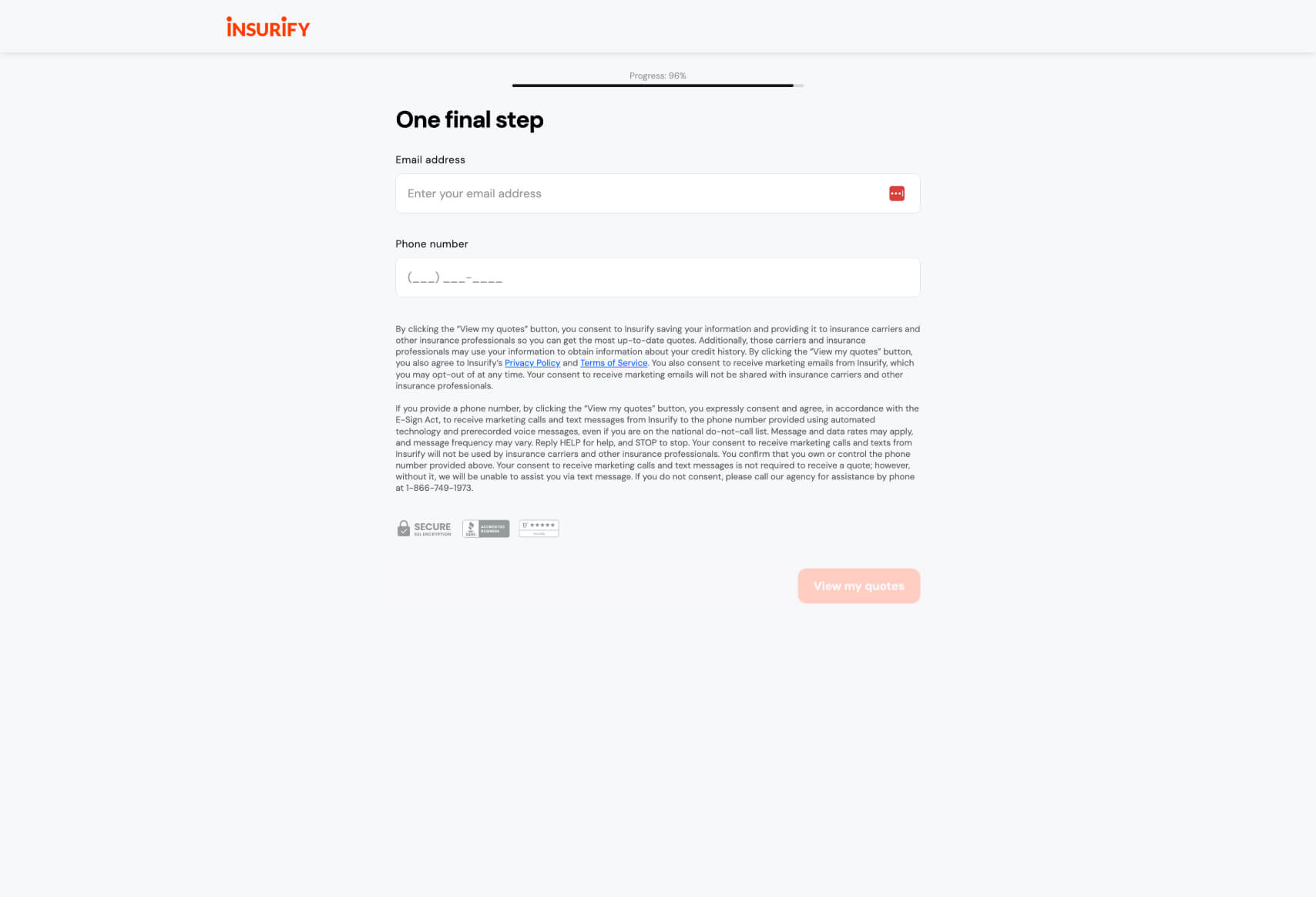

Insurify likely chose this funnel design to efficiently gather detailed user information necessary for providing accurate insurance quotes while maintaining a user-friendly experience. The step-by-step approach allows users to answer questions in a relaxed, focused manner without feeling overwhelmed by a long, complex form. The progress indicator is a crucial element that keeps users engaged by showing them how much they’ve completed and how much remains.

