Quick Summary of Why This Funnel Works

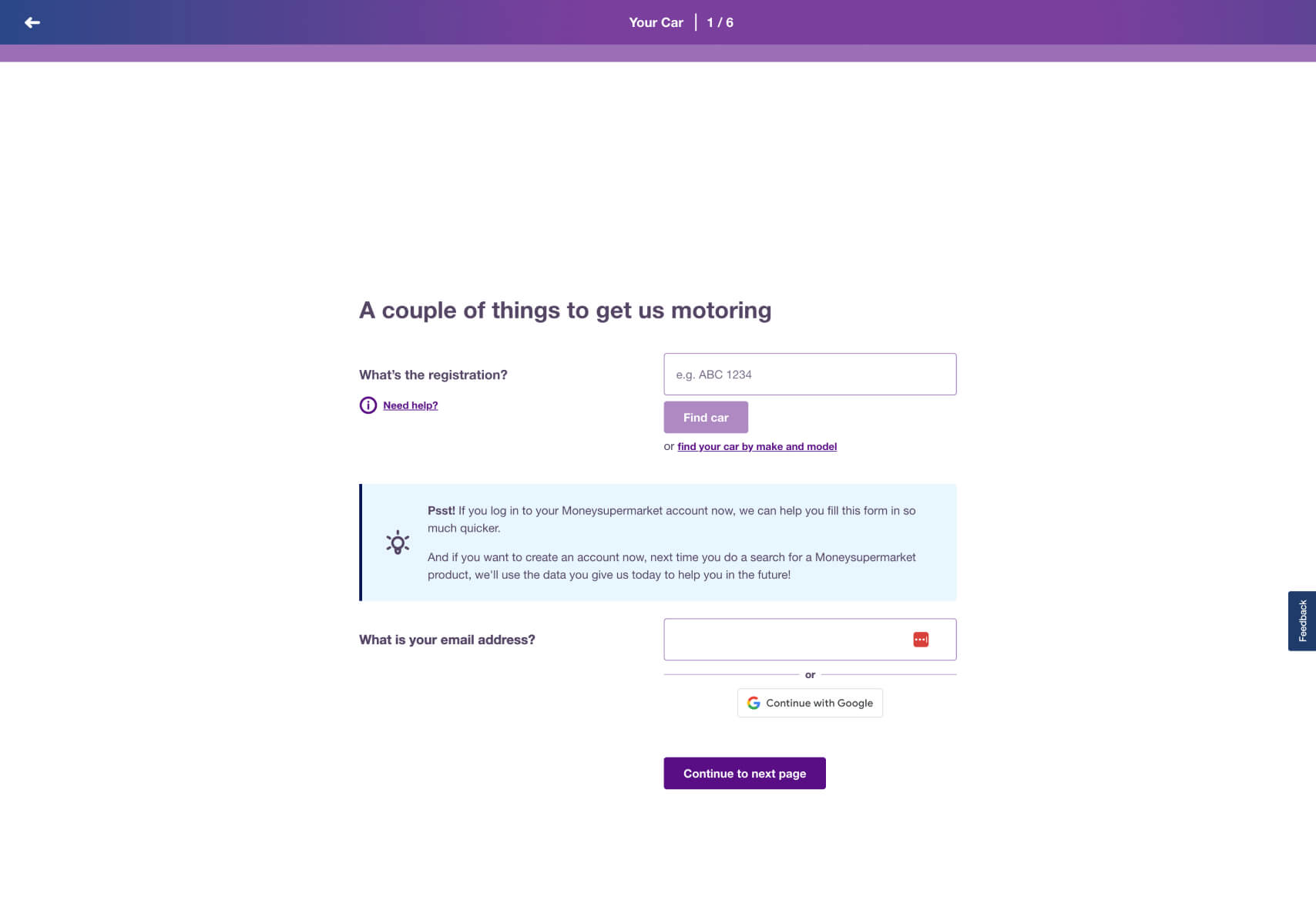

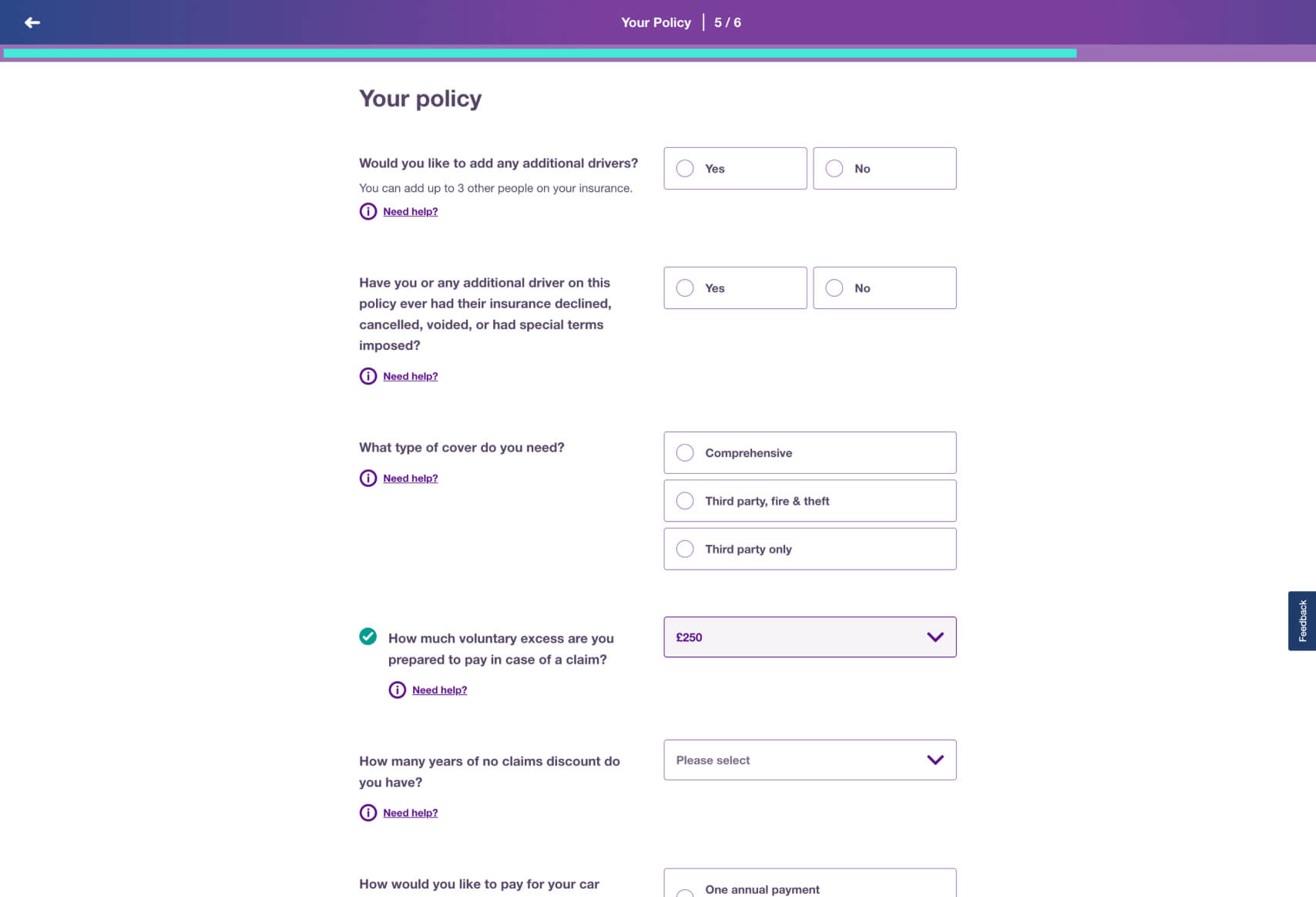

- Clear Step-by-Step Process: The funnel effectively breaks down a complex process into manageable steps. The progress bar at the top of each page clearly indicates the user’s position, reducing anxiety about the length or complexity of the process.

