Funnel Analysis for Ethos Life Insurance

Key Strengths of the Funnel:

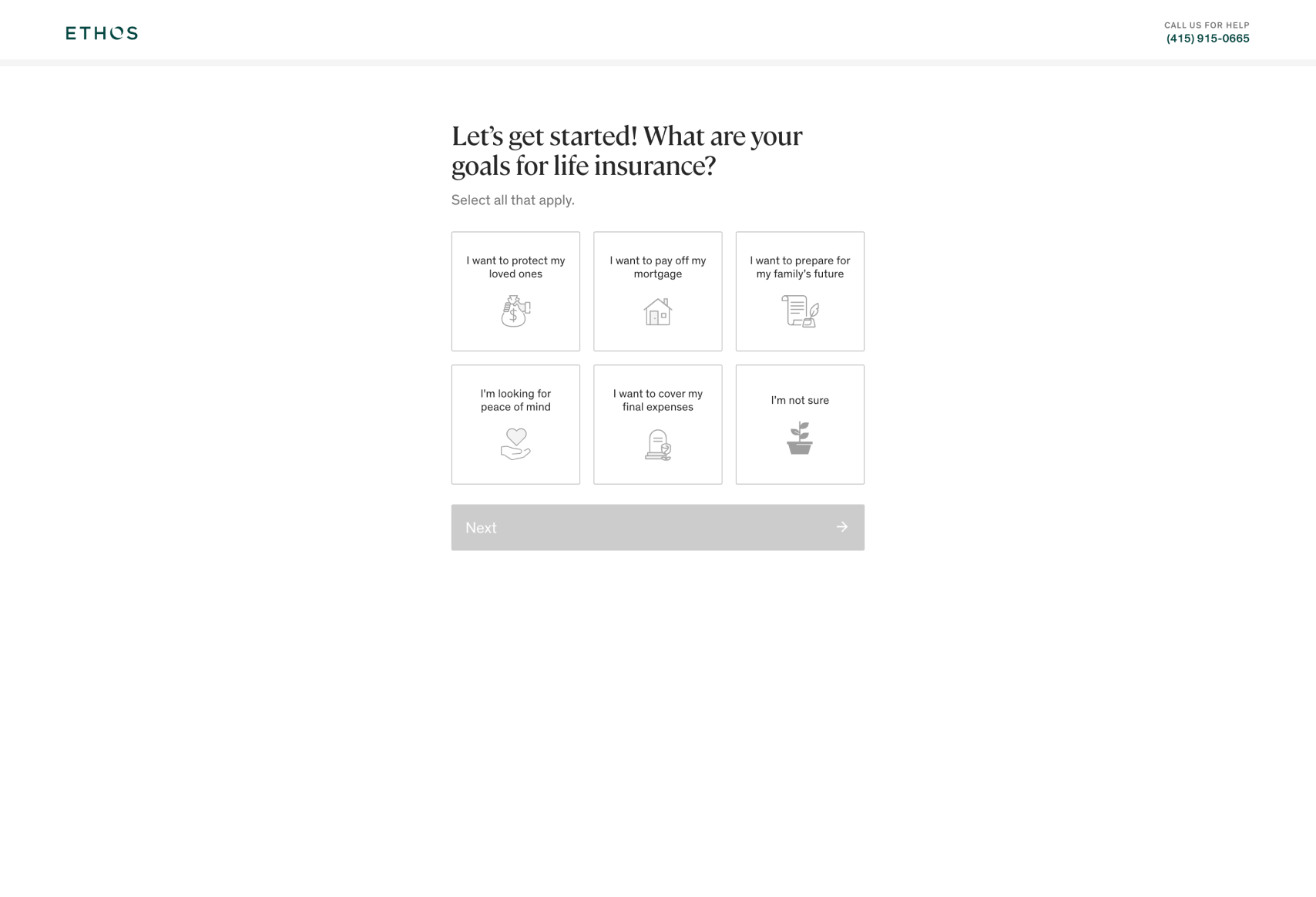

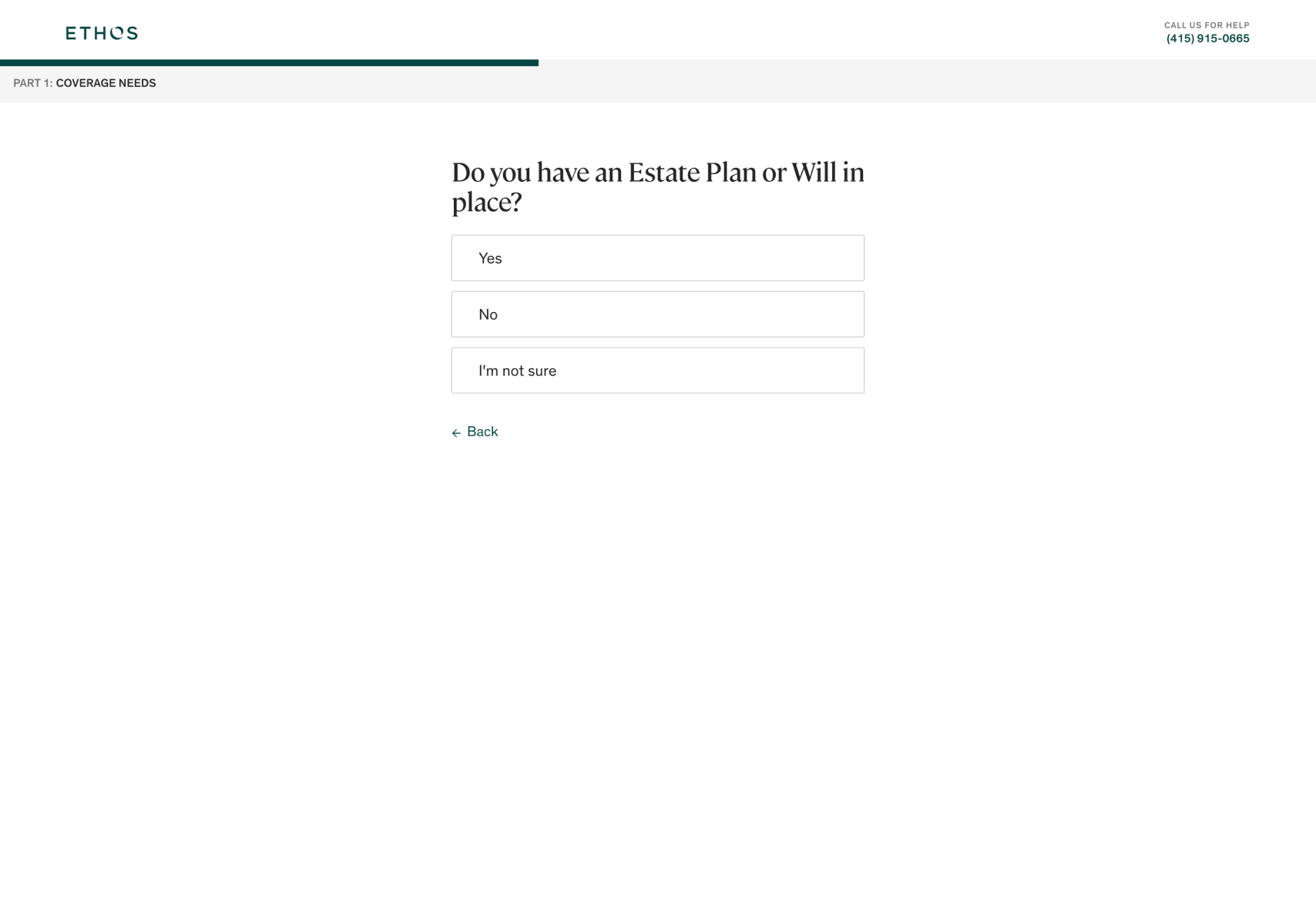

- Personalized Experience: The funnel starts by asking users about their life insurance goals, which immediately personalizes the experience. This approach ensures that the user feels understood and that their specific needs are being addressed.