This design is particularly effective for Insurify because it reflects a balance between user engagement and data collection. Each question is purposefully designed to extract essential information without causing frustration or confusion. By asking one question at a time and offering simple, binary or multiple-choice answers, the funnel reduces the chances of user error or abandonment.

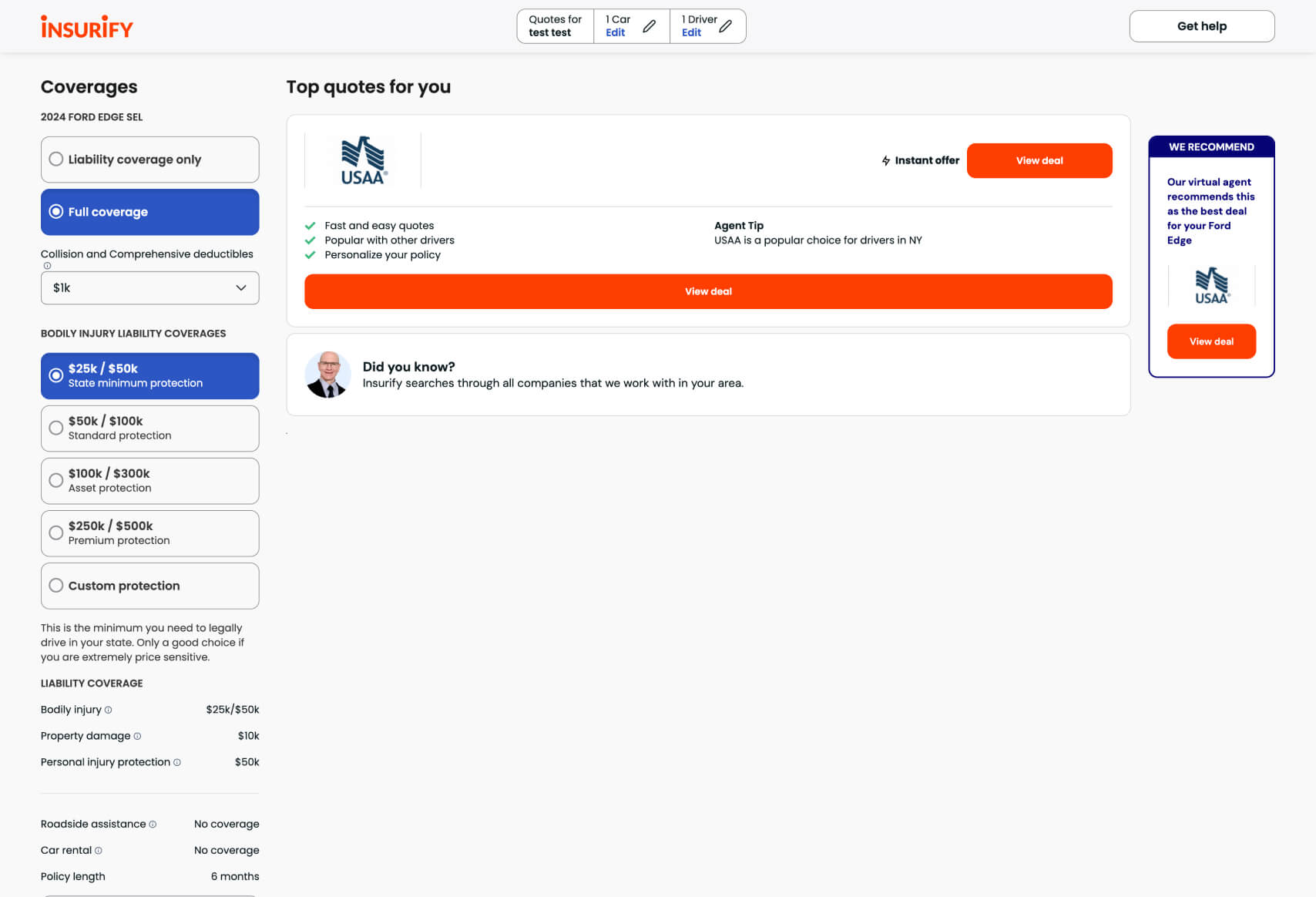

For Insurify, the business benefit lies in the ability to provide users with personalized insurance quotes based on accurate, user-specific data. This approach enhances the likelihood of conversion, as users are more likely to trust and complete a process that feels tailored and transparent. Additionally, the simplicity and clarity of the funnel help in maintaining a positive brand image, positioning Insurify as a straightforward and reliable option in the insurance marketplace.