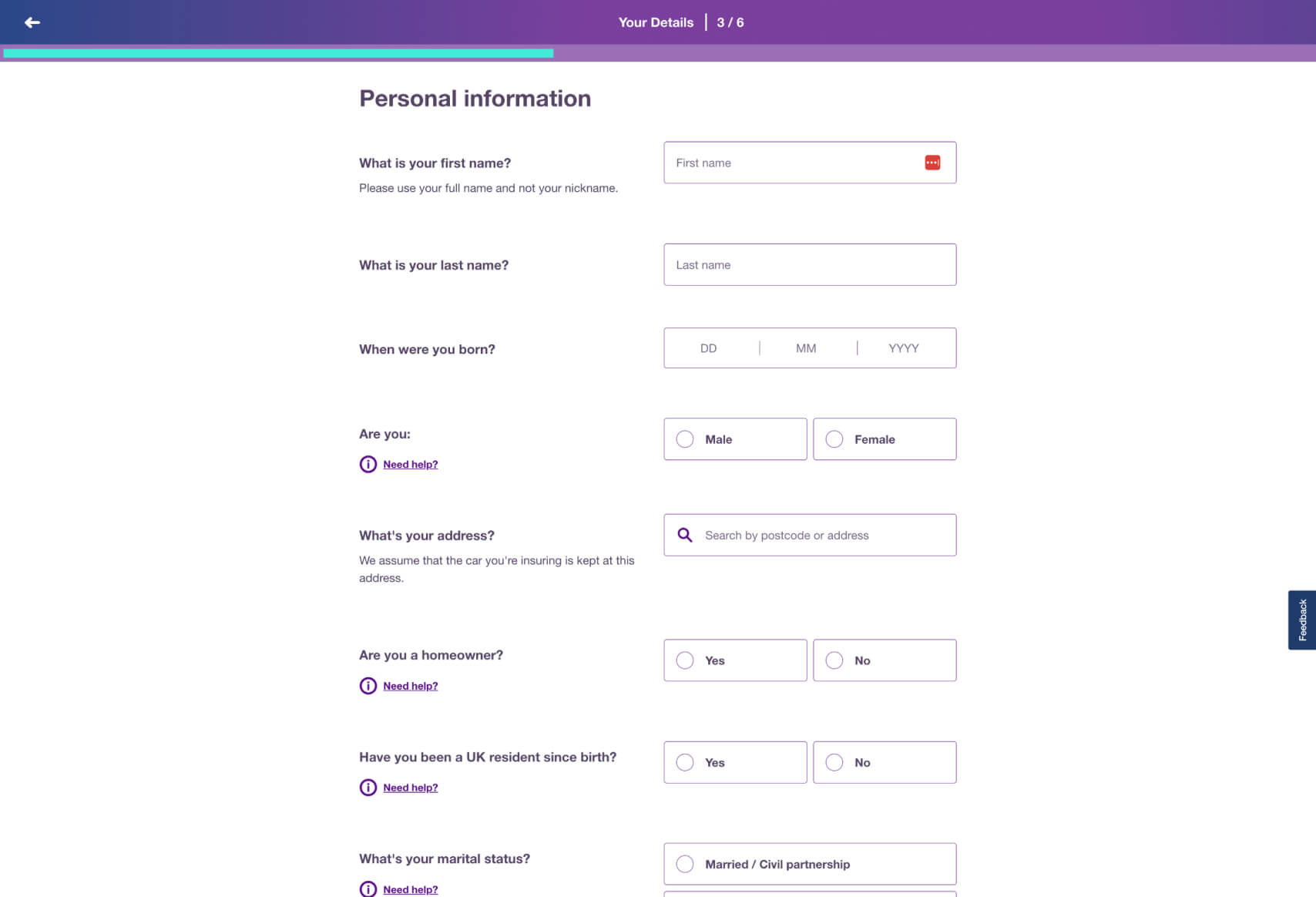

- Consistent Design Language: The consistent use of color, typography, and layout across all screens provides a cohesive experience. The use of purple as a primary color creates a strong brand identity and a calming, professional appearance.