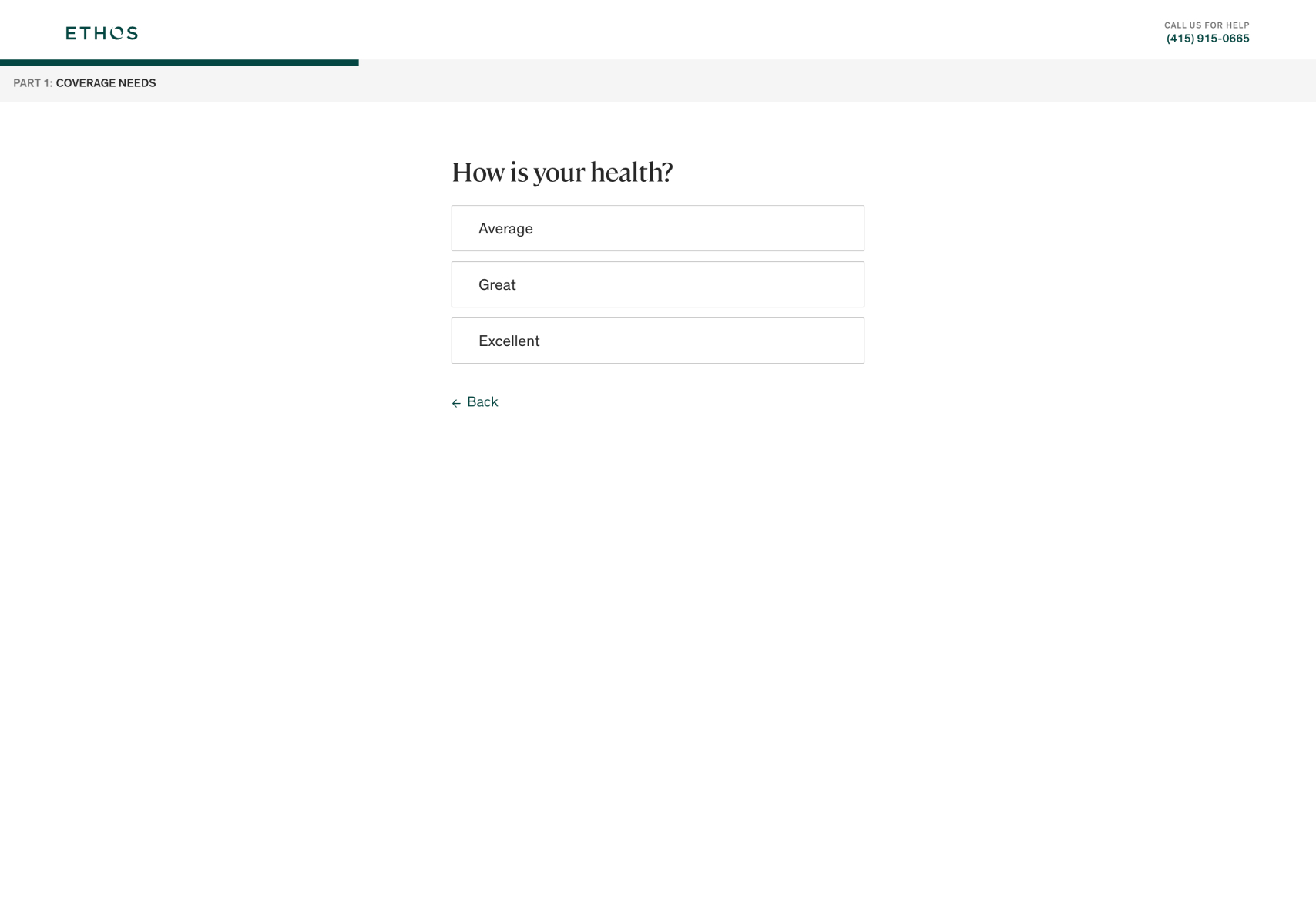

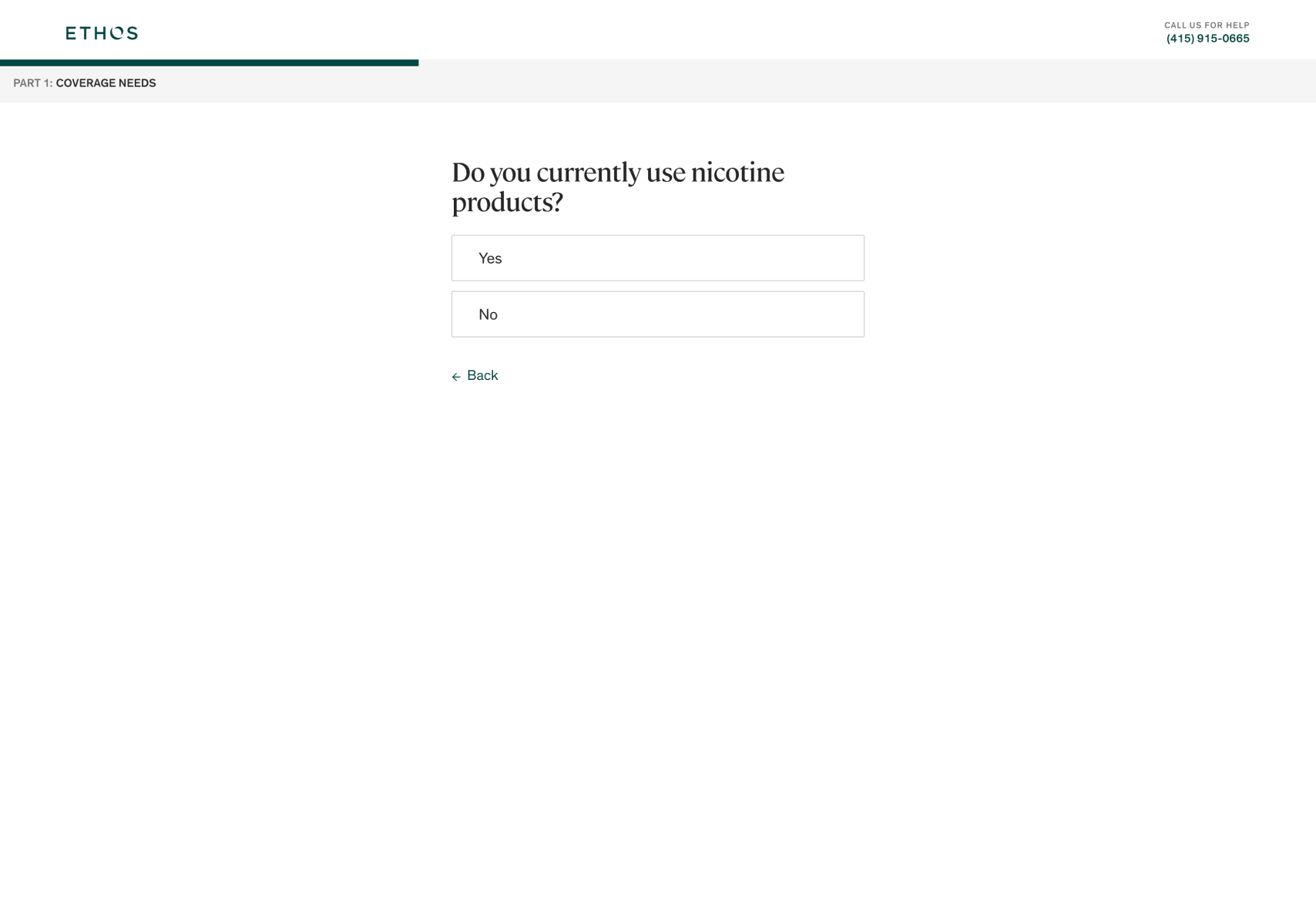

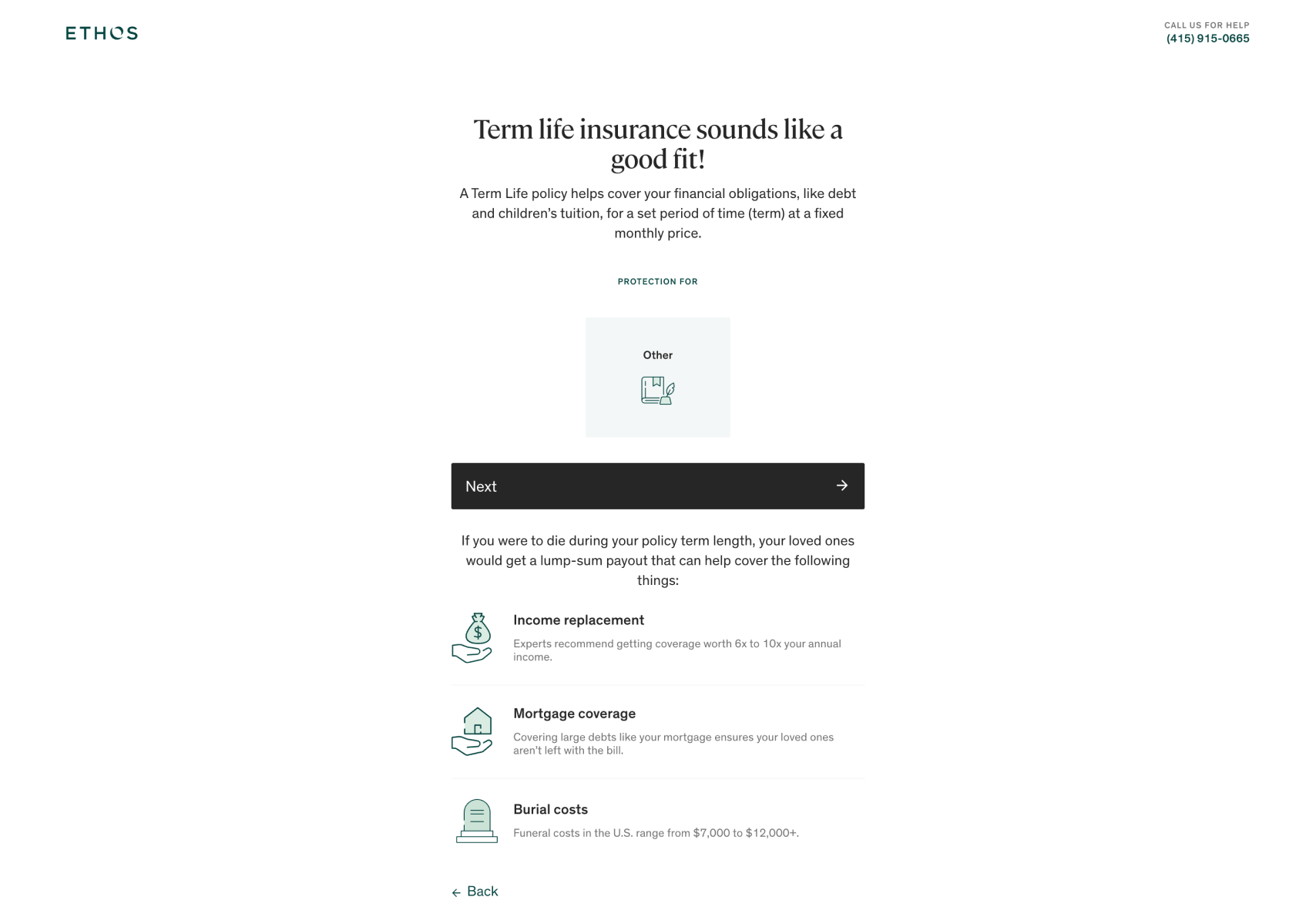

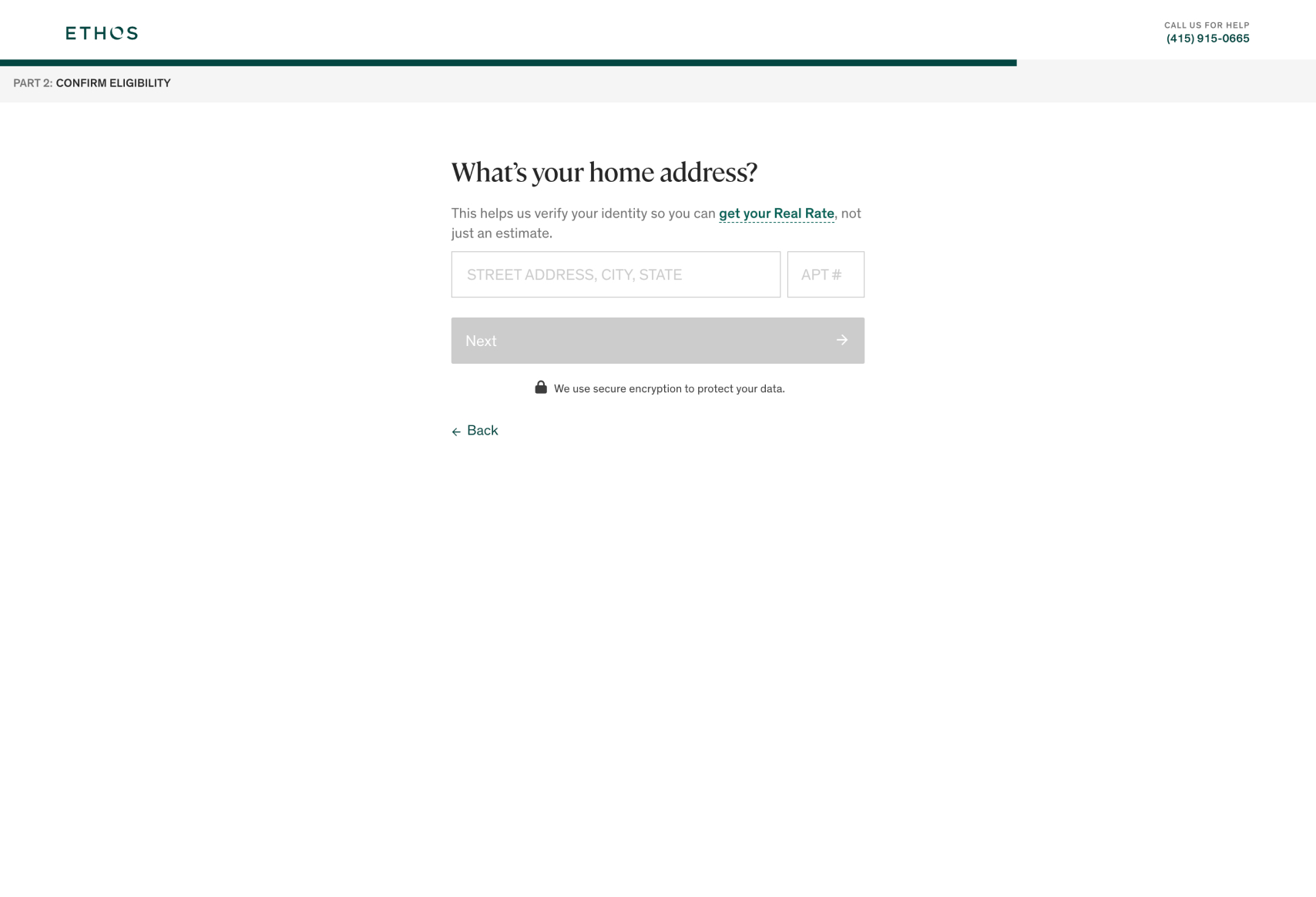