Most Impactful Questions in the Funnel:

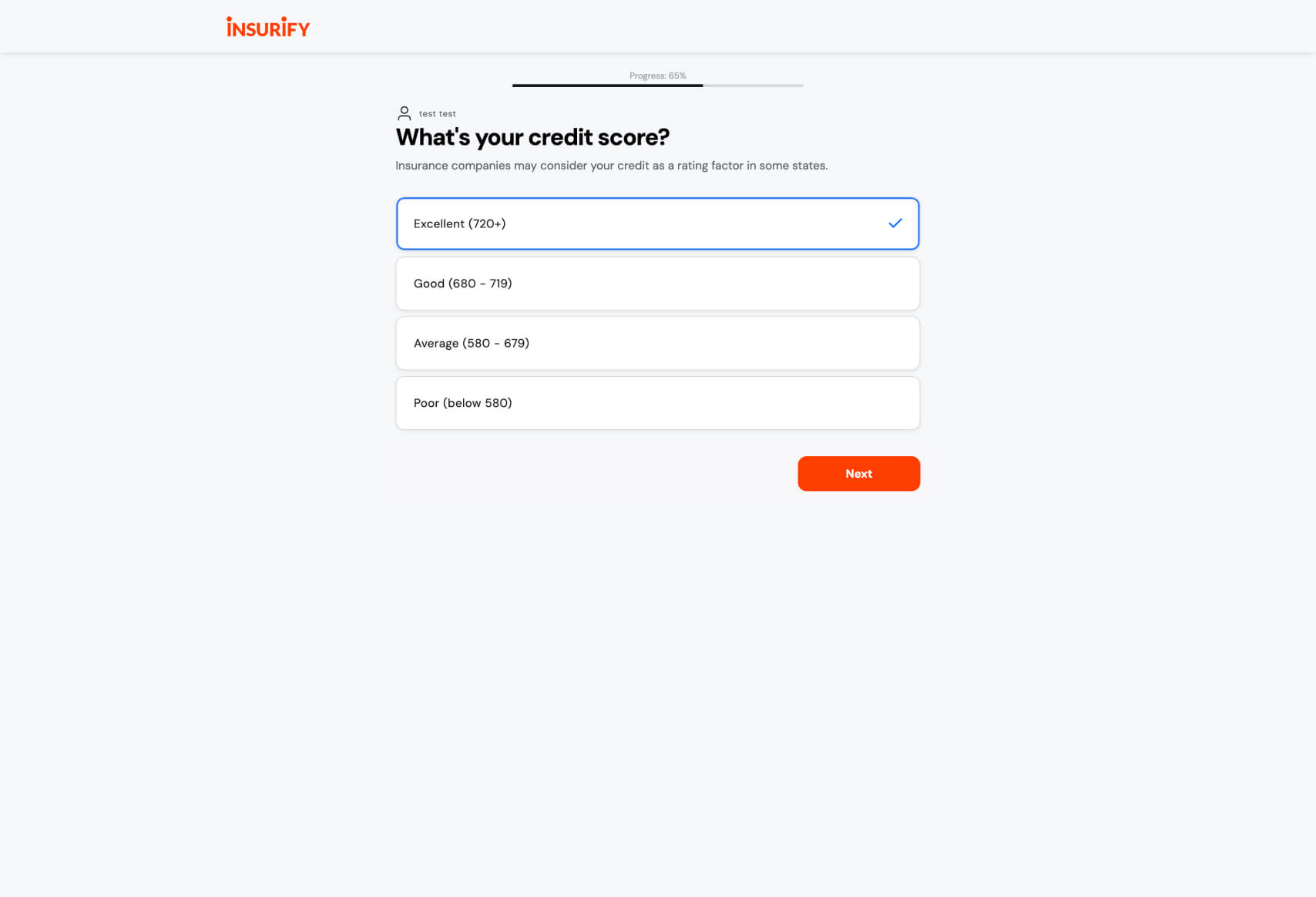

- “What’s your credit score?”

- Purpose: This question is crucial for determining insurance rates, as credit score can influence the cost of premiums in many states.

- Impact: The clear categorization of credit scores makes it easy for users to self-identify without feeling judged. The explanation about why this information is needed reassures users and reduces any potential discomfort.