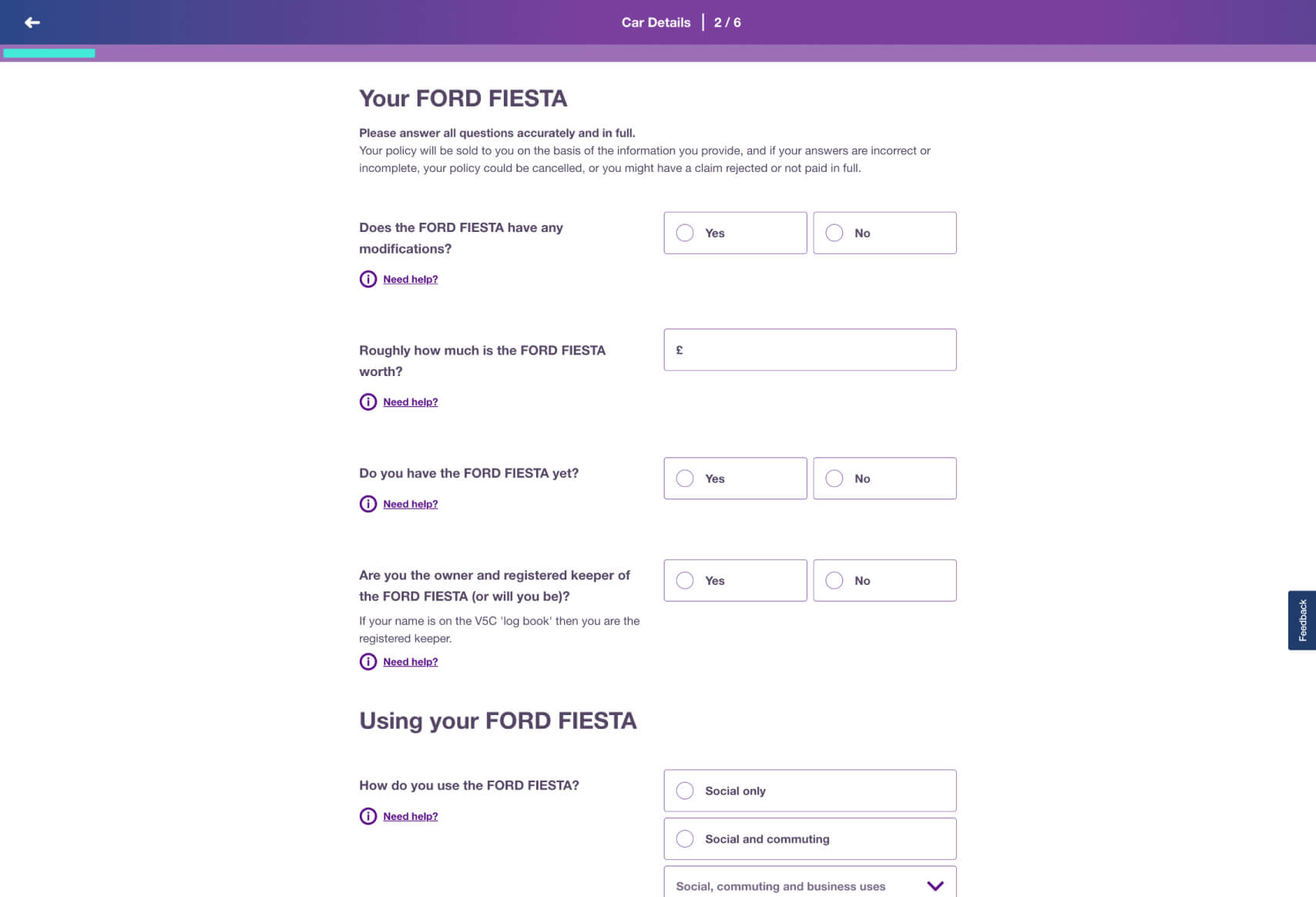

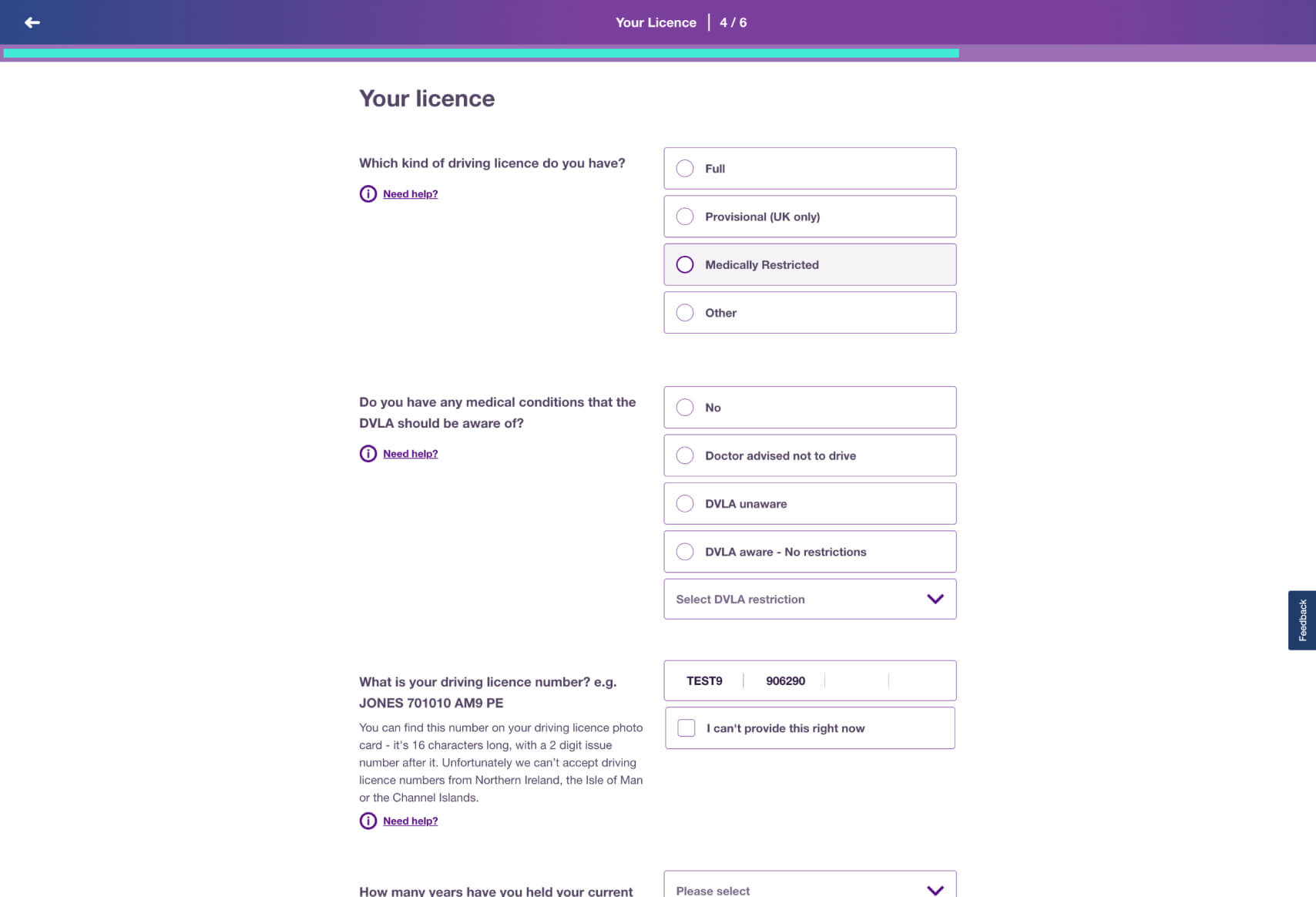

- Helpful Contextual Information: The “Need help?” prompts strategically placed next to each question allow users to access additional information without cluttering the main interface. This ensures users can proceed confidently, even if they are unfamiliar with certain terms or concepts.