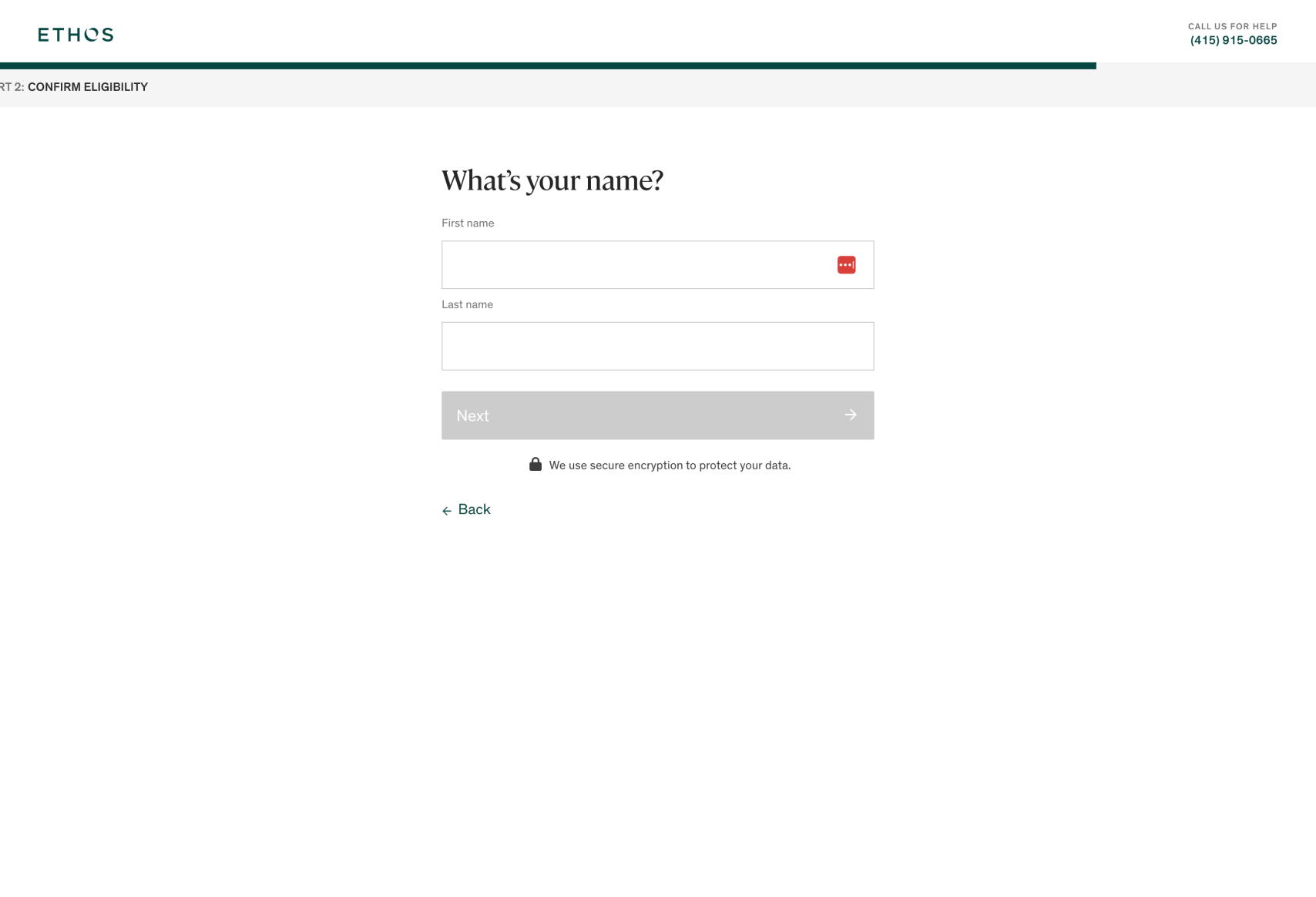

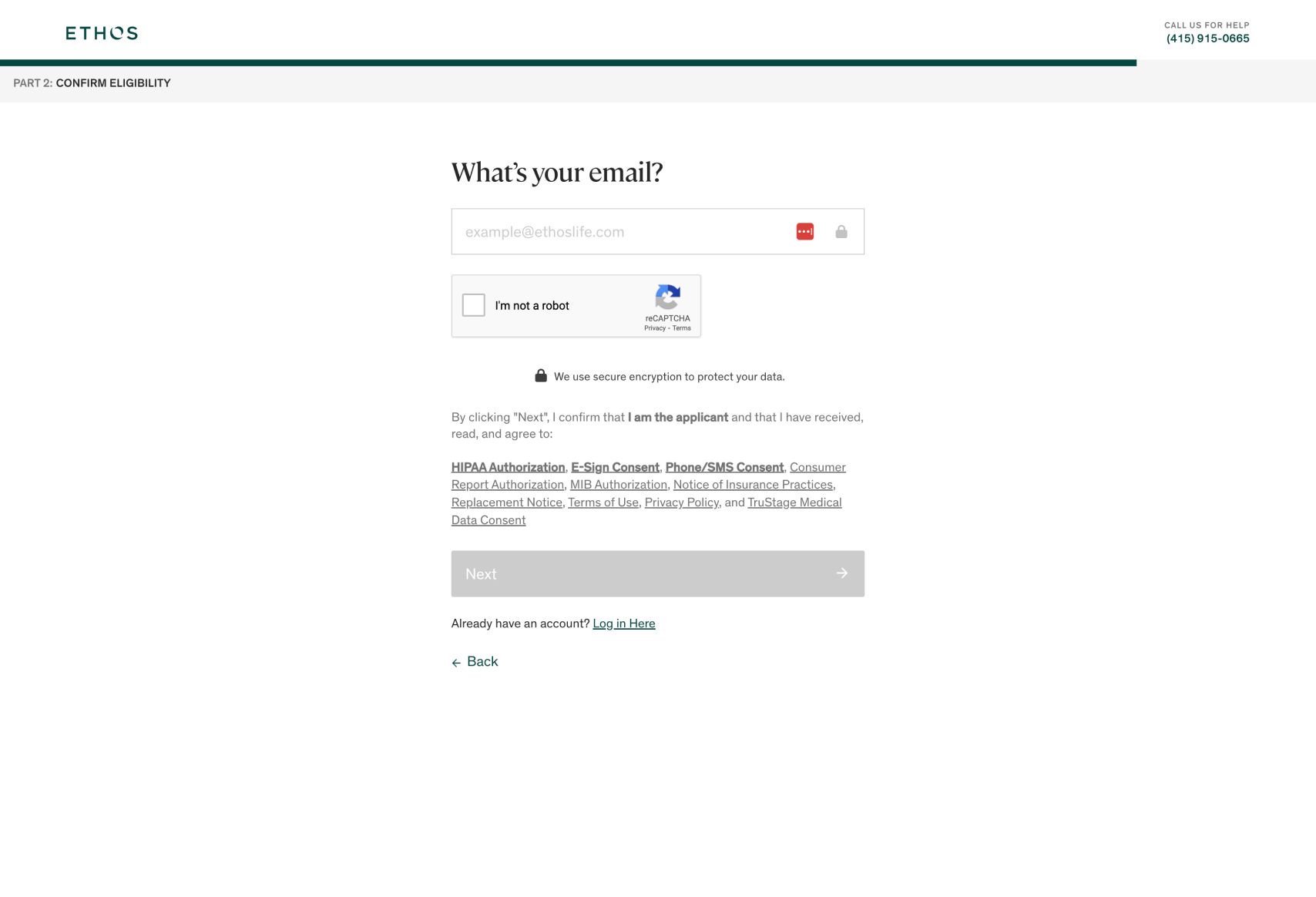

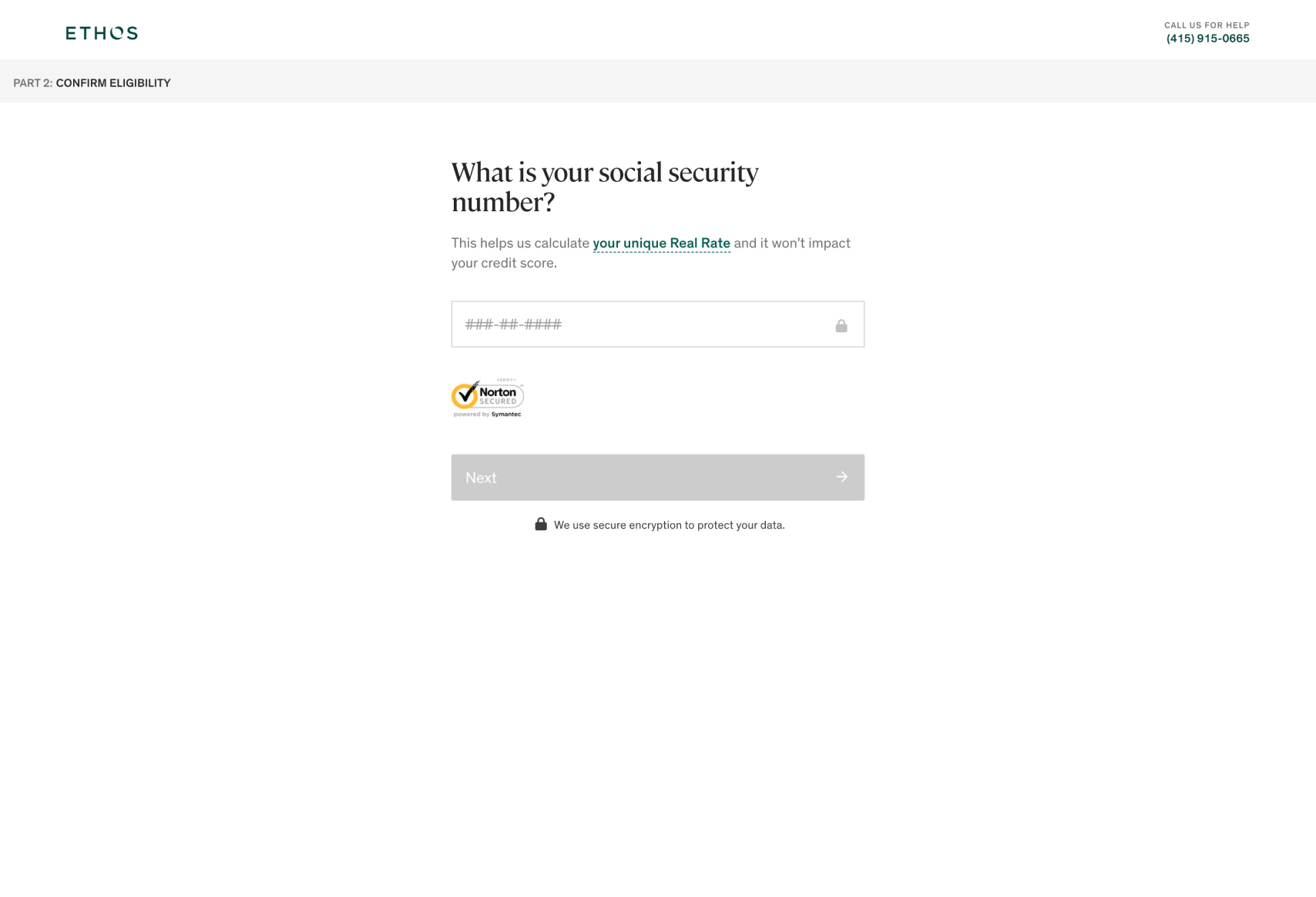

- Simple and Intuitive Design: The minimalist design with plenty of white space helps keep users focused on the task without feeling overwhelmed. The use of clean, easy-to-read fonts and a consistent color scheme reinforces a sense of professionalism and trustworthiness.