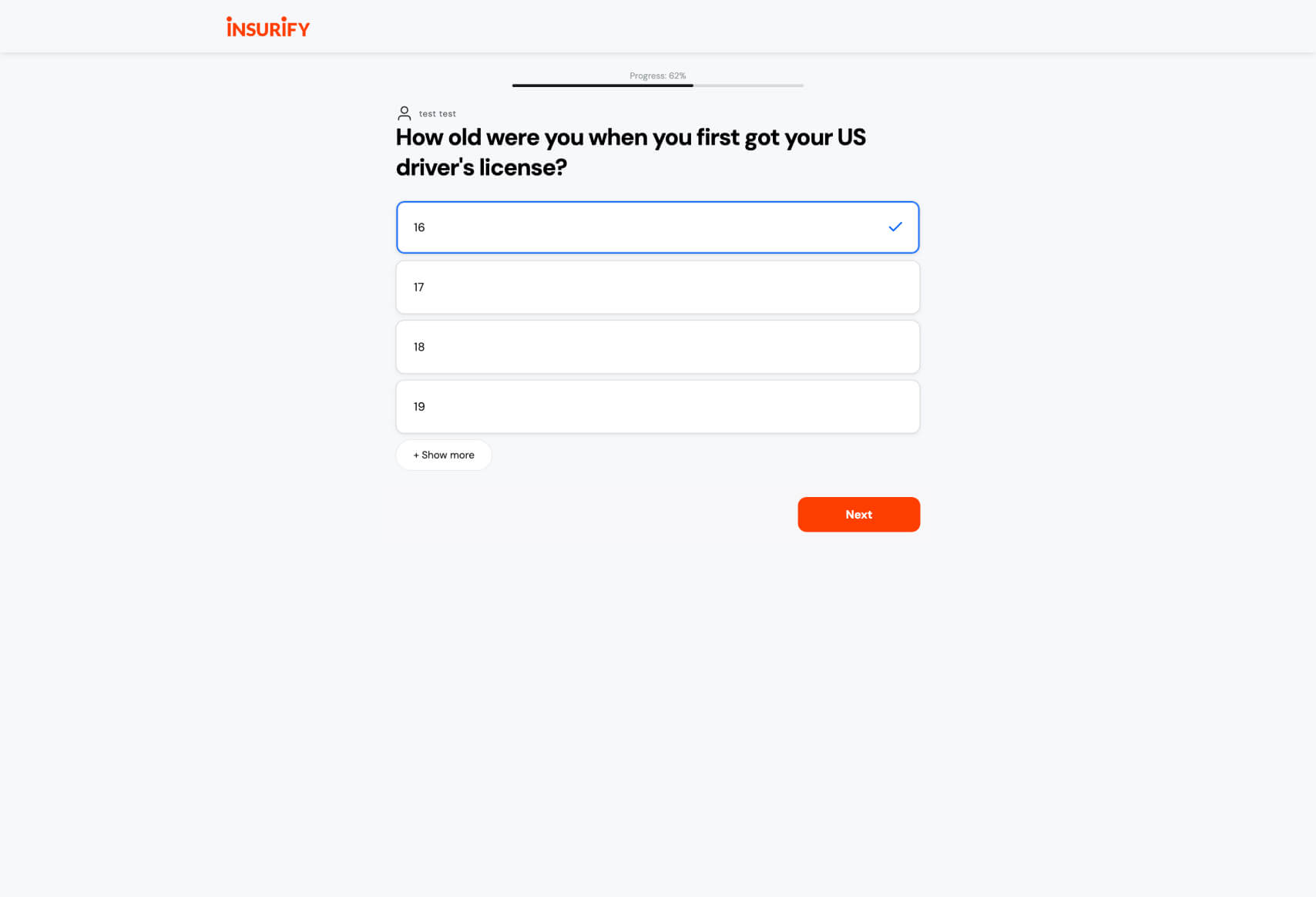

- “How old were you when you first got your US driver’s license?”

- Purpose: This question helps Insurify assess the user’s driving experience, which is a key factor in determining insurance rates.

- Impact: The straightforward nature of this question, along with the simple multiple-choice format, allows users to answer quickly and accurately, keeping the process moving smoothly.