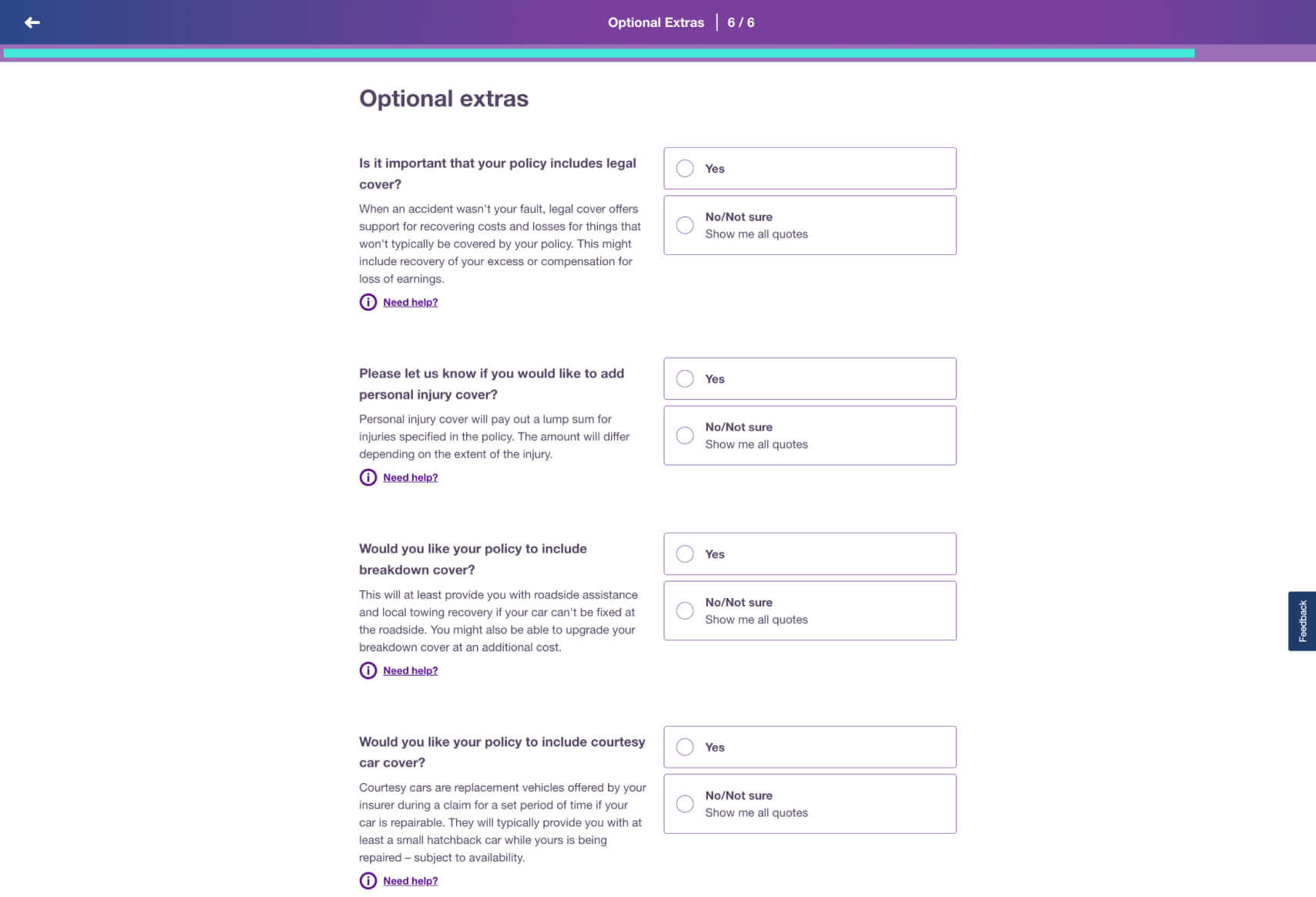

- User Empowerment Through Choice: By offering options like “Yes” or “No/Not sure” alongside explanations, the funnel empowers users to make informed decisions without feeling pressured. This is particularly important for complex products like insurance.

- Personalization Elements: The funnel includes steps that ask for specific information about the user’s car and driving history, ensuring that the final product or recommendation is tailored to their unique situation.

- Emphasis on Optional Extras: The final screen asking about optional extras like legal cover, personal injury cover, and breakdown cover allows users to customize their policy. This not only adds value to the offer but also helps the company upsell additional services.

Why This Business Might Choose This Funnel Design

This funnel is designed for Lead Generation within the automotive insurance sector. The structured and detailed approach to gathering information suggests that the business aims to create highly personalized insurance quotes based on precise user data. This is likely a product offered through a comparison site like MoneySuperMarket, given the branding and context clues.

The business likely chose this design over a traditional form for several reasons:

- User Confidence and Clarity: Insurance products are complex, and the funnel’s design provides clarity at each step. By offering explanations and optional help for each question, the design minimizes confusion and builds user confidence in the process.

- Higher Completion Rates: The segmented approach reduces cognitive load by guiding users through one question at a time. This makes the process feel less daunting compared to filling out a long, overwhelming form.

- Customization and Upselling Opportunities: The funnel’s design allows users to select optional extras towards the end, which not only increases the potential revenue per customer but also gives users the feeling of control and customization over their policy.