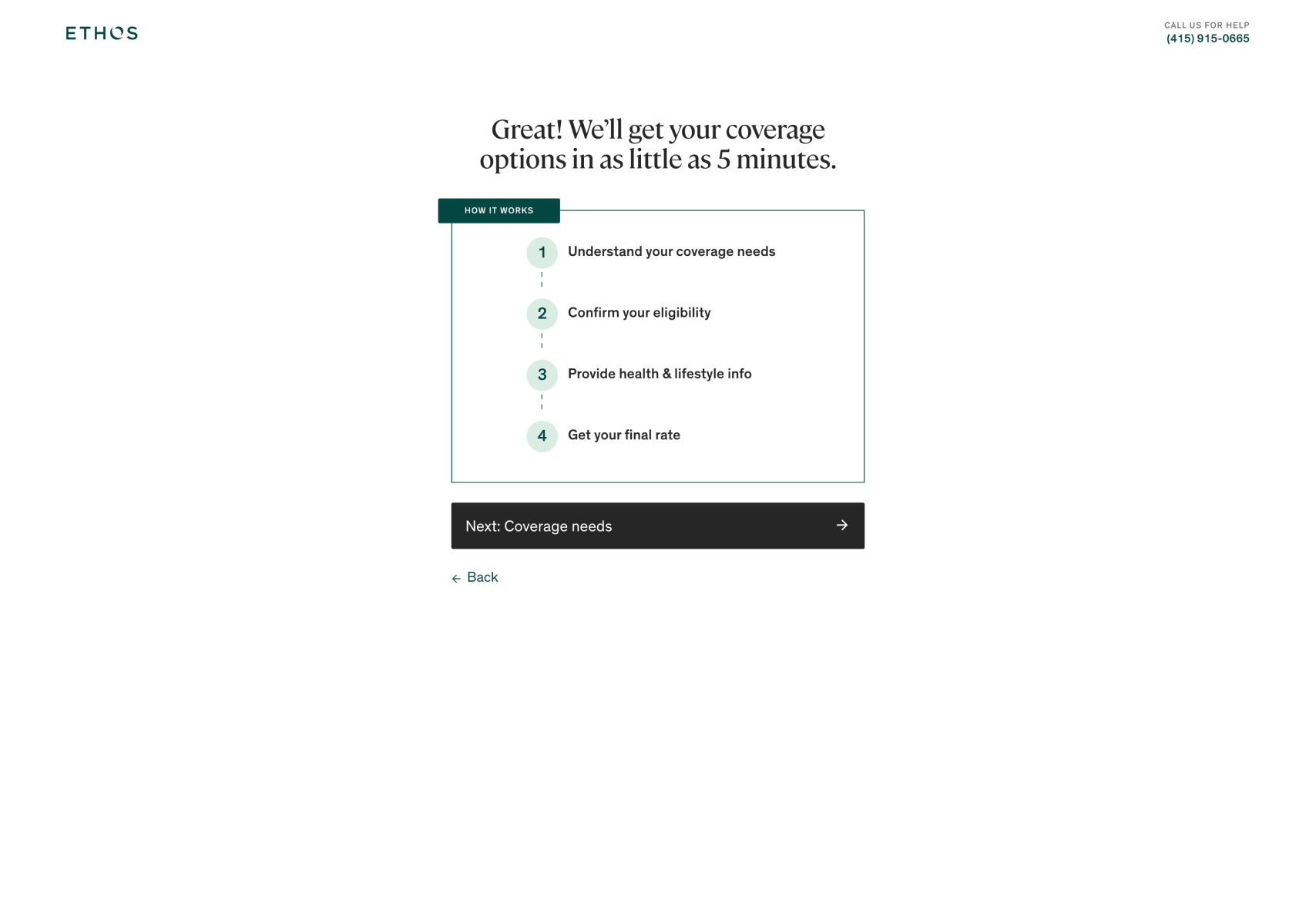

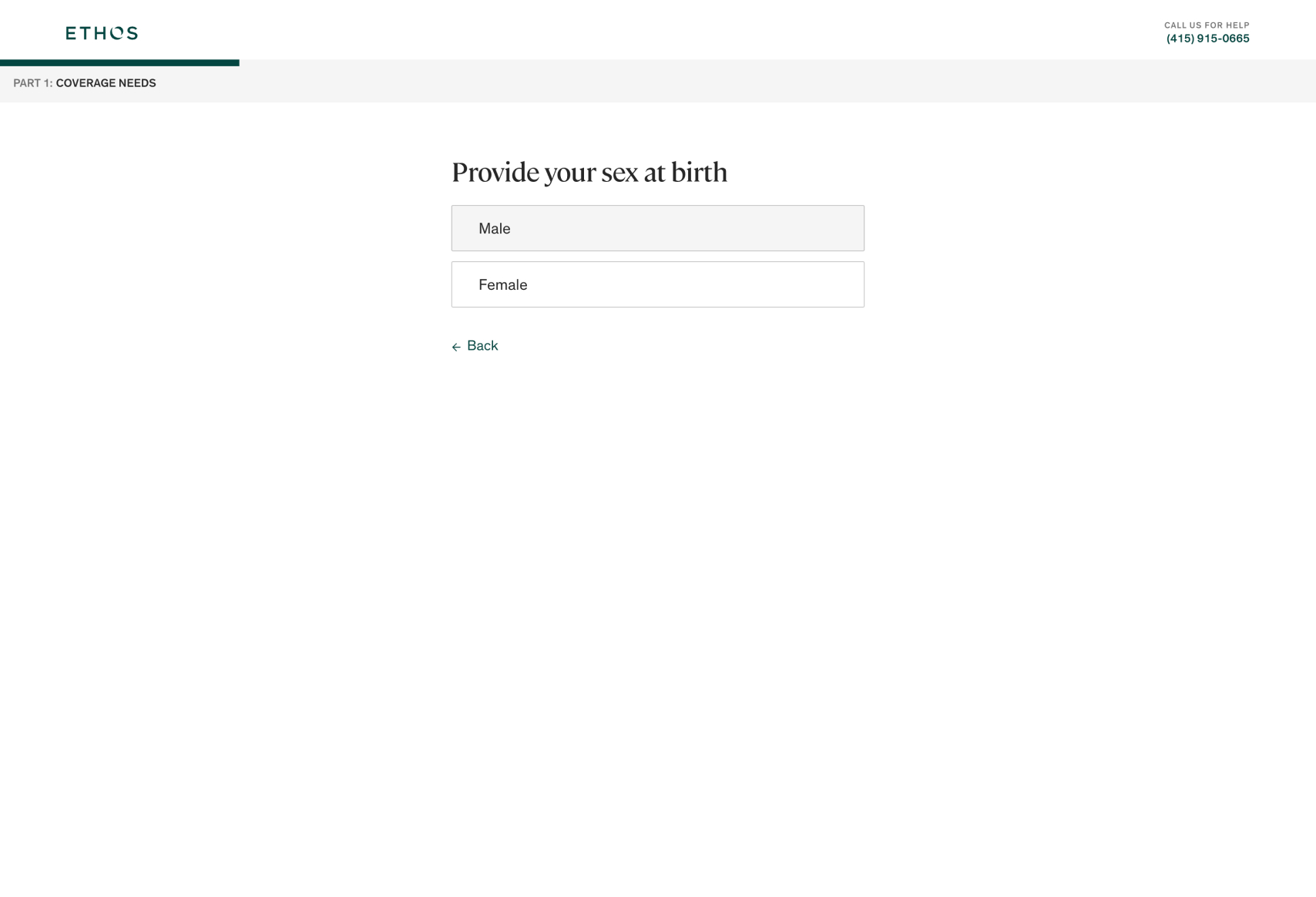

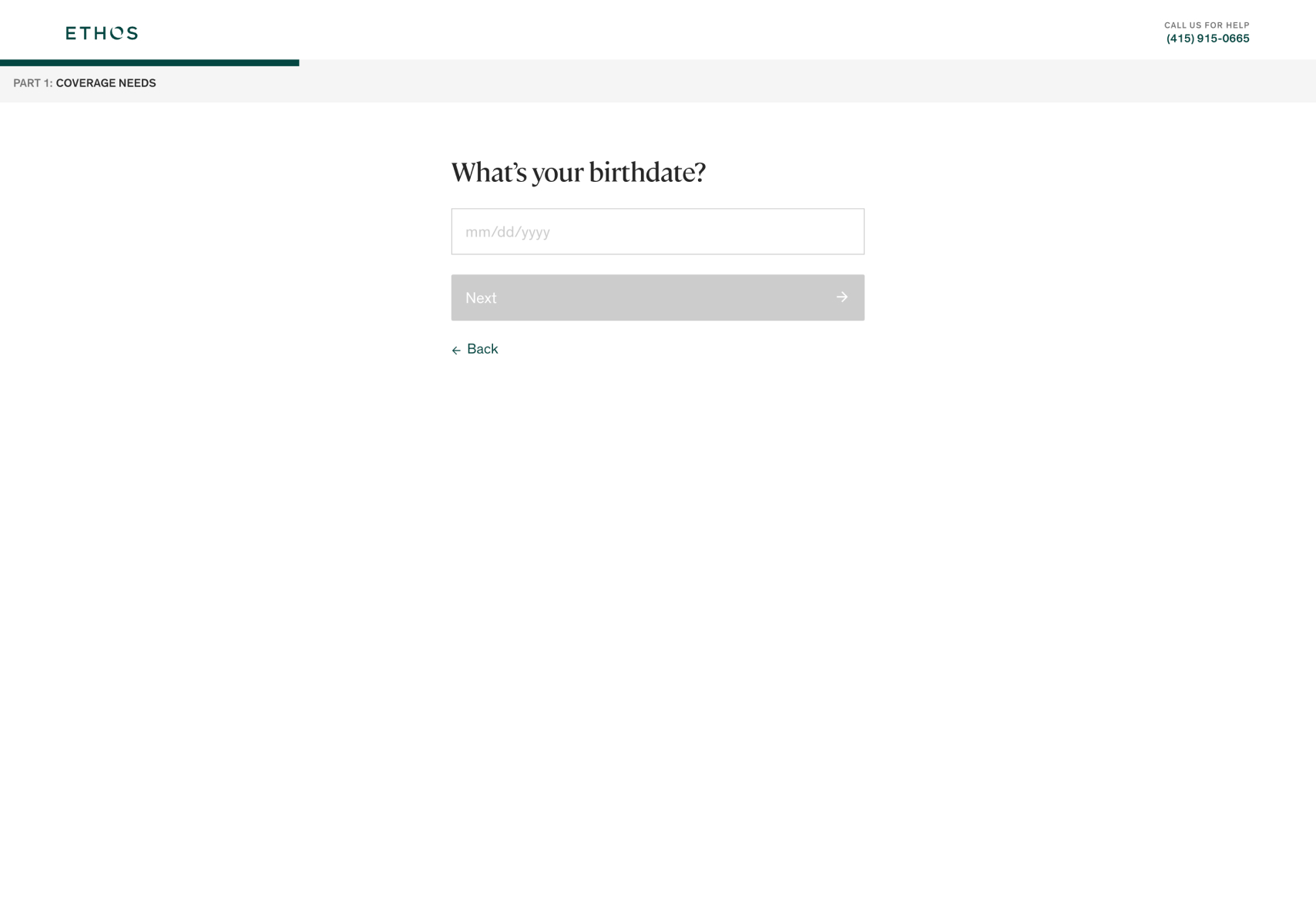

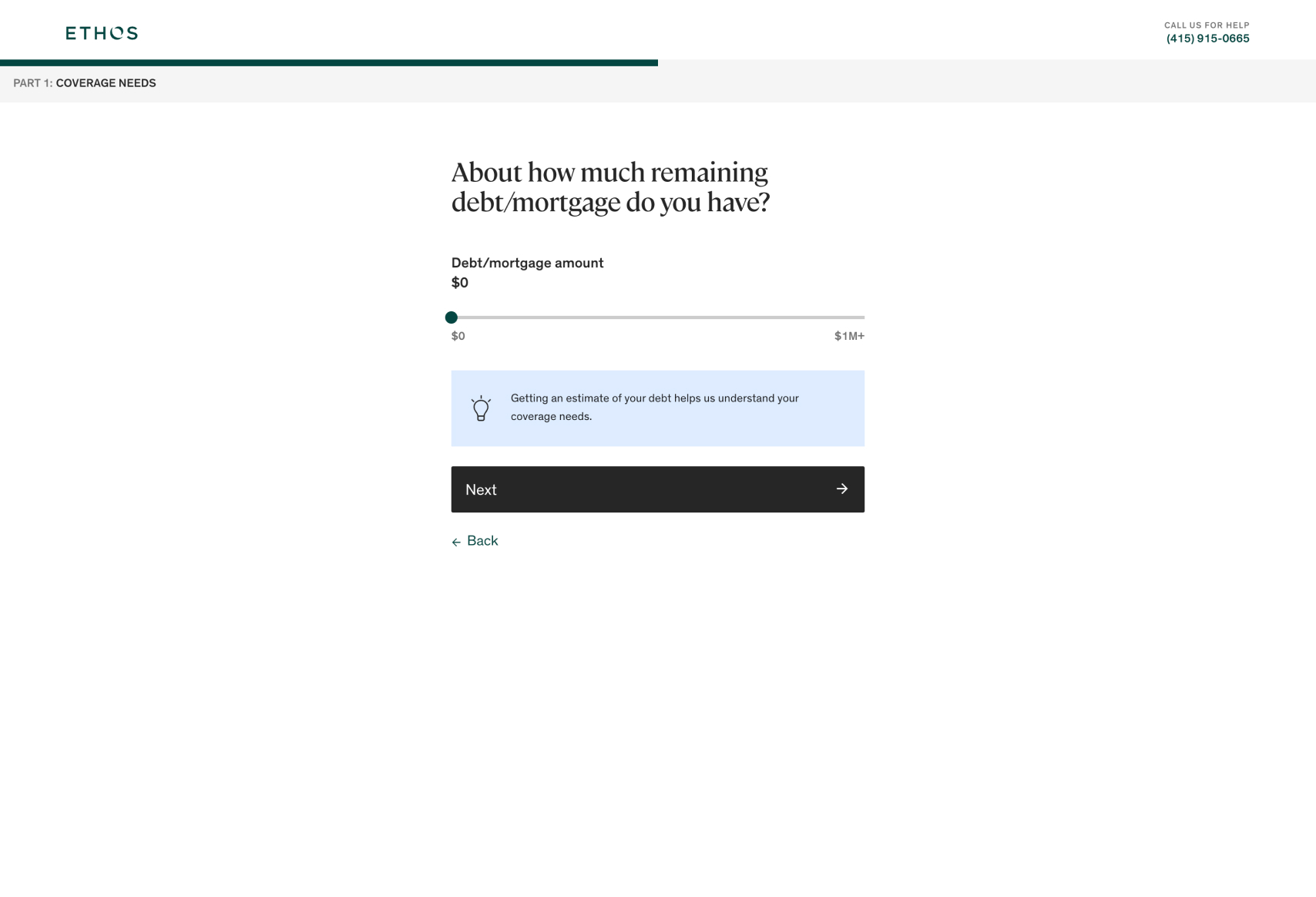

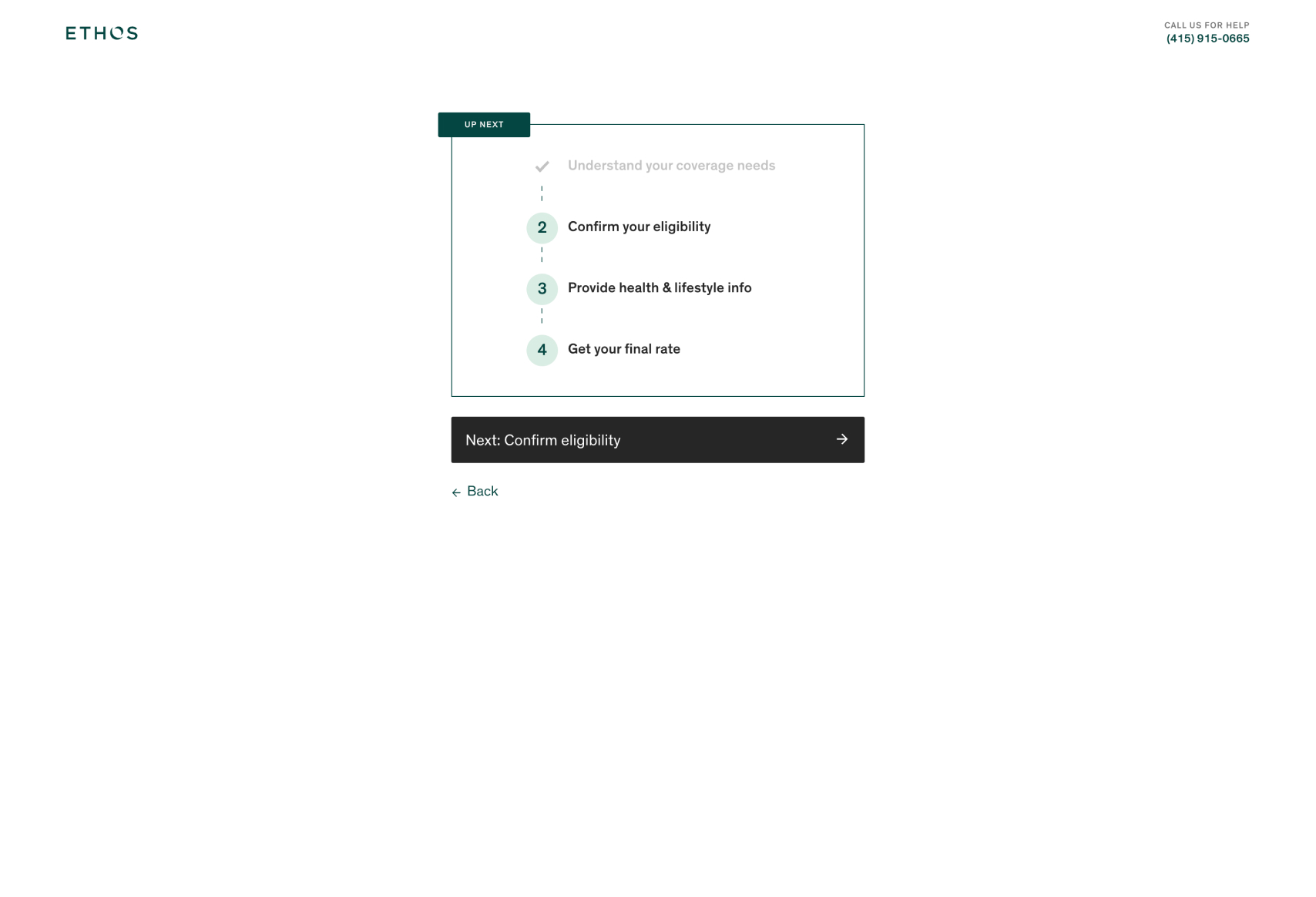

- Step-by-Step Guidance: The funnel is broken down into clear, manageable steps, making it easy for users to provide necessary information