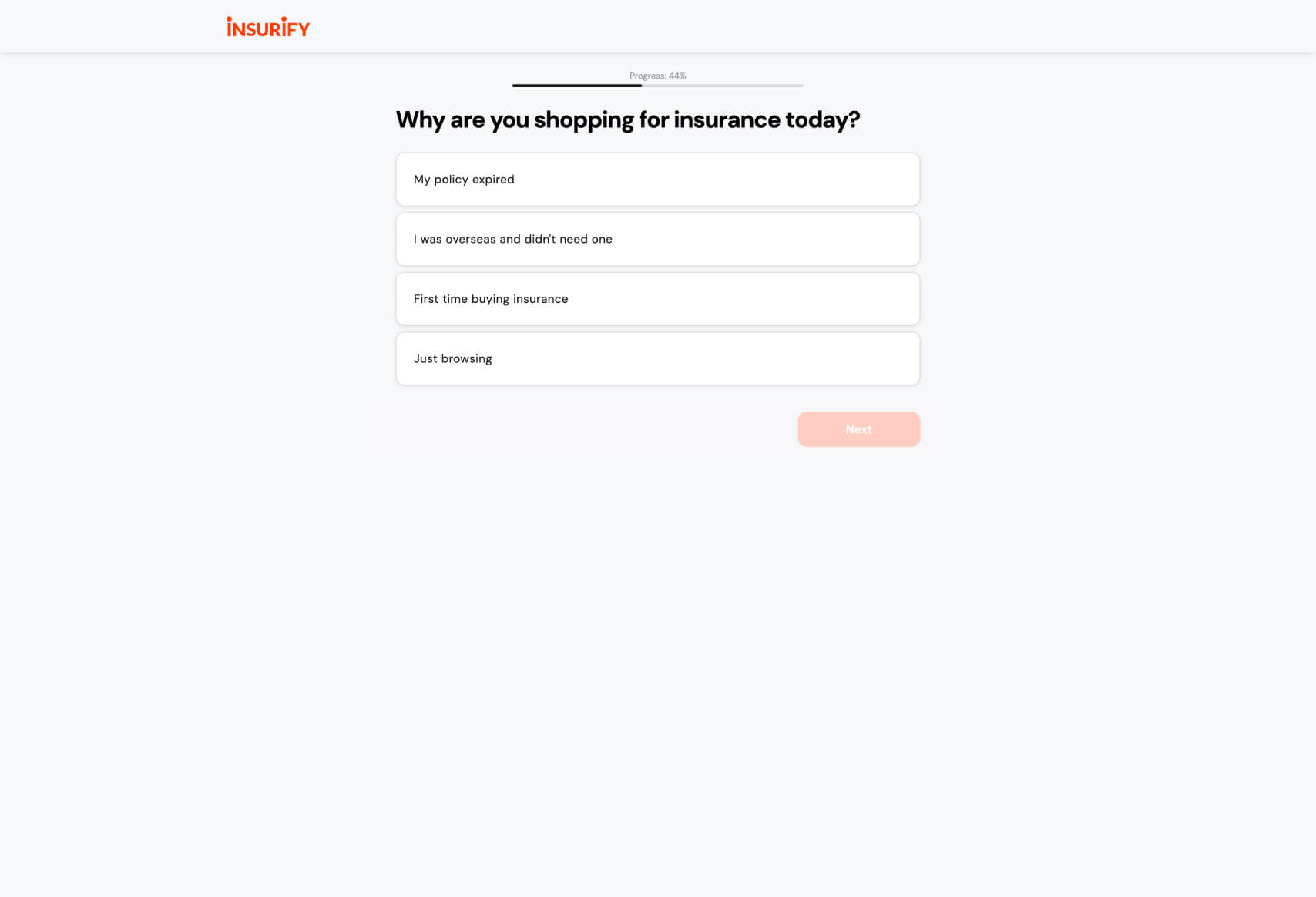

- “Why are you shopping for insurance today?”

- Purpose: This question helps Insurify understand the user’s intent and urgency, allowing the platform to tailor its messaging and offerings accordingly.

- Impact: The options provided cover a range of scenarios, from policy expiration to first-time purchases, ensuring that all users feel their specific situation is understood and catered to.

This funnel design effectively balances user-friendly interaction with data collection, likely leading to improved customer engagement and higher conversion rates. For more examples of effective funnel designs, you can explore our database of websites that have successfully implemented similar strategies.

No development or design required

No development or design required  Executed by just adding one line of Convincely code to your website

Executed by just adding one line of Convincely code to your website  Plan and strategize with your team. Execute and deploy with Convincely

Plan and strategize with your team. Execute and deploy with Convincely