- Data Accuracy and Relevance: By asking specific questions related to the user’s car, driving history, and personal preferences, the funnel ensures that the data collected is accurate and relevant. This likely results in more accurate quotes and a better match between the user and the insurance product.

Key Impactful Questions in the Funnel

1. “Would you like your policy to include legal cover?” (Screen 1)

- User Control and Clarity: This question directly asks the user about an additional feature, making them feel in control of their insurance package. The explanation provided clarifies what legal cover entails, helping users make informed decisions.

2. “What type of cover do you need?” (Screen 3)

- Tailored Coverage: This question is crucial because it determines the scope of the insurance policy. Offering a clear choice between comprehensive, third-party fire & theft, and third-party only helps users select the coverage that best meets their needs, enhancing satisfaction and relevance.

3. “Have you or any additional driver on this policy ever had their insurance declined, cancelled, voided, or had special terms imposed?” (Screen 3)

- Risk Assessment: This question is vital for the insurance company’s risk assessment process. It’s presented in a straightforward manner, with an option to get help if the user is unsure, which ensures accuracy while maintaining user trust.

This funnel is a great example of how detailed and well-structured questions can lead to better data collection, personalized offers, and ultimately higher conversion rates. The use of contextual help, consistent design, and user-friendly options makes this funnel an effective tool for generating quality leads in the competitive insurance market. The design also contributes to an improved overall user experience, likely leading to higher customer engagement.

For additional examples of effective funnels, consider exploring more sites we’ve analyzed at Convincely Listings.

No development or design required

No development or design required  Executed by just adding one line of Convincely code to your website

Executed by just adding one line of Convincely code to your website  Plan and strategize with your team. Execute and deploy with Convincely

Plan and strategize with your team. Execute and deploy with Convincely