without feeling rushed or confused. Each step is focused on a single question or a set of related questions, which helps to maintain user engagement.

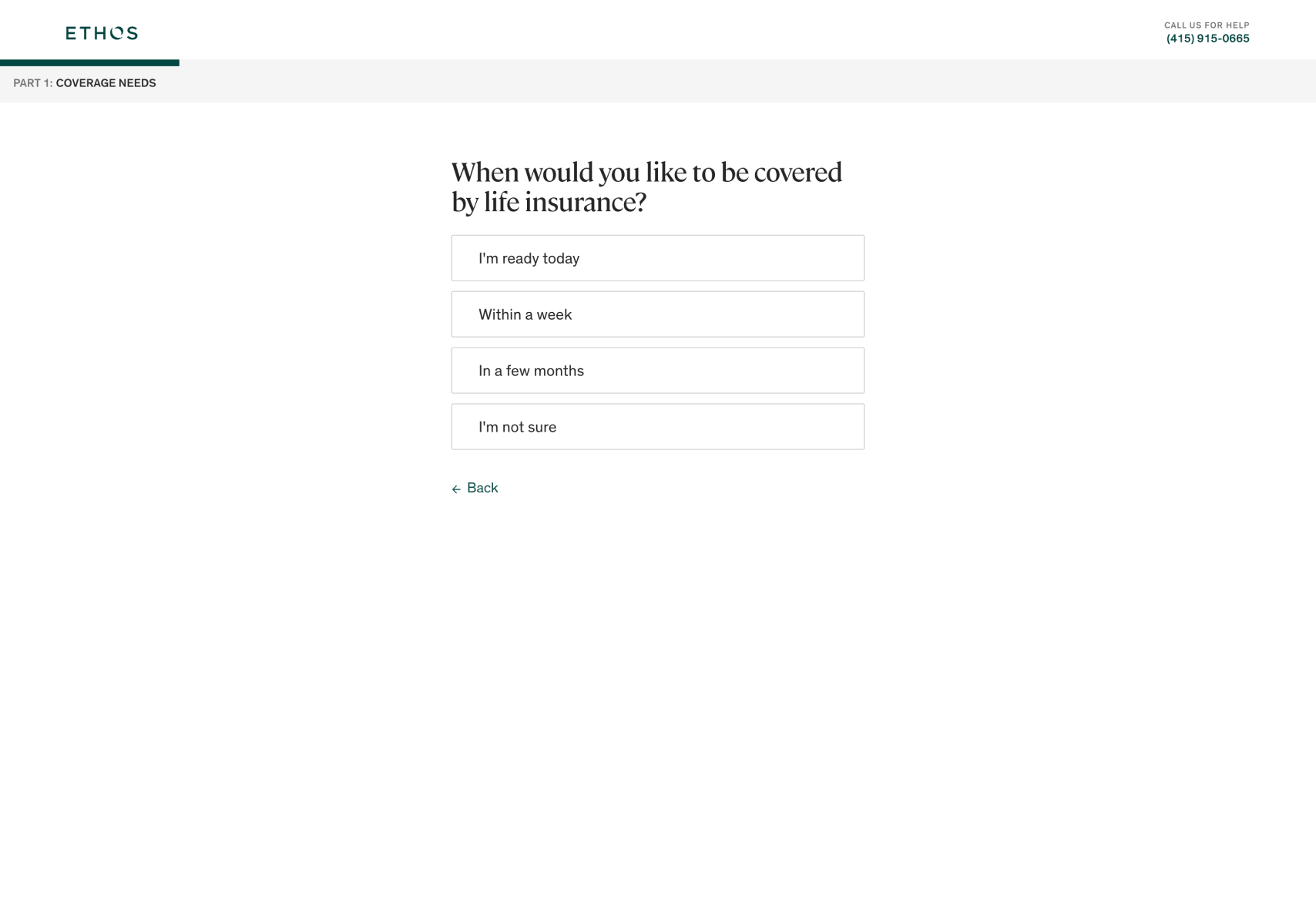

- Clear Progress Indicators: The inclusion of progress indicators, such as “Part 1: Coverage Needs,” keeps users informed about where they are in the process. This transparency helps reduce anxiety and encourages users to complete the process.

- Reassuring Copy: Phrases like “This helps us estimate your family coverage needs” and “Great! We’ll get your coverage options in as little as 5 minutes” help to reassure users that their time and effort are well-invested, and that they will get quick results.

Business Rationale and Benefits:

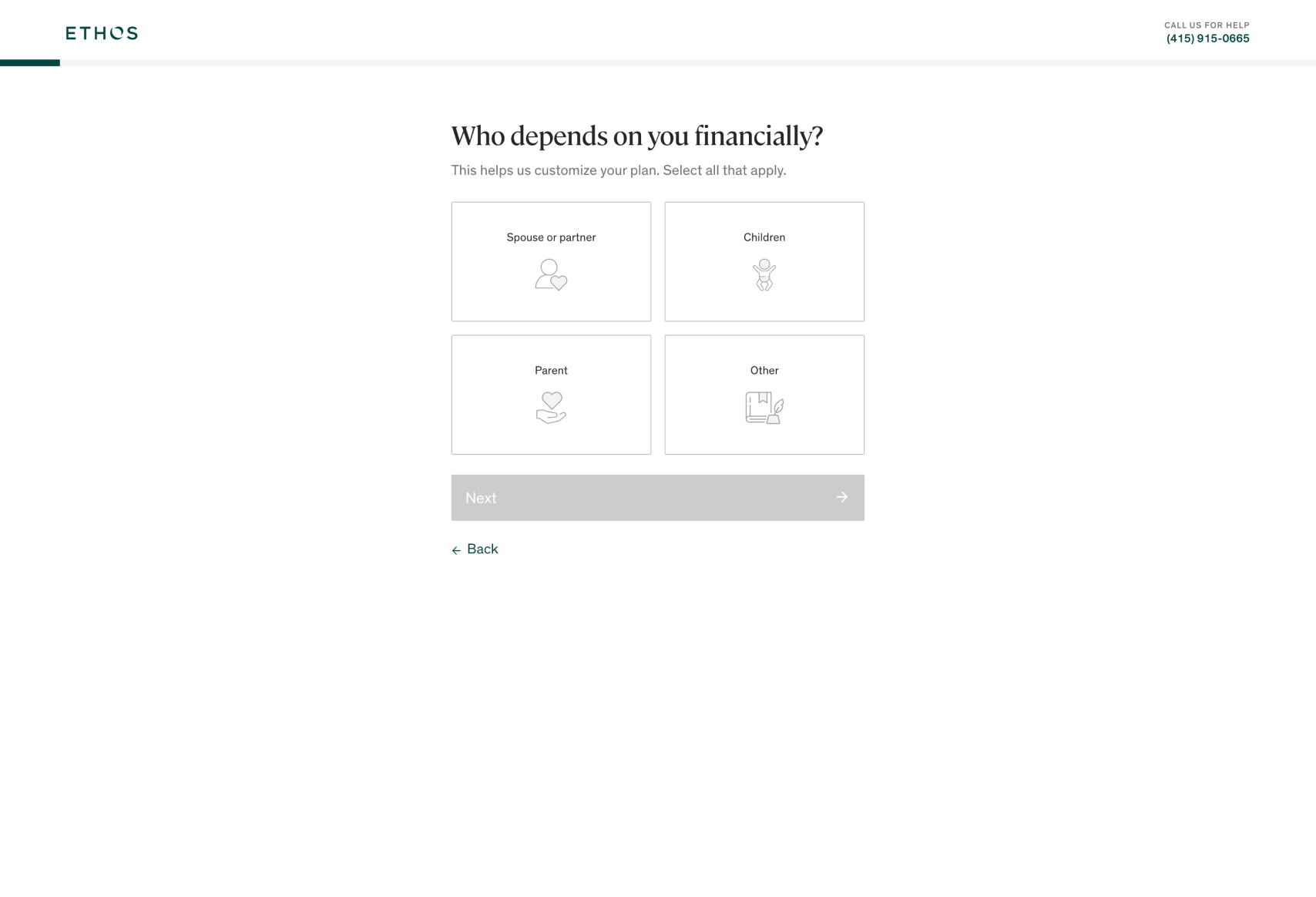

Ethos has likely chosen this funnel design to create a highly personalized and user-friendly onboarding process for potential life insurance customers. By asking the user about their specific goals and personal circumstances, Ethos can tailor their product offerings to each individual, which increases the relevance of their proposals and the likelihood of conversion.

This approach contrasts sharply with a traditional, one-size-fits-all insurance form, which can often feel impersonal and tedious. The funnel design also reduces user friction by breaking down what could be a long, complex process into small, easy-to-handle steps. This is particularly important in the life insurance industry, where users may already feel hesitant or anxious about the process.

By focusing on simplicity, personalization, and clarity, Ethos can effectively guide users through the funnel while gathering the necessary information to provide a tailored insurance plan. This approach not only improves the user experience but also aligns with Ethos’s brand promise of making life insurance easy and accessible.

Impactful Questions and Why They Work:

- “What are your goals for life insurance?”

- Personal Relevance: This question directly engages the user by making them consider why they need life insurance, which helps Ethos tailor the subsequent steps. It also reassures the user that their specific needs are being considered, making the process feel more personalized and relevant.

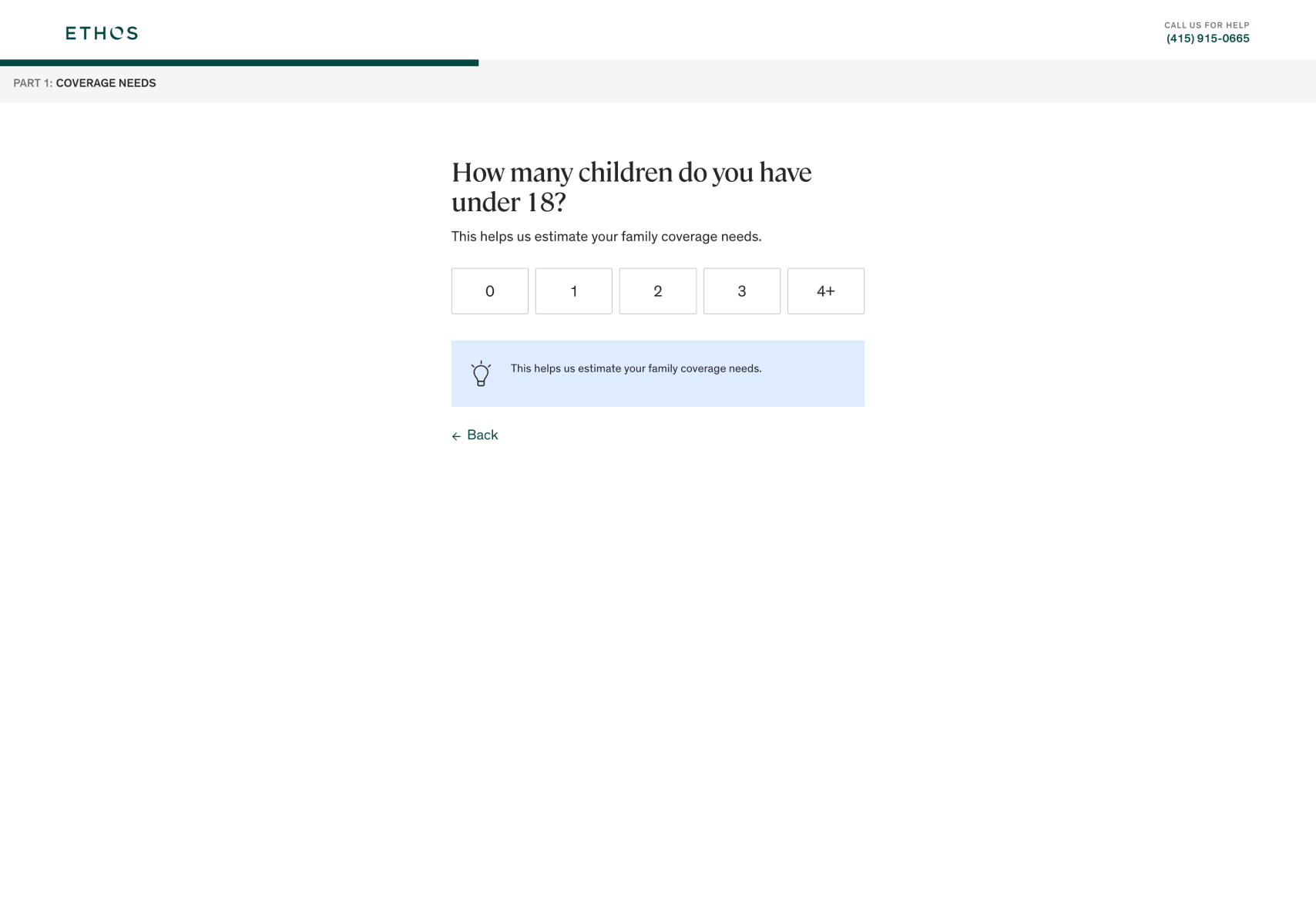

- “How many children do you have under 18?”

- Specificity and Clarity: This question helps Ethos estimate the coverage needs more accurately. It’s direct and clear, making it easy for the user to answer without second-guessing, thereby speeding up the process while ensuring accuracy.

- “When would you like to be covered by life insurance?”

- Immediate Action: By asking this question, Ethos prompts the user to think about the urgency of their needs. This not only helps Ethos prioritize leads but also encourages the user to commit to a timeline, which can help move them closer to making a decision.

Overall, Ethos’s funnel exemplifies how a well-designed, user-centric approach can simplify complex processes, making them more accessible and engaging for potential customers. This design likely leads to improved conversion rates and higher customer engagement. For more examples of successful funnel designs, you can explore Convincely’s listings.

No development or design required

No development or design required  Executed by just adding one line of Convincely code to your website

Executed by just adding one line of Convincely code to your website  Plan and strategize with your team. Execute and deploy with Convincely

Plan and strategize with your team. Execute and deploy with Convincely